Euro continues its descent during Asian trading session, partly due to the optimism expressed by ECB Chief Economist about slowing in inflation ahead. The common currency currently ranks as the worst performer for the month, although it still holds above last month’s low against all currencies, barring the Pound. Meanwhile, Sterling also shows signs of softness, while Swiss franc is mixed.

Yen, on the other hand, is attempting a comeback, but its upside remains capped by resilient risk sentiment and recovery in global benchmark treasury yields. Dollar is mixed as market awaits tomorrow’s US CPI data. Commodity currencies are leading the pack for now, with New Zealand and Australian dollars outpacing Canadian dollar.

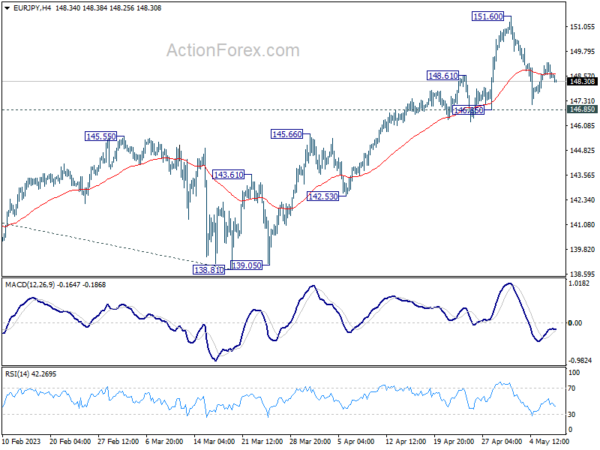

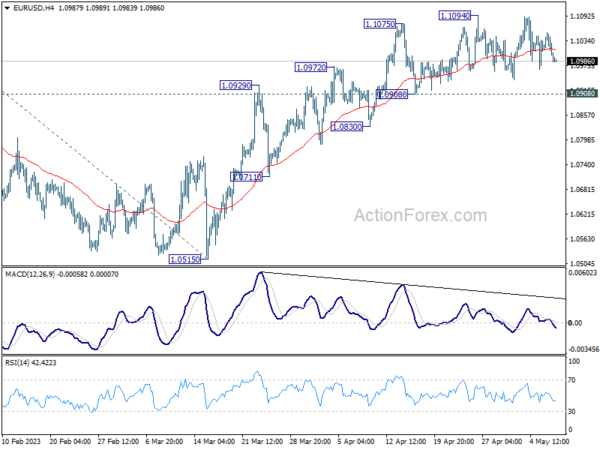

On the technical front, EUR/JPY’s recovery appears to have faltered after a brief break of 55 4H EMA. Deeper fall would bring 146.85 support level into focus. Firm break below this level could indicate that deeper correction is underway towards 145.66 resistance turned support level, and possibly even lower. This 146.85 support level should be watched closely alongside 1.0908 support level in EUR/USD. Decisive break of these two levels could signal broader weakness in Euro.

In Asia, at the time of writing, Nikkei is up 1.05%. Hong Kong HSI is down -0.53%. China Shanghai SSE is up 0.39%. Singapore Strait Times is down -0.29%. Japan 10-year JGB yield is up 0.163 at 0.429. Overnight, DOW dropped -0.17%. S&P 500 rose 0.05%. NASDAQ rose 0.18%. 10-year yield rose 0.075 to 3.521.

BoJ Ueda sees position signs in trend inflation

BoJ Governor Kazuo Ueda pointed to encouraging signs in trend inflation during a recent parliamentary session. “We’re seeing some positive signs in trend inflation, including inflation expectations,” Ueda said. He added that once the BOJ could foresee inflation stably and sustainably meeting their 2% target, they would “abandon yield curve control and then move towards shrinking the bank’s balance sheet.”

Ueda also spoke about the upcoming monetary policy review, stating it would critically examine the benefits and side effects of past monetary policies. The review process will include workshops with private academics. However, the governor clarified that the central bank did not have any preconceived notions about how the review could influence future monetary policy decisions.

“We will take necessary policy steps at each of our rate reviews, with an eye on financial and price developments, even while we conduct the review,” Ueda stated.

Australia sees second consecutive quarter of falling retail sales volume amidst rising living costs

Australia’s retail sales volume declined by -0.6% qoq to AUD 96.17 billion in Q1 2023. Through the year, sales volume only managed to register a modest 0.3% yoy growth in the quarter.

ABS’s head of retail statistics, Ben Dorber, noted that this marked the second consecutive quarter of falling retail sales volumes, primarily influenced by mounting cost of living pressures that continue to burden household spending.

“Outside of the COVID-19 pandemic period, this is the largest fall in retail sales volumes since the September quarter of 2009,” Dorber stated, underlining the gravity of the situation.

