Gold price remains at the back foot on Wednesday and hit new two-week low, in extension of Tuesday’s 1.3% fall which also registered a daily close below psychological $2000 level for the first time since May 1.

The metal came under increased pressure on the latest hawkish comments from Fed officials, who played down prospects for rate cuts this year, but pointed to central bank’s super strong stance in fighting high inflation.

This revived expectations for another rate hike, against still high percentage forecast that the Fed is about to pause its tightening cycle, as signaled after the last policy meeting, deflating the non-interest bearing metal.

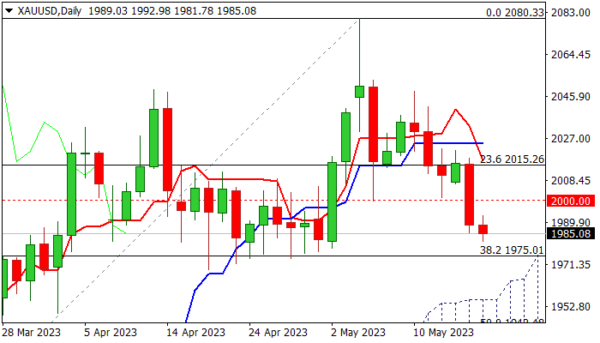

Daily chart structure weakened on break of $2000 handle, daily Tenkan-sen crossed below Kijun-sen, 14-d momentum is at the border line and the action is weighed by Tuesday’s large bearish candle, but stochastic is oversold.

However, fresh bears still face strong supports at $1975 (higher base/Fibo 38.2% of $1804/$2080) and $1955 (top of rising daily Ichimoku cloud which underpins the action) where strong headwinds should be anticipated, and bears are unlikely to break them on first attempt.

Near-term bias is expected to remain with bulls while the action stays above $1975, though the downside would remain vulnerable while $2000 caps.

Bounce and close above $2000, as minimum requirement for initial reversal signal, would improve near-term picture, however verification of the signal will still require acceleration above daily Kijun-sen ($2024).

Res: 1992; 2000; 2015; 2024.

Sup: 1975; 1969; 1955; 1942.