In today’s quiet Asian session, forex markets have largely stayed within a narrow range, with minimal response to positive PMI data from Australia and Japan. Yen has seen a slight recovery but continues to be the weakest performer of the week, followed closely by Sterling and Dollar. On the flip side, New Zealand Dollar remains the leader, with Swiss Franc and Aussie following, while Canadian and Euro are mixed.

Attention is now shifting to PMI data from Eurozone, UK, and US, set to be released later today. Even though these figures may not trigger significant market reactions, they will still offer some insights into how these economies are faring amidst prolonged global monetary policy tightening.

On the technical front, Gold has dipped notably in the Asian session, but it remains to be seen if the corrective recovery from 1951.77 has completed. Nevertheless, near-term outlook remains cautiously bearish, as long as 1999.30 support-turned-resistance continues to hold. Break below 1951.77 would resume the overall decline from 2062.95. If this occurs, a downside breakout in Gold could coincide with a drop below 1.0759 temporary low in Euro, signaling potential upside momentum in the greenback.

In Asia, at the time of writing, Nikkei is down -0.67%. Hong Kong HSI is down -0.58%. China Shanghai SSE is down -0.58%. Singapore Strait Times is up 0.35%. Japan 10-eyar JGB yield is up 0.0060 at 0.393. Overnight, DOW dropped -0.42%. S&P 500 rose 0.02%. NASDAQ rose 0.50%. 10-year yield rose 0.027 to 3.719.

Some Fed officials not prejudging June meeting

Fed Presidents Thomas Barkin of Richmond and Raphael Bostic of Atlanta shared their perspectives during an event hosted by the Richmond Fed.

Barkin didn’t provide any conclusive hints about the June meeting, stating, “I’m not going to prejudge June. I’d like to be convinced of that and I’m still looking to be convinced of that.”

Bostic emphasized the lag effect of the policy, adding, “Our policy works with a lag. And we’re just at the very beginning of this time when that lag is starting to play out and you’re starting to see tightness emerge. Right now, absent a big change, I think I will be comfortable saying let’s just look and see how things play out.”

Separately, San Francisco Fed President Mary Daly shared a similar sentiment of cautious observation, saying, “I really think, at this point in our tightening cycle, it is prudent to resist the temptation to say what we are going to do for the rest of the year.”

The collective view indicates an element of uncertainty and data-dependency in Fed’s next moves.

ECB’s De Cos: Monetary tightening process well advanced but still have some way to go

During an event in Barcelona yesterday, ECB Governing Council Pablo Hernandez de Cos, said, “The process of monetary tightening is already well advanced, although, with the information currently available to us, we still have some way to go.”

He further explained, “We also anticipate that interest rates will have to remain in restrictive territory for a long time to reach our target in a sustained manner.”

Acknowledging the potential impact of this strategy on economic activity, de Cos pointed out, “The tightening process is having and will have short-term costs in terms of lower economic activity.”

However, he underscored the necessity of this process in maintaining price stability, which he deemed crucial for promoting long-term economic growth.

“Keeping price stability is the main contribution that the central bank can make to ensure economic growth solid long term,” he concluded.

Australia PMI composite dropped to 51.2, still early to call an end to RBA tightening

Australia’s PMI Manufacturing index stayed put at 48.0 in May, marking the joint-lowest reading since May 2020. On the other hand, PMI Services fell from 53.7 to 51.8, causing Composite PMI to decrease from 53.0 to 51.2.

Warren Hogan, Chief Economic Advisor at Judo Bank, said, “The May Flash result shows a small retracement from the strong April outcome reinforcing the view that overall economic activity in Australia is holding up well as we enter the winter months.”

Despite the manufacturing sector’s continuous slowdown, Hogan emphasized that this does not signal a recession. In contrast to manufacturing, the services sector has shown recent strength, and was “far from the risk of recession:.

However, he warned of the implications of better economic conditions in terms of inflation. “The RBA is trying to engineer a soft landing to rid the economy of inflation. But if they don’t lean hard enough on monetary policy, we could see a more stubborn inflation emerge which will ultimately require a bigger lift in interest rates,” Hogan cautioned.

Highlighting the strong correlation between the pick-up in the services PMI, housing market, rising population growth, and job advertising, he concluded, “Last week’s labour market data on employment and wages have bought the RBA some time, but the Flash PMIs highlight that it is still too early to call an end to the monetary policy tightening cycle.”

