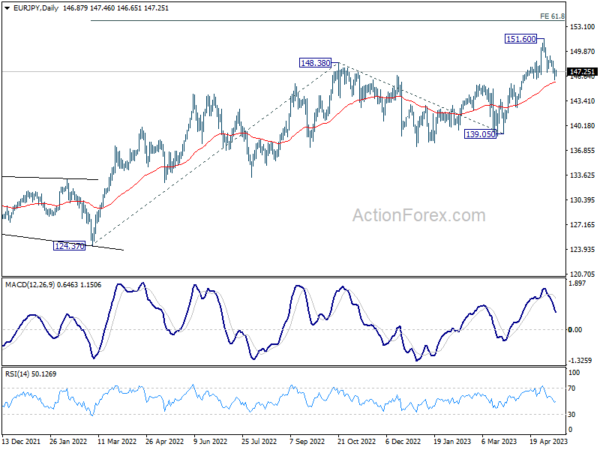

EUR/JPY’s decline indicates that 151.60 is already a short term top. Further fall is in favor this week as long as 149.25 resistance holds. Sustained trading below 55 D EMA (now at 145.81 will bring deeper pull back to 61.8% retracement of 139.05 to 151.60 at 143.84. On the upside, though, firm break of 149.25 will turn bias back to the upside for retesting 151.60 high instead.

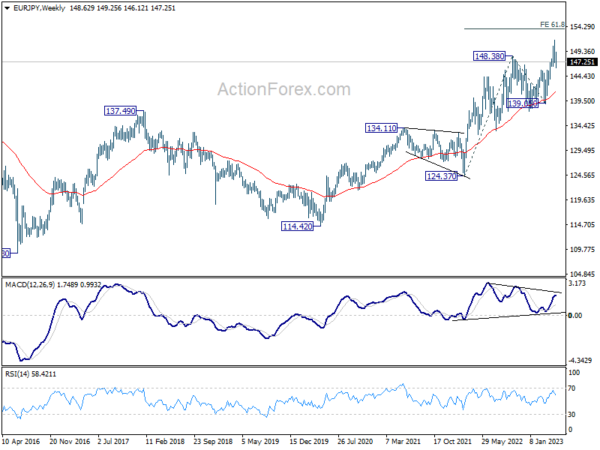

In the bigger picture, rise from 114.42 (2020 low) is in progress. Next target is 61.8% projection of 124.37 to 148.38 from 138.81 at 153.64. Sustained break there will pave the way to 100% projection at 162.82. For now, medium term outlook will remain bullish as long as 139.05 support holds, even in case of deep pull back.

In the long term picture, break of 149.76 (2014 high) argues that whole up trend form 94.11 (2012 low) is resuming. Sustained trading above 149.76 will pave the way to 100% projection of 94.11 to 149.76 from 109.03 at 164.68, which is close to 169.96 (2008 high).