With investors flirting with the idea of one final Fed rate increase this summer and the dollar making a comeback, there will be increased emphasis on the next round of US employment data on Friday. Debt ceiling negotiations will also be front and center as the clock ticks down to a US government shutdown, while in Europe, there’s a batch of inflation numbers to shape the euro’s fortunes.

Dollar looks to NFP for more juice

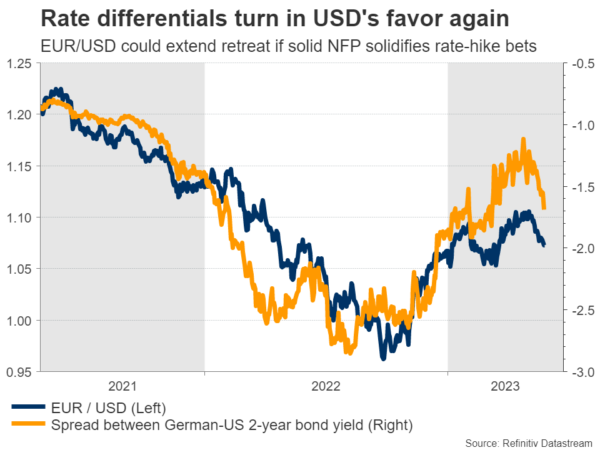

It’s been a fantastic month for the US dollar, which smoked the competition with a little help from interest rate differentials and safe-haven flows. With incoming business surveys highlighting the resilience of the American economy, investors have started to recalibrate the Fed’s rate trajectory higher.

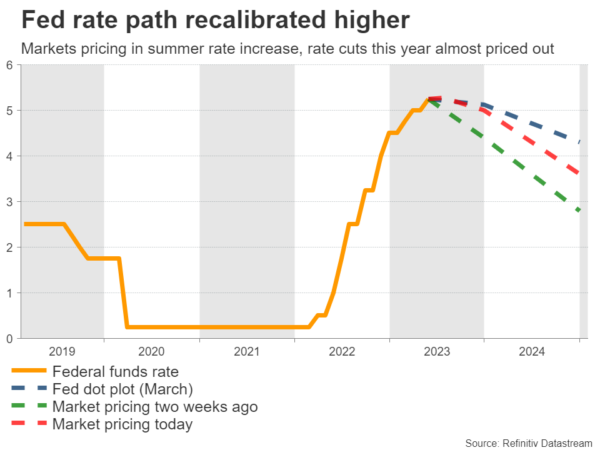

Markets are currently pricing in a 40% probability for the Fed to raise rates in June, which increases to 85% when looking at the July meeting. Meanwhile, the rate cuts that were baked into the cake later in the year have been mostly priced out, as concerns of an imminent recession have melted away.

However, Fed officials are split on whether further tightening is needed. Some want to raise rates again, others would rather pause, but the majority is still on the fence, preferring to examine the next round of economic data before making any decisions.

As such, there will be increased attention on the latest employment report due Friday. Forecasts suggest nonfarm payrolls rose by 180k in May, less than the previous month but still a respectable number. The unemployment rate is set to tick up to 3.5%, while wage growth is projected to accelerate slightly in yearly terms.

Nonfarm payrolls have exceeded estimates 12 times in the last 13 months, so economists seem to consistently underestimate the strength of the labor market. This phenomenon might be repeated this time, as the latest business surveys from S&P Global pointed to the fastest increase in employment growth for ten months. They also highlighted rising salary pressures.

A surprisingly strong employment report could cement expectations for one final rate increase this summer, or lead investors to further unwind rate-cut bets, keeping the wind in the dollar’s sails.

Another factor that can boost the reserve currency is a selloff in stocks that fuels safe-haven demand. Paradoxically, the catalyst for such an event might be a debt ceiling deal. After a compromise is reached, the Treasury will scramble to raise its depleted cash levels by ramping up borrowing, unleashing a tsunami of bond issuance that can drain liquidity.

Other data releases include the JOLTS job survey on Wednesday, ahead of the ADP report and the ISM manufacturing index on Thursday. Note that several markets in the US and Europe will be closed on Monday for a bank holiday.

Euro grinds lower ahead of inflation stats

In euro land, the single currency has been under selling pressure for several weeks now. Some of that reflects the resurgent dollar, as the euro and the dollar are basically opposite sides of the same coin. However, there’s also an element of economic weakness creeping in.

In particular, the slowdown in the manufacturing sector has intensified, dragging the bloc’s manufacturing powerhouse – Germany – into a technical recession. That’s a huge problem for the European Central Bank as economic growth seems to be rolling over but inflationary pressures remain scorching hot, leaving policymakers in a bind.

Markets are still pricing in another 60bps of ECB rate increases in the coming months, so the focus will be on incoming data, starting on Wednesday with Germany’s inflation and unemployment numbers for May. Then on Thursday, investors will get a glimpse at the same releases for the entire Eurozone, alongside the latest ECB minutes.

Forecasts point to a cooldown in inflation, something supported by business surveys where average selling prices for goods and services rose at the slowest pace in two years in May. If inflation cools significantly, some of those ECB rate-hike bets could be unwound, spelling more trouble for euro/dollar.

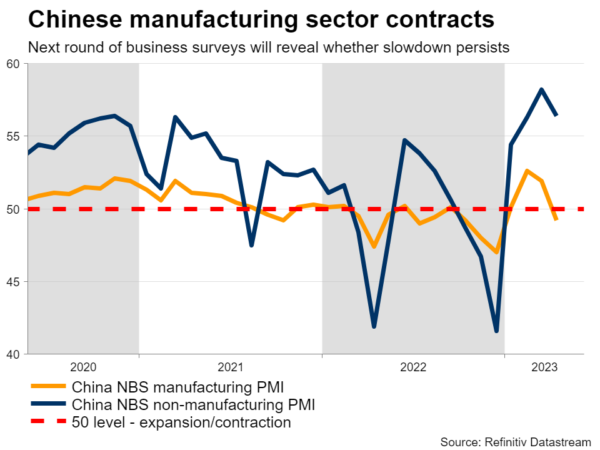

Chinese, Canadian, and Australian releases

Over in China, the latest PMIs will be released Wednesday. The economy has lost steam lately as the reopening boom faded, so these surveys will reveal whether this worrisome trend persisted in May. If so, the currencies of nations that depend on Chinese demand to absorb their exports – such as Australia and New Zealand – could encounter further downside.

Speaking of Australia, monthly CPI data for April is out on Wednesday, ahead of Thursday’s capex data. In Canada, GDP growth numbers for Q1 will see the light on Wednesday.

Finally in Turkey, the second round of the presidential election will be held Sunday.