Dollar is capitalizing on its recent rebound in early US sessions, bolstered by data that showed a 0.4% month-on-month rise in import prices for April – marking the first increase since late 2022. This resurgence places the Greenback on track to be this week’s top performer, trailed by Japanese Yen and Swiss Franc. This picture hints at a subtle risk-off sentiment, despite its most apparent manifestation being in commodities market.

Conversely, Sterling remains weak after the surprising contraction in the country’s monthly GDP for The Australian and New Zealand Dollars are faring even worse, struggling amidst the broader market dynamics.

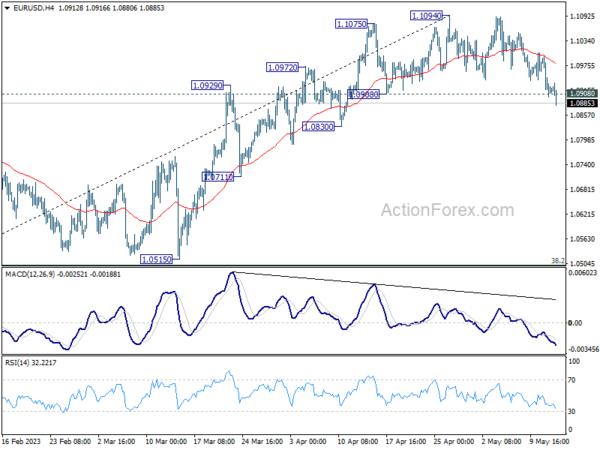

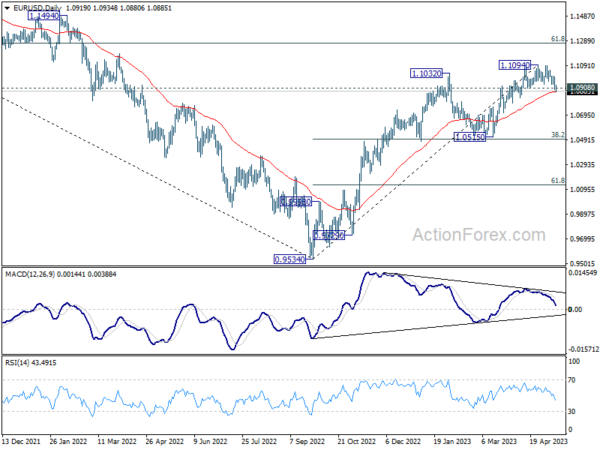

Euro is also displaying softness, succumbing to fresh selling pressure against Dollar. From a technical perspective, break of 1.0908 support level in EUR/USD suggests that deeper correction is now underway. Given bearish divergence condition in Daily MACD, sustained trading below the 55 D EMA could trigger steeper selloff towards 1.0515 cluster support, in what could be a correction to the entire rise from 0.9534.

In Europe, at the time of writing, FTSE is up 0.20%. DAX is up 0.45%. CAC is up 0.47%. Germany 10-year yield is up 0.261 at 2.250. Earlier in Asia, Nikkei rose 0.90%. Hong Kong HSI dropped -0.59%. China Shanghai SSE dropped -1.12%. Singapore Strait Times dropped -0.65%. Japan 10-year JGB yield dropped -0.0031 to 0.389.

Fed Bowman suggests potential for further monetary tightening

Fed Governor Michelle Bowman highlighted concerns over persistently high inflation and a tight labor market. In a speech, she suggested the need for additional monetary policy tightening should these conditions persist.

She stated, “The most recent CPI and employment reports have not provided consistent evidence that inflation is on a downward path, and I will continue to closely monitor the incoming data as I consider the appropriate stance of monetary policy going into our June meeting.”

She emphasized the necessity of a “sufficiently restrictive” policy stance to curtail inflation over time, especially if inflation remains elevated and the labor market continues to be tight.

She further added, “I also expect that our policy rate will need to remain sufficiently restrictive for some time to bring inflation down and create conditions that will support a sustainably strong labor market.”

Despite her clear inclination towards policy tightening, Governor Bowman was careful to stress the uncertainty of economic outlook and the adaptability of Fed’s policy actions.

“Of course, the economic outlook is uncertain and our policy actions are not on a preset course,” she concluded, indicating Fed’s readiness to adjust its approach as necessary in response to evolving economic conditions.

UK GDP contracted -0.3% mom in March; services main contributor to decline

UK GDP saw a contraction of -0.3% mom in March, significantly underperforming against expectations of being flat. The contraction was primarily driven by the services sector, which slipped by -0.5% in the month, following an unrevised dip of 0.1% in February.

However, not all areas of the economy were in decline. Production output experienced its strongest monthly growth since May 2021, with a 0.7% increase in March, rebounding from a 0.1% fall in February. Similarly, construction sector showed modest growth of 0.2% in March, albeit much slower than February’s robust 2.6% rise.

On a quarterly basis, GDP growth for Q1 met expectations at 0.1% qoq. In output terms, services sector eked out 0.1% growth over the quarter, fueled by advancements in information and communication, and administrative and support service activities. Construction sector also saw growth at 0.7%, while the production sector managed a marginal 0.1% increase, with a slightly better 0.5% growth in manufacturing.

Year-on-year, the implied GDP deflator for Q1 2023 rose by 6.3%, indicating a slowdown from the 7.3% seen in Q4 2022. This suggests a softening of inflationary pressures within the UK economy over this period.

