The Chinese economy continues to exhibit sluggish growth, with recent inflation data falling short of expectations at 0.1% year-on-year. Consequently, the Chinese yuan (CNH) experienced a decline, potentially influencing the performance of the Australian dollar (AUD), particularly when considering the additional factor of weak copper prices.

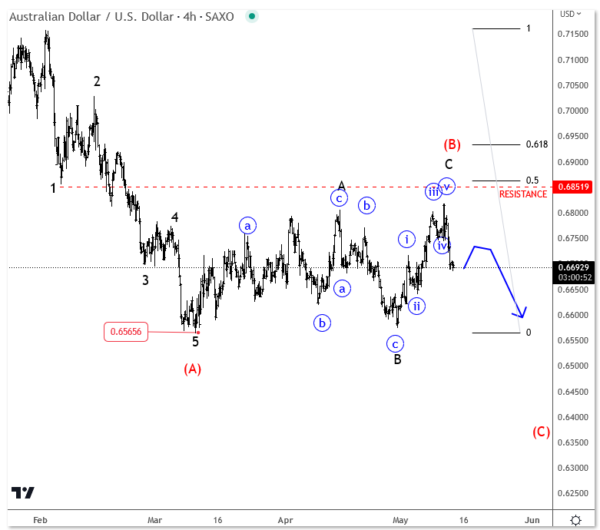

Upon examining the price chart, it becomes evident that the AUD has been displaying a bearish trend since February. During this period, the currency pair reached a significant peak, representing a higher degree impulse, as evidenced by the daily chart. Subsequently, a notable downward movement has transpired from the 0.7150 level, ideally leading to a higher degree correction that remains incomplete. Typically, corrections consist of three waves, but thus far, only wave (A) has materialized, followed by a wave (B) rally, which displays initial signs of completion around the resistance zone of 0.68-0.69. Presently, a compelling downward movement is underway. This implies the potential for further weakness in the upcoming weeks, with a probable retracement towards the 0.6565 area.