With the Fed’s final rate increase now likely in the rear-view mirror and the markets pricing in decent chances for the central bank to cut rates by July, the spotlight will fall squarely on the next round of US inflation data out on Wednesday. Forecasts point to a slowdown in core CPI, although business surveys signaled the opposite. As for the dollar, it has been trading ‘heavy’ lately and it is doubtful whether even an upside surprise in this dataset can change that.

Sluggish dollar

The dollar has been under intense selling pressure this year, despite mounting signs that the US economy has started to regain momentum. It’s been one-way traffic, with FX traders placing more emphasis on negative news and overlooking positive developments. The greenback seems unable to rally on stronger data, but any disappointment tends to inflict damage.

Behind this asymmetric reaction function lies speculation about Fed rate cuts. Even though the Fed has raised rates with incredible speed, market pricing suggests the next move will be a cut. A total of 70bps of rate reductions are priced in by December, which is striking given the persistence of inflationary pressures.

Most likely, this pricing reflects the problems in the banking system. Investors are betting the Fed will ride to the rescue soon by lowering rates, and will be forced to tolerate a period of higher inflation to avoid a cascade of bank failures. Because of this speculation, the dollar has lost some of its interest rate advantage.

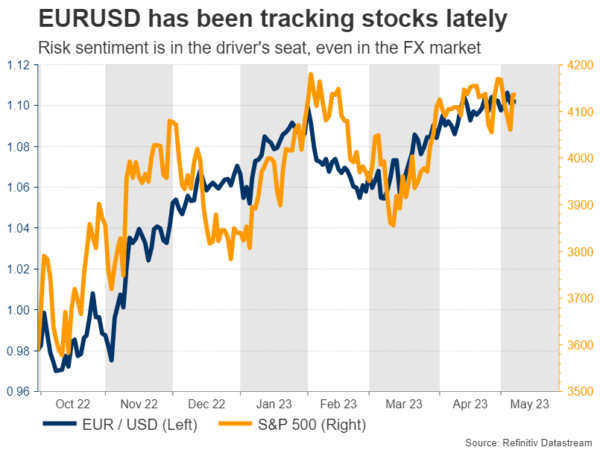

Another factor has been the cheerful mood in equity markets. The dollar often acts like a safe-haven, so the stunning rally in stocks has diminished demand for the reserve currency. It is probably not a coincidence that the dollar index topped in late September, a couple of weeks before the stock market bottomed.

Upside risks from CPI?

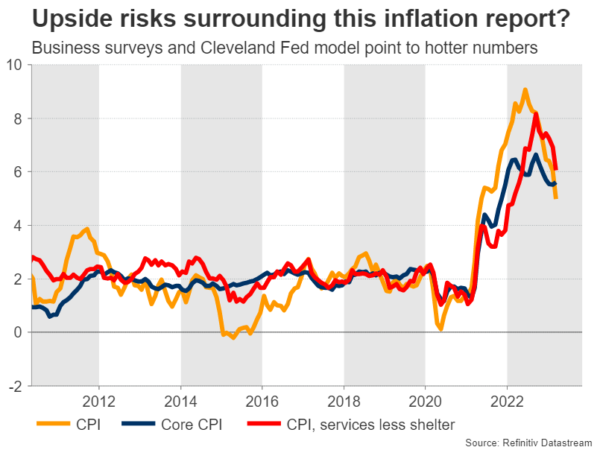

Turning to this week’s data releases, the ball will get rolling on Wednesday with the latest CPI inflation report. Forecasts suggest the headline CPI rate remained unchanged at 5.0% in April, while the core rate is expected to have ticked down to 5.5%, from 5.6% previously.

As for any surprises, the risks seem tilted towards a hotter-than-expected report. The S&P Global services PMI showed that companies raised their selling prices at the fastest pace since August, taking advantage of stronger demand. Similarly, the Cleveland Fed Inflation Nowcast model points to a CPI rate of 5.19% in April and a core rate of 5.56%, both higher than official forecasts.

If indeed the report exceeds expectations, investors might unwind some rate cut bets, helping to breathe life back into the dollar. Taking a look at euro/dollar, such an outcome might push the pair lower, with the first obstacle for the bears likely to be the 1.0940 zone.

On the other hand, a surprisingly cold CPI report could propel the pair higher, turning the focus towards the recent highs near 1.1095. Note that data on producer prices will be released on Thursday, ahead of the University of Michigan consumer sentiment report on Friday.

Dollar needs risk aversion to shine

In the big picture, it is doubtful whether even an upside inflation surprise will change the dollar’s fortunes. For now, investors seem confident that banking troubles will override inflation concerns at the Fed.

Instead, the dollar’s best chance for a sustainable comeback probably lies with risk sentiment. Specifically, a selloff in stock markets could help boost the dollar through the safe-haven channel, considering that pairs like euro/dollar and sterling/dollar have a strong correlation with the S&P 500 this year.

From a chart perspective, the ‘line in the sand’ in euro/dollar is the 1.1095 level, which rejected a couple of advances recently. If that is violated, it would signal a trend continuation, dashing hopes of an immediate recovery in the dollar.