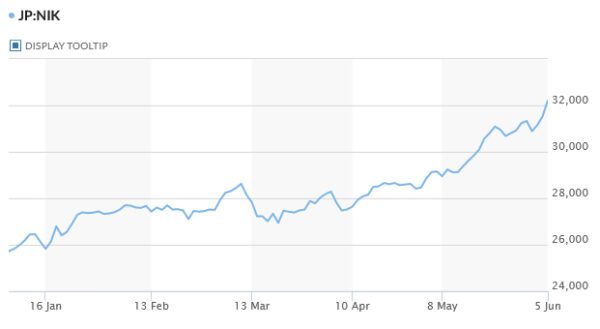

In a remarkable rally during Asian session, Japanese stocks surged sharply, with Nikkei index smashing through the 32k mark, reaching a high not seen in 33 years. This surge followed the bullish trend seen in US markets last week, further buoyed by robust services data emanating from Japan and China. However, it’s important to note that outside Japan, stock markets are experiencing a more sluggish performance.

Turning our attention to the currency markets, commodity currencies are exhibiting notable strength, with US Dollar performing well, albeit lagging slightly behind Australian Dollar and New Zealand Dollar. Both Australian Dollar and Canadian Dollar are looking forward to potential hawkish holds by their respective central banks – RBA and BoC – later in the week.

Interestingly, Dollar continues to show a decoupling from risk sentiment, displaying strength even as risk appetite seems to be strongly on the “on”side. European currencies, along with Japanese Yen, are generally underperforming.

The week ahead promises to be exciting, with crucial monetary policy decisions from RBA and BoC that could influence the path of commodity currencies and, by extension, global currency dynamics.

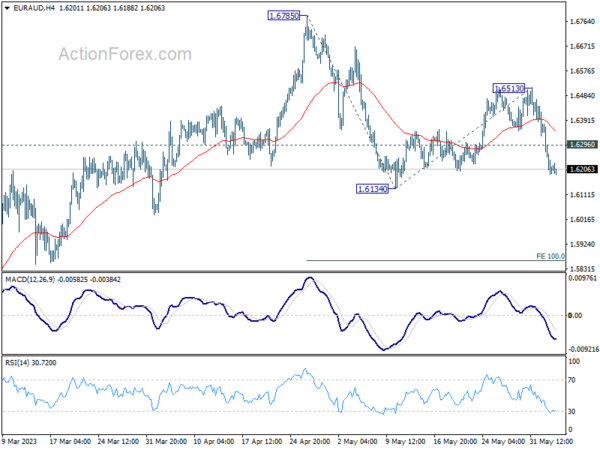

Technically, EUR/AUD would be a focus in the next 24-hours with RBA a feature. Based on current downside momentum, fall from 1.6513 is possibly resuming whole decline from 1.6785. Deeper fall is in favor as long as 1.6296 minor resistance holds. Break of 1.6134 will confirm this bearish case and target 100% projection of 1.6785 to 1.6134 from 1.6513 at 1.5862.

In Asia, Nikkei closed up 2.12% at 32192.32. Hong Kong HSI is up 0.33%. China Shanghai SSE is down -0.04%. Singapore Strait Times is up 0.63%. Japan 10-year JGB yield is up 0.0175 at 0.433.

Oil prices surge as Saudi Arabia pledges additional production cut

Oil prices shot up in response to an announcement from Saudi Arabia, the world’s leading exporter, to slash production by an additional 1 million barrels per day starting in July. This voluntary reduction from the Saudis comes on the heels of an agreement by OPEC and their allies, including Russia, to curtail supply into 2024.

Collectively referred to as OPEC+, this group accounts for approximately 40% of the world’s crude oil production. The group currently has cuts of 3.66 million barrels per day in place, which translates to about 3.6% of global demand.

The latest move by Saudi Arabia may take many by surprise, given that the most recent adjustments to quotas were implemented just a month ago. Consequently, the oil market is poised to tighten even further in the second half of 2023.\

Technically speaking, however, WTI crude oil is just extending near term range trading. It’s currently struggling to break through 55 D EMA decisively. Rejection by 55 D EMA would set the stage for another fall through 64.19 low to resume the medium term down trend sooner rather than later. Even though sustained break of 55 D EMA could bring stronger rebound, 83.46 will still represent a significant medium term resistance to overcome.

Japan PMI services finalized at record 55.9, overall growth accelerated in Q2

Japan PMI Services was finalized at 55.9 in May, up from April’s 55.4, setting another fresh series record. PMI Composite was finalized at 54.3, up from April’s 52.9, the second strongest reading since record began in 2007, after October 2013.

Usamah Bhatti, Economist at S&P Global Market Intelligence, said: “The record expansion in activity among service providers, coupled with a renewed increase in manufacturing production contributed to a stronger increase in overall private sector activity.

“The rate of expansion was solid and the second-strongest in the history of the series (behind October 2013). The upturn was led by the dominant services sector, although there was a renewed sense of optimism for private sector activity given the expansions in manufacturing output and new orders.

“Latest data also provides the indication economic growth has accelerated in the second quarter of the year, following the 1.3% year-on- year increase in growth in the first quarter of 2023, according to the latest official statistics.”

China Caixi PMI services rose to 57.1, overall economy lacks internal drive

China Caixin PMI Services rose from 56.4 to 57.1 in May, above expectation of 55.2. The rate of expansion was the second-steepest seen over the past two-and-a-half years. PMI Composite rose from 53.6 to 55.6, highest since end of 2020.

Wang Zhe, Senior Economist at Caixin Insight Group said: “In general, it remains a prominent feature of the Chinese economy that the services sector is stronger than manufacturing. In May, the Caixin China services PMI showed that services activity was picking up overall, but employment expansion and market optimism weakened. In the manufacturing sector, employment deteriorated, prices plunged, and manufacturers also became less optimistic toward the outlook, according to the Caixin China manufacturing PMI.