Meanwhile, retail prices growth has slowed to 0.6% qoq in Q1. “Retail prices rose for the sixth straight quarter, but price growth this quarter is the smallest since September 2021,” Dorber added.

He attributed the slowdown in price growth mainly to discounts on clothing and larger household items such as furniture and electronic goods. However, he noted that food retailing prices continued their upward trajectory.

China exports rose 8.5% yoy in Apr, exports to Russia surged 153% yoy

China’s April exports outperformed expectations, growing by 8.5% yoy to reach USD 295.4B. This marked the second consecutive month of growth, exceeding anticipated 8.0% yoy. However, imports dropped by -7.9% yoy to USD 205.2B, falling short of expected 0.0% yoy. As a result, trade surplus widened from USD 88.2B to USD 90.2B, significantly surpassing the forecasted USD 69.0B.

Breaking down the numbers, exports to EU experienced a modest growth of 3.7% yoy, while imports from the bloc saw a slight decrease of -0.12% yoy. Trade with the US reflected a downturn, with exports dropping by -6.5% yoy and imports declining by -3.1% yoy.

Trade relations with ASEAN region were mixed, with exports increasing by 4.49% yoy, while imports fell by -6.25% yoy. Meanwhile, trade with Russia exhibited a significant surge. Chinese exports to Russia skyrocketed by a staggering 153.09% yoy, and imports also rose, though at a more modest rate of 8.06% yoy.

ECB Lane predicts disinflation later this year, despite ongoing core inflation momentum

ECB Chief Economist Philip Lane acknowledged yesterday ongoing momentum in inflation but predicted a shift toward disinflation later this year.

Speaking at a panel in Berlin, Lane said, “There’s still a lot of momentum in inflation, but later this year and ongoing a lot of this inflation is supposed to reverse, partly because of the reversal of the underlying shocks, partly because of monetary policy.”

Despite this outlook, Lane noted that there is still momentum in food and core inflation, which runs counter to the decline in energy inflation.

Discussing businesses’ expectations, Lane mentioned, “This year (businesses) expect margins to fall quite a bit, because they may face cost increases, including labour costs increases, but they won’t be able to increase prices by so much because demand is normalising.”

He also emphasized the importance of rebuilding real wages in the labor market, stating, “There’s a very basic imperative for the labour market to rebuild real wages.” Lane explained that this transition phase, which will last several years, helps clarify why inflation is not immediately dropping back to 2%.

Looking ahead

France trade balance is the only feature in European session while US will release NFIB business optimism index.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0985; (P) 1.1019; (R1) 1.1039; More…

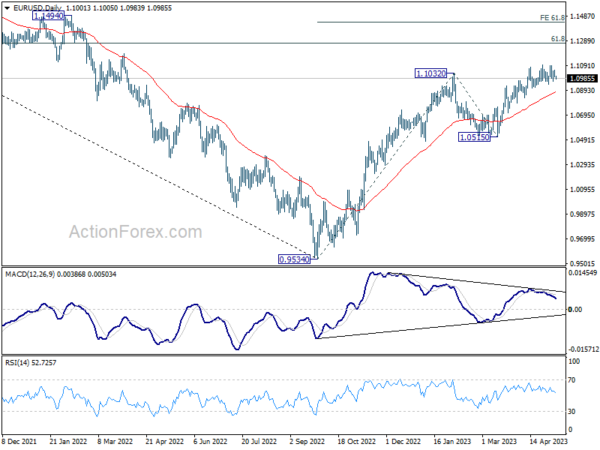

No change in EUR/USD’s outlook as range trading continues. Intraday bias stays neutral first. Further rally could still be seen with 1.0908 support intact. On the upside, firm break of 1.1094 will resume larger up trend to 1.1273 fibonacci level. Break there will target 61.8% projection of 0.9534 to 1.1032 from 1.0515 at 1.1441 However, considering bearish divergence condition in 4H MACD, break of 1.0908 support will indicate short term topping and turn bias back to the downside.

In the bigger picture, rise from 0.9534 (2022 low) is in progress for 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273. Sustained break there will solidify the case of bullish trend reversal and target 1.2348 resistance next (2021 high). This will now remain the favored case as long as 1.0515 support holds, even in case of deeper pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y Mar | 0.80% | 1.00% | 1.10% | |

| 23:30 | JPY | Overall Household Spending Y/Y Mar | -1.90% | 0.40% | 1.60% | |

| 03:00 | CNY | Trade Balance (USD) Apr | 90.2B | 69.0B | 88.2B | |

| 06:45 | EUR | France Trade Balance (EUR) Mar | -9.5B | -9.9B | ||

| 10:00 | USD | NFIB Business Optimism Index Apr | 89.6 | 90.1 |