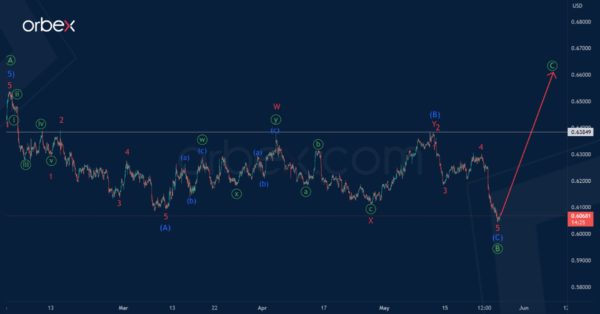

We talked about NZDUSD three weeks ago. The pair presumably builds a correction zigzag pattern consisting of three primary waves Ⓐ-Ⓑ-Ⓒ.

Primary impulse wave Ⓐ completed successfully. The bearish correction Ⓑ is under development, its structure is similar to the standard zigzag (A)-(B)-(C). Impulse (A) and correction (B) can be considered completed, it is a minor double zigzag.

Now the price is moving down in the intermediate impulse (C) towards 0.590. At that level, primary correction Ⓑ will be at 61.8% of actionary wave Ⓐ.

Alternatively, the primary correction Ⓑ could be fully completed. It is a standard intermediate zigzag (A)-(B)-(C). The intermediate sub-waves (A) and (C) are impulses, correction (B) has the form of a double zigzag.

Thus, if the current option is confirmed, in the near future market participants may expect the development of the initial part of the final wave Ⓒ.

The first target for the bulls is a maximum of 0.638. The minor sub-waves W and Y of the correction (B) were completed on it.