“This divergence highlights that economic growth is lacking internal drive and market entities lack sufficient confidence, underscoring the importance of expanding and restoring demand. Currently, stabilizing employment, increasing income and bolstering expectations through proactive fiscal policy should be prioritized given a dire job market and mounting deflationary pressure.

RBA and BoC interest rate decisions in Focus

RBA and BoC are set to announce their interest rates decisions this week, with both banks expected to maintain the status quo at 3.85% and 4.50% respectively.

BoC’s decision to pause started in March and June meeting will be the third consecutive time the central bank has chosen to stand pat. However, expectations of a BoC rate hike are mounting in the wake of recent data showing robust GDP growth and persistent inflation. While June seems too early for the central bank to make a move, any hawkish undertones in the statement indicating openness for action in Q3 could buoy Canadian dollar.

As for RBA, markets are pricing in around 1/3 chance of a hike this week. So a hold is the more likely outcome even though the central bank has recent history of surprising the markets. The perception is that current interest rate level is not restrictive enough to bring down inflation to target within a reasonable timeframe. Therefore, further tightening is expected in the future. If RBA aims to set market expectations for a quarter-point hike per quarter, the next move will likely be in August.

On the data front, Eurozone Sentix investor confidence; Australia GDP, China Caixin PMI services CPI and PPI, as well as Canada employment are worth watching too.

Here are some highlights for the week:

- Monday: Australia MI inflation gauge; China Caixin PMI Services; Germany trade balance; Swiss CPI; Eurozone PMI services final, Sentix investor confidence, PPI; US ISM services, factory orders.

- Tuesday: Japan average cash earnings, household spending,; RBA rate decision; Germany factor orders, UK PMI construction, Eurozone retail sales; Canada building permits, Ivey PMI.

- Wednesday: Australia GDP; China trade balance; Swiss unemployment rate, foreign currency reserves; German industrial production; Italy retail sales; Canada trade balance, BoC rate decision; US trade balance.

- Thursday: Japan GDP final, current account; Australia trade balance; Eurozone GDP revision; US jobless claims.

- Friday: China CPI, PPI; Italy industrial production; Canada employment.

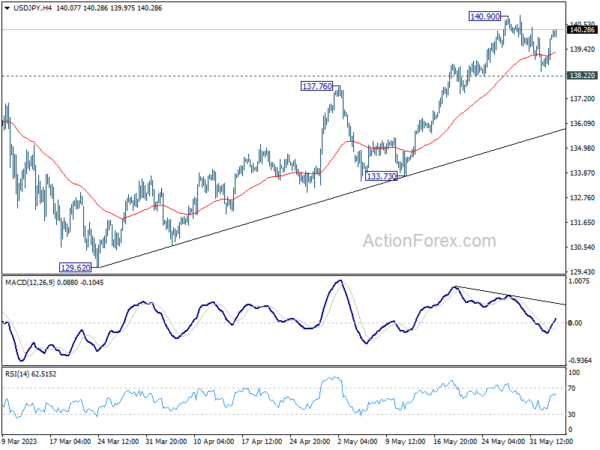

USD/JPY Daily Outlook

Daily Pivots: (S1) 139.03; (P) 139.55; (R1) 140.49; More…

Intraday bias in USD/JPY stays neutral as consolidation from 140.90 is extending. Further rally is expected as long as 138.22 minor support holds. On the upside, break of 140.90 will resume larger rise from 127.20 to 142.48 fibonacci level. However, considering bearish divergence condition in 4 hour MACD, break of 138.22 will confirm short term topping, and turn bias back to the downside for 55 D EMA (now at 136.27).

In the bigger picture, rise from 127.20 is seen as the second leg of the corrective pattern from 151.93 high. Stronger rally would be seen to 61.8% retracement of 151.93 to 127.20 at 136.34. Sustained break there will pave the way back to retest 151.93. On the downside, however, break of 133.73 support will argue that the pattern could have started the third leg through 127.20 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:00 | AUD | TD Securities Inflation M/M May | 0.90% | 0.20% | ||

| 01:30 | AUD | Company Gross Operating Profits Q/Q Q1 | 0.50% | 2.10% | 10.60% | 12.70% |

| 01:45 | CNY | Caixin Services PMI May | 57.1 | 55.2 | 56.4 | |

| 06:00 | EUR | Germany Trade Balance (EUR) Apr | 18.4B | 16.1B | 16.7B | |

| 06:30 | CHF | CPI M/M May | 0.40% | 0.00% | ||

| 06:30 | CHF | CPI Y/Y May | 2.10% | 2.60% | ||

| 07:45 | EUR | Italy Services PMI May | 53.7 | 57.6 | ||

| 07:50 | EUR | France Services PMI May F | 52.8 | 52.8 | ||

| 07:55 | EUR | Germany Services PMI May F | 57.8 | 57.8 | ||

| 08:00 | EUR | Eurozone Services PMI May F | 55.9 | 55.9 | ||

| 08:30 | EUR | Eurozone Sentix Investor Confidence Jun | -9.2 | -13.1 | ||

| 08:30 | GBP | Services PMI May F | 55.1 | 55.1 | ||

| 09:00 | EUR | Eurozone PPI M/M Apr | -2.70% | -1.60% | ||

| 09:00 | EUR | Eurozone PPI Y/Y Apr | 0.80% | 5.90% | ||

| 13:45 | USD | Services PMI May F | 55.1 | 55.1 | ||

| 14:00 | USD | ISM Services PMI May | 52.6 | 51.9 | ||

| 14:00 | USD | Factory Orders M/M Apr | 0.80% | 0.90% |