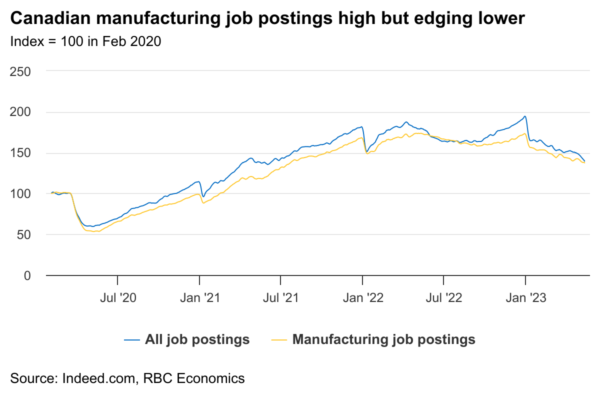

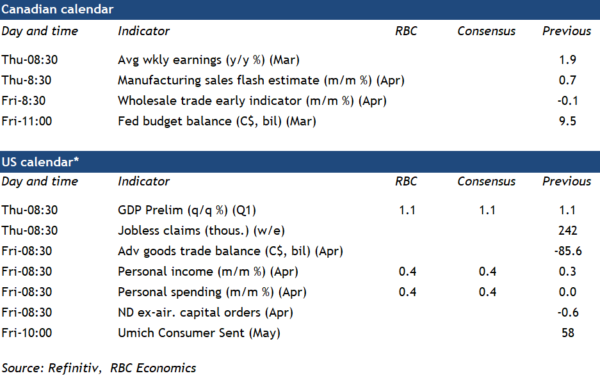

Did the economy lose steam early in Q2? Advance estimates of Canadian manufacturing sales for April will be watched carefully for signs of weakness. A surge in home resales and sticky ‘core’ inflation measures in April have markets speculating that the Bank of Canada might need to re-start interest rate hikes. Still, the economy had been slowing after a surge in activity in January. Early GDP estimates from Statistics Canada last month showed a small 0.1% increase in February output—and an outright decline in March, led by weakness in retail and wholesale trade. Manufacturing production likely fell in March as well, despite a tick higher in sales that was mostly supported by strength in transport equipment. That in mind, we expect next week’s advance manufacturing sales report for April to show even more softness. This would coincide with the decline we’ve seen in demand for discretionary consumer goods and lower manufacturing job postings into May. Adding to the headwinds was the strike among federal employment that lasted ~ten days in April.

Job vacancies are also on the radar next week as the March Survey of Employment, Payrolls & Hours (SEPH) is released. Vacancies have already declined steadily since peaking in spring 2022 but were more than 50% above where they were compared to 2019 levels. That helps explain the current backdrop for the Canadian labour market. Indeed, conditions remain overheated (as evidenced by strong headline employment growth and decade-low unemployment rates) but cracks of stalling labour demand are forming under the surface. All told, we continue anticipate more softening in activity to come as higher living costs strain household spending.

Solid U.S. retail sales for April (+0.4%) are pointing to a pickup in consumer spending after two softer months over February and March. Growth was likely supported by more spending on durable goods, especially cars. A jump in hours worked and average hourly wages in April is pointing to a 0.4% increase in household incomes.