WTI crude oil rebounded on Monday after three sessions of declines in the second half of last week. Oil found support just before the start of active trading in Europe after falling to a 10-day low of $69.40.

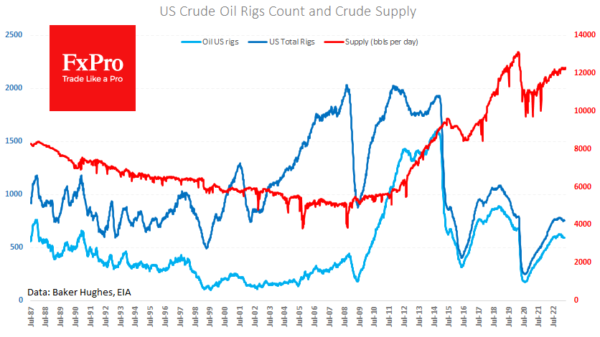

Today’s pullback is still within the recent downtrend. Behind the buying is Friday’s data showing a further drop in the number of rigs operating in the US, from 748 last week to 731, the lowest since June last year and the continuation of the downtrend since November last year. This dynamic reflects doubts among US producers about maintaining and increasing oil supply over the six-month to one-year outlook.

However, while at the end of last year, this sentiment was influenced by fears of a recession in the developed world, it is now more a reaction to deteriorating financial conditions.

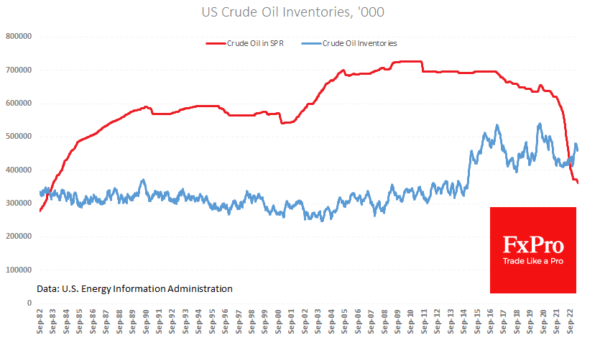

Another explanation from oil producers is worth considering. Over the past five weeks, the US government has returned to selling oil from the Strategic Petroleum Reserve, discouraging producers from making new investments as it tends to lower final prices. Late last week, administration officials confirmed their intention to return to replenishing the reserves this coming summer, but this is not the first time that date has been pushed back.

The sharp fall in oil prices, which peaked at the start of trading on 4 May, looked like a turning point for the market. However, buyers failed to provide sufficient traction, and the pressure on prices soon returned, briefly pushing prices back below $70.

Judging by the emerging short-term technical picture, it is better to be prepared for another test of the $65-67 per barrel WTI area. However, we expect oil to stay within this level, given the monumental task of replenishing US reserves and replacing Russia’s share of oil, shifting the supply/demand balance in favour of the former.