GBP/USD – 1.3277

Original strategy :

Sold at 1.3315, Target:1.3115, Stop: 1.3375

Position: – Short at 1.3315

Target: – 1.3115

Stop: – 1.3375

New strategy :

Hold short entered at 1.3315, Target:1.3115, Stop: 1.3315

Position: – Short at 1.3315

Target: – 1.3115

Stop:- 1.3315

Although cable found support at 1.3225 and has rebounded, as long as indicated resistance at 1.3312-25 holds, mild downside bias remains for another retreat, below 1.3225 would bring weakness to 1.3195-00 but a drop below indicated support at 1.3121 is needed to retain bearishness and signal the rebound from 1.3027 has ended, bring further fall to 1.3065-75, then retest of said support at 1.3027.

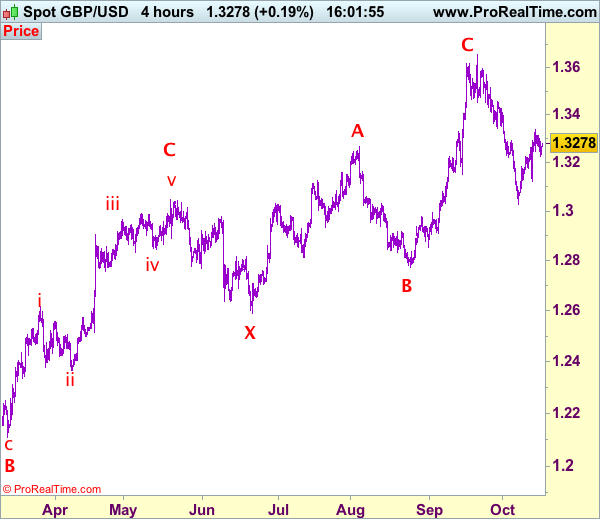

In view of this, we are holding on to our short position entered at 1.3315. Above said resistance at 1.3312-15 would risk test of said resistance at 1.3338 (last week’s high), break there would abort and signal low has been formed at 1.3027 instead, bring at least a correction of the fall from 1.3658 top to 1.3390-00 later. Our preferred count is that (pls see the attached chart) the wave IV is unfolding as a complex double three (ABC-X-ABC) correction with 2nd wave B ended at 1.2774, hence 2nd wave C could have ended at 1.3658.

Our preferred count on the daily chart is that cable’s rebound from 1.3500 (wave (A) trough) is unfolding as a wave (B) with A ended at 1.7043, followed by triangle wave B and wave C as well as wave (B) has ended at 1.7192, the subsequent selloff is the larger degree wave (C) which is still unfolding with minor wave (III) of larger degree wave 3 ended at 1.1986, hence wave (IV) correction is in progress which could either be a triangle wave (IV) of a complex formation but upside should be limited to 1.3500 and price should falter well below 1.4000, bring another decline in wave (V) of 3 for weakness to 1.1500, then 1.1200.