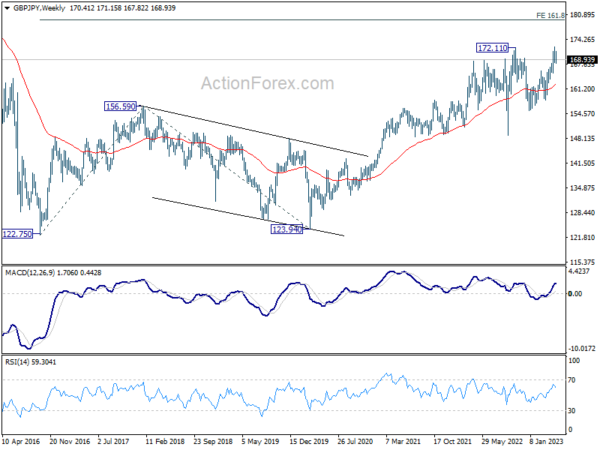

GBP/JPY is still holding on to 167.95 resistance turned support despite last week’s decline. Initial bias remains neutral this week first. On the upside, break of 172.30 will resume larger up trend to 100% projection of 148.93 to 172.11 from 155.33 at 178.51. Nevertheless, firm break of 167.95 should confirm short term topping, and turn bias back to the downside for deeper pull back to 165.40 support and possible below instead.

In the bigger picture, focus stays on 172.11 resistance (2022 high). Decisive break there will resume whole up trend from 123.94 (2020 low). Next target will be 161.8% projection of 122.75 (2016 low) to 156.59 (2018 high) from 123.94 at 178.69. Nevertheless, firm break of 165.40 support will indicate rejection by 172.11 and extend the corrective pattern from there with another falling leg.

In the longer term picture, as long as 55 M EMA (now at 154.40) holds, rise from 122.75 (2016 low) could still extend higher at a later stage to 195.86 (2015 high).