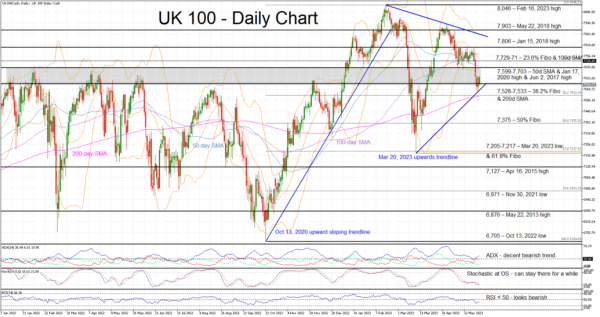

The UK 100 cash index has been trading sideways over the past few trading sessions, as it has returned inside the 7,599-7,689 range that acted as strong resistance during the January-December 2022 period. This area was eventually broken forcefully in January 2023, but it has now come into play again. In addition, a series of lower highs and higher lows is supporting the current index move.

The momentum indicators appear to be mixed at this stage. The Average Directional Movement Index (ADX) is edging higher and signaling a decent bearish trend, and the RSI is hovering below its 50-threshold point. On the other hand, the stochastic oscillator has dropped to its oversold area. However, it can stay there for a while, allowing the bears to keep pushing the index even lower.

Should the bears manage to overcome the lower boundary of the aforementioned range, they would quickly come up against the support set by the 200-day simple moving average (SMA) and the 38.2% Fibonacci retracement level of the October 13, 2022 – February 16, 2023 uptrend at 7,528-7,533 range. The path then looks clear until the 7,375 level.

On the other hand, the bulls are keen on pushing the index above the 7,703 level. The 7,729-7,771 area, populated by the 23.6% Fibonacci retracement and the 100-day SMA respectively, awaits them, a tad below the Jan 15, 2018 high of 7,806.

To sum up, the UK 100 cash index appears to be stuck in a key range. A break lower could quickly lead the index towards the 7,375 area. On the other hand, the path higher looks much tougher.