Japan PMI manufacturing rose to 50.8, services rose to 56.3

Japan PMI Manufacturing rose from 49.5 to 50.8 in April, signalling the first improvement in operating conditions since October 2022. PMI Manufacturing Output rose from 47.9 to 51.9. PMI Services rose from 55.4 to 56.3. PMI Composite Output rose from 52.9 to 54.9.

Usamah Bhatti, Economist at S&P Global Market Intelligence, said:

“The Japanese private sector economy continued on an upward trajectory, as signalled by a further expansion in May. The rate of growth quickened from April to reach the strongest since October 2013 and the second-strongest in the survey history (since September 2007).

“Service providers continued to report strong growth momentum with a renewed record increase in business activity, while manufacturers indicated an improvement in operating conditions for the first time in seven months, with output and new orders returning to expansion territory for the first time since last June.”

Looking ahead

Eurozone PMIs and UK PMIs are the main focuses in European session. Later in the day, Canada will release IPPI and RMPI. US will release PMIs and new homes sales.

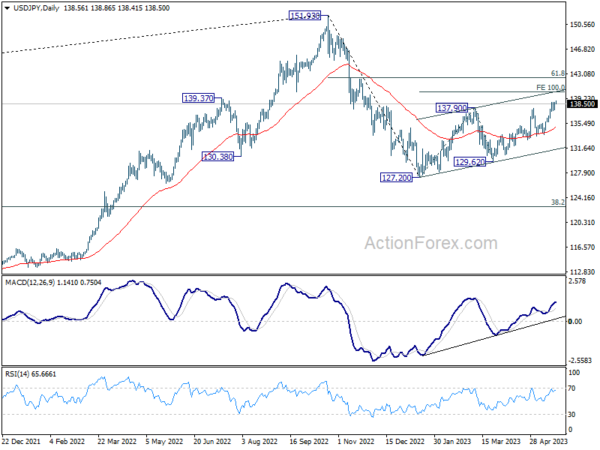

USD/JPY Daily Outlook

Daily Pivots: (S1) 137.83; (P) 138.26; (R1) 139.02; More…

USD/JPY’s rally is trying to resume with breach of 138.73 temporary top and intraday bias is back on the upside. Current rally from 127.20 should target 100% projection of 127.20 to 137.90 from 129.62 at 140.32. Break there will target 142.48 fibonacci level. On the downside, break of 137.41 minor support will turn intraday bias neutral again first, and bring more consolidation before staging another rise.

In the bigger picture, rise from 127.20 is seen as the second leg of the corrective pattern from 151.93 high. Stronger rally would be seen to 61.8% retracement of 151.93 to 127.20 at 136.34. Sustained break there will pave the way back to retest 151.93. On the downside, however, break of 133.73 support will argue that the pattern could have started the third leg through 127.20 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:00 | AUD | Manufacturing PMI May P | 48 | 48 | ||

| 23:00 | AUD | Services PMI May P | 51.8 | 53.7 | ||

| 00:30 | JPY | Manufacturing PMI May P | 50.8 | 49.5 | ||

| 06:00 | GBP | Public Sector Net Borrowing (GBP) Apr | 17.5B | 20.7B | ||

| 07:15 | EUR | France Manufacturing PMI May P | 46.1 | 45.6 | ||

| 07:15 | EUR | France Services PMI May P | 54.3 | 54.6 | ||

| 07:30 | EUR | Germany Manufacturing PMI May P | 45.2 | 44.5 | ||

| 07:30 | EUR | Germany Services PMI May P | 55.5 | 56 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI May P | 46.2 | 45.8 | ||

| 08:00 | EUR | Eurozone Services PMI May P | 55.6 | 56.2 | ||

| 08:00 | EUR | Current Account (EUR) Mar | 20.2B | 24.3B | ||

| 08:30 | GBP | Manufacturing PMI May P | 48.2 | 47.8 | ||

| 08:30 | GBP | Services PMI May P | 55.5 | 55.9 | ||

| 12:30 | CAD | Industrial Product Price M/M Apr | 0.20% | 0.10% | ||

| 12:30 | CAD | Raw Material Price Index Apr | 0.70% | -1.70% | ||

| 13:45 | USD | Manufacturing PMI May P | 50 | 50.2 | ||

| 13:45 | USD | Services PMI May P | 53.6 | 53.6 | ||

| 14:00 | USD | New Home Sales Apr | 665K | 683K |