CHF/JPY resumes recent up trend today by breaking through 153.93 resistance, and reaches as high as 154.38 so far. The move is firstly driven but return to weakness in Yen, following extended rally in US and European benchmark treasury yields. Nikkei also ended up for another day and closed above 31k handle, extending the run for the highest level in more than 30 years. Secondly, Swiss Franc is also rising against European majors, even though it’s starting to hesitate.

Near term outlook in CHF/JPY will now stay bullish as long as 149.77 support holds even in case of retreat. Next target is 161.8% projection of 137.40 to 147.58 from 140.21 at 156.68.

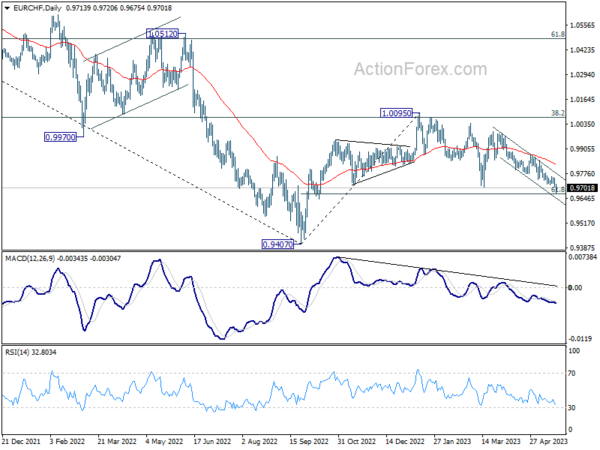

The momentum of CHF/JPY will very much depend on the performance of Swiss Franc elsewhere. In particular, if EUR/CHF could break through 61.8% retracement of 0.9407 to 1.0095 at 0.9670 decisively towards 0.9407 low, CHF/JPY could accelerate up in tandem. However, bottoming and rebound in EUR/CHF from current level could cap CHF/JPY’s upside momentum.