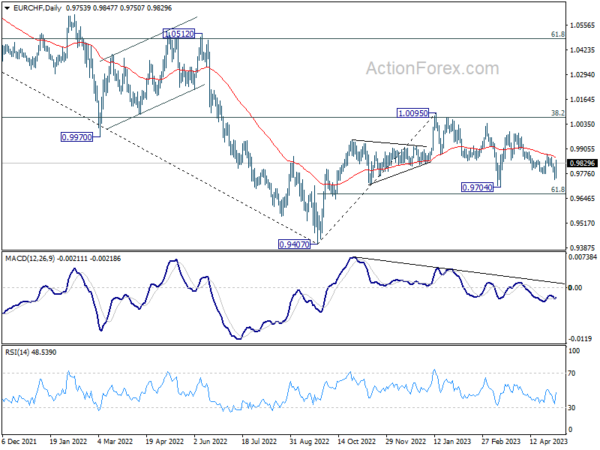

Daily Pivots: (S1) 0.9730; (P) 0.9772; (R1) 0.9798; More…

EUR/CHF rebounded strongly after dipping to 0.9742 and intraday bias is turned neutral first. On the upside, break of 0.9878 will indicate short term bottoming, and turn bias back to the upside. Also, outlook is unchanged that whole correction from 1.0095 has completed at 0.9704. Sustained trading 55 D EMA (now at 0.9864) will affirm this bullish case, and target 0.9995 resistance next.

In the bigger picture, prior rejection by 55 W EMA (now at 0.9972) and 38.2% retracement of 1.1149 to 0.9407 at 1.0072 suggests that medium term outlook is staying bearish. That is, down trend from 1.2004 is not completed yet and is in favor to resume through 0.9407 at a later stage. However, decisive break of 1.0095 resistance will raise the chance of bullish trend reversal. Rise from 0.9407 should then target 1.0505 cluster resistance (2020 low at 1.0505, 61.8% retracement of 1.1149 to 0.9407 at 1.1484).