The dollar index keeps firm bullish stance and hit ten-week high on Thursday, driven by growing uncertainty over so far unsuccessful talks about raising US debt ceiling ahead of June 1 deadline, when the Treasury will run out of money.

The minutes of Fed’s last policy meeting added to dollar’s positive sentiment as the policymakers left all options open, despite signals of pausing tightening cycle for the rest of the year.

Inflationary pressures are still high, as inflation is running at more than two times the Fed’s 2% target, which keeps the central bank alerted, while risk to economic growth rose significantly on high borrowing cost and tightening credit conditions after several banks collapsed in past few months that supports dovish approach to monetary policy in coming months.

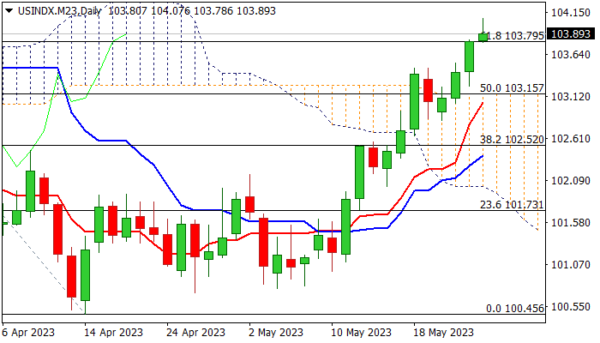

The picture on daily chart is firmly bullish but overbought, suggesting that bulls are likely to face strong headwinds on approach to targets at 104.58/66 (Fibo 76.4% of 105.85/100.45 / base of thick weekly cloud).

Shallow consolidation ahead of fresh push higher would be likely scenario on persisting favored fundamentals, with extended dips to stall above the top of thick daily cloud (103.15) and keep near-term bias with bulls.

Caution on break of daily cloud top (103.15, reinforced by rising daily Tenkan-sen) and loss of 102.83 pivot (May 22 trough) which may sideline bulls and increase risk of deeper pullback.

Res: 104.07; 104.66; 105.00; 105.56.

Sup: 103.79; 103.45; 103.15; 102.83.