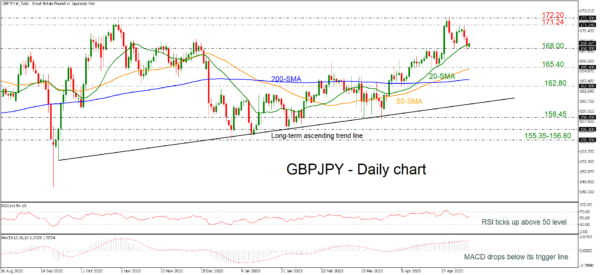

GBPJPY posted two consecutive red days, meeting the 168.00 support, and is currently holding near the 20-day simple moving average (SMA). When looking at the bigger picture, the pair is bullish as it is standing above the long-term uptrend line and the 200-day SMA.

From a technical perspective, the RSI is pointing upwards near the 50 level, while the MACD is losing momentum beneath its trigger line in the positive region.

If price action remains above 168.00 (immediate support), there is scope to test 171.24. Clearing this key level would see additional gains towards 172.20. This is considered to be a strong resistance area which has been rejected a few times in the past.

If the 168.00 support fails, then the focus would shift to the downside towards 165.40, which stands near the 50-day SMA. If this level is breached, the pair would increase downside pressure and bring about a reversal of the trend. From here, GBPJPY would be on the path towards the 200-day SMA at 163.65 and 162.80.

Overall, GBPJPY has been in a negative correction in the very short-term, but the broader outlook is bullish.