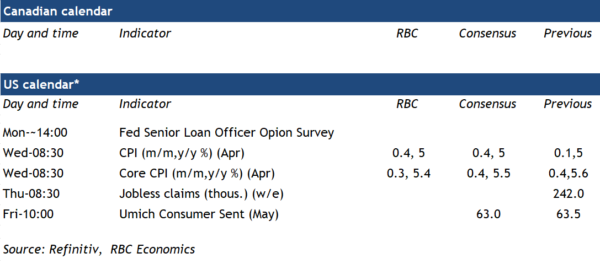

Next week’s April U.S. inflation report is expected to show headline inflation unchanged at 5%, matching the annual rate in March. This would be the first time that the U.S. inflation rate didn’t post a decline since peaking in June 2022. But the underlying details should be more encouraging. A 3% monthly increase in gasoline prices (on a seasonally adjust basis) likely pushed April energy prices up slightly, to -4.5% on a year-over-year basis. But with oil prices running well below year-ago levels, energy prices should continue to lose steam. And though food inflation is still high, it likely slowed again in April. We expect this measure to slip to ~8% from a year ago.

Outside of food and energy products, “core” CPI growth also likely slowed. We expect this measure to fall to 5.4% from 5.6% in March on a year-over-year basis or increase 0.3% from March. That would mark the smallest month-over-month increase since November. Higher rent prices have been driving the majority of core price growth in recent months, as earlier hikes feed through to the consumer price index. But that surge has probably run its course. Measures of current market rent inflation peaked more than a year ago.

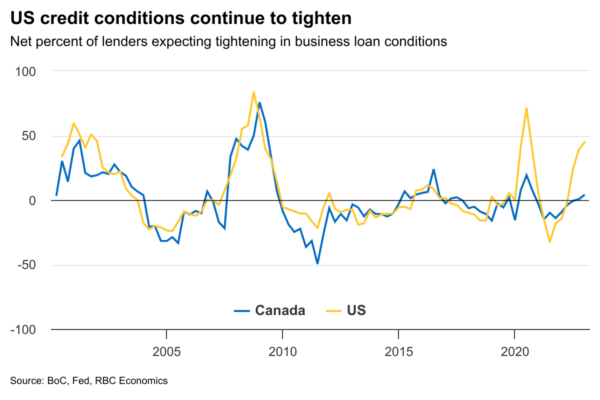

Inflation is still a concern for Federal Reserve officials, and U.S. price pressures, while easing, have been sticky. But there is a growing list of signs that economic momentum is slowing under the surface and higher interest rates are cutting into household purchasing power. Employment is still rising, but job openings are down. Lower quit rates and slowing wage growth suggest workers aren’t as confident in labour markets as they once were. And credit markets have tightened as the list of U.S. regional banks struggling to calm investor worries continues to grow. The Senior Loan Officer Opinion Survey—on tap next week—should provide an update on lending practices in the U.S., where tighter standards and weaker demand for commercial and industrial (C&I) and consumer loans are expected to have continued.