- China’s NBS Manufacturing and Non-Manufacturing PMIs for May have increased the risk of a deflationary spiral in China.

- A weaker Chinese yuan may be required to counter and smooth the adverse effects of the deflationary spiral at least in the short-term.

- Risk aversion has resurfaced in the FX market via weakness seen in the G-10 JPY crosses.

In stark contrast to the recent findings of China’s manufacturing sector survey done by China Beige Book, a US-based data provider that has indicated a rebound in manufacturing activities in May from April, the latest data released today on the official NBS Manufacturing PMI as well as the Non-Manufacturing PMI have showed another month of contraction and growth slowdown in May.

The second consecutive month of weak manufacturing and services activities in China

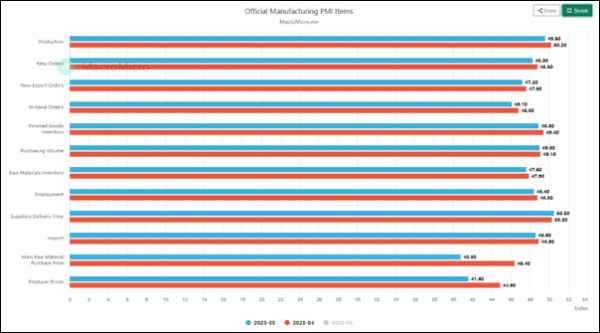

Fig 1: NBS Manufacturing PMI for May 2023 (Source: MacroMicro, click to enlarge chart)

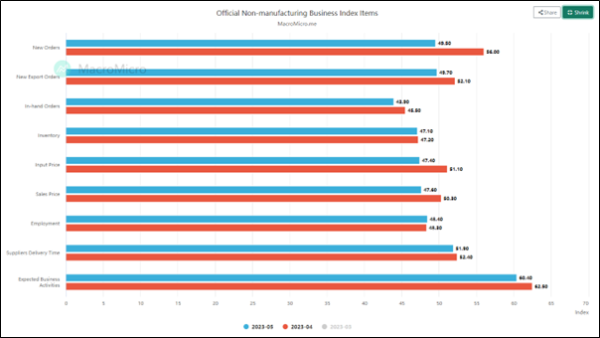

Fig 2: NBS Non-Manufacturing PMI for May 2023 (Source: MacroMicro, click to enlarge chart)

Headline manufacturing activities (PMI) contracted further to a five-month low at 48.8 in May from 49.2 in April; two consecutive months of contraction and came in below consensus estimates of 49.4. Key sub-components of NBS Manufacturing PMI such as new orders (48.3 vs 48.8), new export orders (47.2 vs. 47.6), and purchasing volume (49.0 vs. 49.1) have shrunk at a faster rate too. In addition, the production output sub-component contracted for the first time in four months to 49.6 in May from April’s 50.2.

Services activities (Non-Manufacturing PMI) also further cooled down to 54.5 in May from April’s 56.4, its second consecutive month of growth slowdown and its softest pace since January.

Weak demand conditions plus declining input and output prices increase deflationary risk

The latest reading from China’s PMI data for May has further reinforced an increasing slowdown in external demand (global growth) and lacklustre internal domestic demand ex-post re-opening from Covid-19 stringent lockdowns.

A closer inspection of the input and output prices sub-components for both the PMIs has indicated a risk of a deflationary spiral at play. The input cost (main raw material purchase price) sub-component of the Manufacturing PMI declined at the fastest pace in May since July 2022 (40.8 vs. 46.4) while the output cost (producer prices) sub-component fell for the third consecutive and recorded its steepest decline for ten months in May to 41.6 from 44.9.

Also, the input price sub-component of the Non-Manufacturing PMI contracted for the first time in five months to 47.4 in May from 51.1 coupled with a downside reversal in the sales price sub-component that slipped back to a contraction mode of 47.60 in May from a prior rise of 50.3 in April.

All in all, these weak input and output prices surveyed from the manufacturing and services sector in China are likely to cause a further dampening in the upcoming May reading for consumer inflation and factory gate prices (PPI) that are scheduled to release next Friday, 9 June. April’s reading of 0.1% year-on-year for consumer inflation and -3.6% year-on-year for PPI were the weakest inflationary data for China within the G-20 nations.

China policymakers may need a weaker yuan to stabilize internal growth

Given China’s central bank, PBoC current accommodative monetary policy stance is to adopt a targeted and “wait and see” approach rather than “opening the liquidity floodgates”, the foreign exchange rate may be used as a tool in the short term to alleviate the current downturn.

As highlighted above on the risk of the deflationary spiral in China, a weaker yuan at this juncture is unlikely to trigger a significant spike in imported inflation, and on the contrary, it may help to improve export numbers in the short term.

Hence, Chinese authorities and PBoC seems to be willing to accept a weaker yuan in the past two weeks and allow market forces to dictate its move. Yesterday’s onshore USD/CNY mid-point fixing rate was set at 7.0818, the weakest for the CNY seen in six months and today’s (31 May) fixing was set slightly higher at 7.0821.

This latest “implied weak onshore CNY guidance” from PBoC has further reinforced weakness in the offshore CNH. As seen from a technical analysis perspective, the bullish momentum of the medium-term uptrend phase of the USD/CNH in place since 16 January 2023 remains intact. The key medium-term resistance zone to watch will be at 7.1445/7.1730.

Fig 3: USD/CNH trend as of 31 May 2023 (Source: TradingView, click to enlarge chart)

Implications of a weaker yuan

The continuation of weaknesses and underperformance of China equities and its proxies. At this time of writing, the CSI 300, Hong Kong’s Hang Seng Index, Hang Seng Technology Index, and Hang Seng China Enterprises Index have shed between -1.2% to -3.00% intraday. China’s export-dependent Asia ex-Japan markets such as Singapore and Australia equities may also face renewed downside prices in the short to medium term.

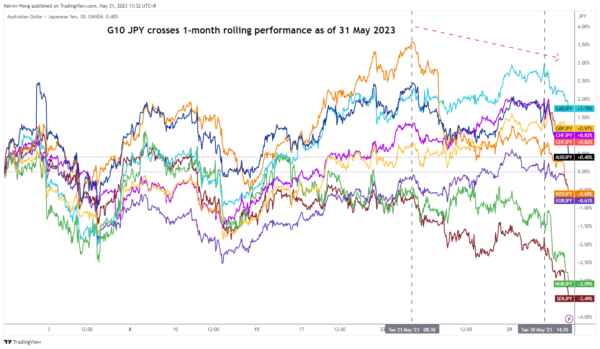

Risk aversion has also crept into the FX market

Fig 4: G-10 JPY crosses trend as of 31 May 2023 (Source: TradingView, click to enlarge chart)

Thus, if a weaker yuan continues to play out and the tentative US debt ceiling extension deal vote that is being scheduled later today in the House hits a roadblock, these JPY crosses may see further weakness at least in the short term.