NIESR forecasts UK GDP to bounce back by 0.3% in Apr

National Institute of Economic and Social Research (NIESR) forecasts a modest rebound in UK’s monthly GDP in April with growth of 0.3%, largely driven by services sector. However, this is viewed as a modest increment rather than the robust ‘jump-start’ the UK economy may need. Paula Bejarano Carbo, Associate Economist at NIESR, highlighted the situation as “(welcome) low growth”.

Meanwhile, the think tank significantly downgrades annual GDP outlook for 2023 to a mere 0.3%, a stark contrast to 4.1% achieved in 2022. This economic stagnation is attributed to persistently high inflation and interest rates, which continue to weigh heavily on household and corporate budgets, and is expected to suppress demand in the forthcoming months.

The forecast paints a paradoxical picture of the UK’s economic future. While there is cautious optimism as it appears the worst of the energy price shock has passed and the country seems poised to avoid an imminent recession, the subdued outlook suggests that it will feel like a recession for many households. NIESR predicts an average fall in real personal disposable incomes of approximately 2% over the next three years, further pressuring households already grappling with the economic challenges.

New Zealand BNZ PMI rose to 49.1, but struggles continue

New Zealand’s manufacturing sector is continuing to grapple with challenges as BusinessNZ Performance of Manufacturing Index edged up to 49.1 in April, from 48.1 in March, remaining below neutral 50.0 mark that separates expansion from contraction.

While the index ticked higher, five of the last seven months have seen contraction, indicating ongoing stress in the sector. In fact, the proportion of negative comments rose to 70.3% in April, compared with 63.2% in March and 60.2% in February. Manufacturers expressed concerns over price pressures, staffing issues, and lower demand, mirroring the broader economic challenges faced by the country.

Digging deeper into the data, we see that production rose from 43.4 to 47.0 and employment edged up from 47.3 to 47.8. New orders also improved, rising from 46.9 to 49.8, but these sub-indexes remained in contraction territory. Finished stocks increased from 48.5 to 52.5, while deliveries dropped from 53.9 to 51.5.

Catherine Beard, BusinessNZ’s Director of Advocacy, commented on the tough conditions, noting the stresses and strains of the wider economy appear to be playing out in the manufacturing sector. She further added that despite the overall activity not straying too far into contraction, the sector seems unable to regain expansion mode, with key indicators of production and new orders failing to return positive results in April.

RBNZ survey sees notable decline in inflation expectations

According to RBNZ Q2 Survey of Expectations (Business), inflation expectations for the year ahead took a notable dip, marking the largest drop since June 2020. The one-year-ahead inflation expectation declined by -83 basis points, moving from 5.11% down to 4.28%.

Further into the future, expectations for inflation over a two-year period also demonstrated a decrease. The mean two-year-ahead inflation expectation fell by -51 basis points from 3.30% to 2.79%, placing it back within RBNZ’s target band of 1-3% for the first time since December 2021. The survey also found that the spread of responses has narrowed compared to the previous quarter, with a lower quartile of 2.00% and an upper quartile of 3.00%.

The survey’s respondents also projected changes in the Official Cash Rate. By the end of June 2023, the OCR is expected to rise to 5.47%, an increase of 58 basis points from the last quarter’s mean estimate of 4.89%. However, expectations suggest the OCR will fall back to 4.84% by March 2024, down from the previous quarter’s estimate of 5.00%.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0878; (P) 1.0938; (R1) 1.0976; More…

EUR/USD’s break of 1.0908 support indicates short term topping at 1.1094. Intraday bias is back on the downside. Considering bearish divergence condition in D MACD, sustained trading below 55 D EMA (now at 1.0881) will pave the way back to 1.0515 cluster support, 38.2% retracement of 0.9534 to 1.1094 at 1.0498, as a correction to whole up trend from 0.9534.

In the bigger picture, rise from 0.9534 (2022 low) is in progress for 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273. Sustained break there will solidify the case of bullish trend reversal and target 1.2348 resistance next (2021 high). This will now remain the favored case as long as 1.0515 support holds, even in case of deeper pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PMI Apr | 49.1 | 48.1 | ||

| 23:50 | JPY | Money Supply M2+CD Y/Y Apr | 2.50% | 2.70% | 2.60% | 2.50% |

| 03:00 | NZD | RBNZ Inflation Expectations Q2 | 2.79% | 3.30% | ||

| 06:00 | GBP | GDP Q/Q Q1 P | 0.10% | 0.10% | 0.10% | |

| 06:00 | GBP | GDP M/M Mar | -0.30% | 0.00% | 0.00% | |

| 06:00 | GBP | Industrial Production M/M Mar | 0.70% | -0.10% | -0.20% | -0.10% |

| 06:00 | GBP | Industrial Production Y/Y Mar | -2.00% | -3.70% | -3.10% | -2.70% |

| 06:00 | GBP | Manufacturing Production M/M Mar | 0.70% | -0.10% | 0.00% | 0.10% |

| 06:00 | GBP | Manufacturing Production Y/Y Mar | -1.30% | -3.80% | -2.40% | -1.90% |

| 06:00 | GBP | Goods Trade Balance (GBP) Mar | -16.4B | -17.5B | -17.5B | -16.6B |

| 12:30 | USD | Import Price Index M/M Apr | 0.40% | 0.30% | -0.60% | -0.80% |

| 14:00 | USD | Michigan Consumer Sentiment Index May P | 63 | 63.5 |