- US stock indices spooked by Fed Chair Powell’s “hawkish” comments.

- USD sold off while safe haven currencies, JPY & CHF in demand.

- Asian stock market outperformed while Hong Kong indices rebounded from the key 200-day moving average.

No surprise from the US central bank, Federal Reserve’s policy meeting outcome yesterday where the Fed hiked its policy Fed funds rate by 25 basis points as expected, its 10th hike in this current tightening cycle to a target range of 5% to 5.25%.

Most importantly, it has signalled a potential pause on its current interest hiking cycle via a change of tonality in its monetary policy statement; it no longer says it “anticipates” further rates will be needed, only that it will watch incoming data to determine if more hikes “may be appropriate.”

The surprising bit came during Fed Chairman Powell’s press conference where he made several “hawkish” comments that implied the current stance of the Fed’s operating modus to be skewed towards inflation targeting rather than to address the potential credit crunch from the US regional banking turmoil that can lead to slower economic growth and a weak labour market;

“Conditions in the banking sector have improved.”

“We’re committed to our inflation target of 2%.”

“The labour market remains very tight.”

“The case of avoiding a recession is more likely than having one.”

Overall, the US stock market did not respond positively to such comments and sold off with all three major indices ending the US session with losses; S&P 500 (-0.70%), Nasdaq 100 (-0.64%) and Dow Jones Industrial Average (-0.80%).

The underperformers were the financials and banks with the SPDR S&P Regional Banking ETF plummeting by -1.80% as fears of further stress on the balance sheets of the US regional banks persist. Not helping much to alleviate such fears was the latest negative news flow from PacWest Bancorp, a California-based mid-sized US bank that saw its share price plunged by -50% in after-hours trading when it announced that it was exploring a strategic sale.

A rate cut is priced in for the September FOMC

Despite the hawkish tonality from Fed Chair Powell, markets are still expecting a Fed pivot to kickstart a fresh interest rate cut cycle before 2023 ends. Based on the CME Watch FedWatch tool derived from pricing data implied by the 30-day Fed Funds futures has indicated an 89% chance of a 25 basis points rate cut during the 20 September 2023 FOMC meeting.

This heightened expectation of a first Fed funds rate cut in September has led the front end of the US Treasury yield curve which is more sensitive to changes in monetary policy to drop more than the longer end; the 2-year US Treasury yield dropped by 16 basis points to close yesterday US session at 3.81%, a five-week low.

USD sold off & safe haven currencies, JPY and CHF in demand

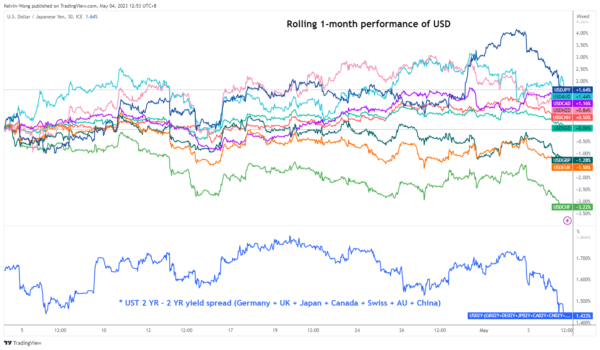

Fig 1: Rolling 1-month performance of USD against major currencies with CNH & SGD as of 4 May 2023

(Source: TradingView, click to enlarge chart)

The recent drop in the 2-year US Treasury yield has led to a further compression of the 2-year US Treasuries yield premium against the rest of the world; US yield over a basket of equally weighted sovereign yields of Germany, United Kingdom, Japan, Canada, Switzerland, Australia, and China has shrunk to 1.43% from 1.73% seen at the start of this week.

The shrinkage of the US yield premium factor explains the current weakness seen in the US dollar as for the heightened overnight demand for the JPY and CHF, it can be attributed to the typical “flight to safe haven” sentiment due to persistent share price weakness of the US regional banks that triggered a resurgence of systemic risk and heightened geopolitical tensions in the on-going Russia-Ukraine conflict where the Kremlin was hit by a drone attack.

Interestingly, last Friday’s gains of the USD/JPY induced by the Bank of Japan’s dovish monetary policy stance have been wiped out as it dropped by 330 pips from its recent 2 May high of 137.77 to 134.50 and traded below the key 200-day moving average at this time of the writing.

Asian stock indices outperformance against the US

Fed Chair Powell spooked US stock traders post-FOMC press conference while the Asian stock market rejoiced today. Most of the Asian benchmarks have recorded intraday gains with Hong Kong being the top performer; Hang Seng Index (+1%), Hang Seng China Enterprise Index (+1.6%) and Hang Seng TECH Index (+0.6%). Even the mainland China CSI 300 recorded just a minor loss of -0.1% after it reopened today from its Labour Day Golden Week holiday despite a consensus forecast miss on the China Caixin Manufacturing PMI that contracted to 49.5 in April from 50.0 printed in March.

Two primary reasons that account for today’s Asian stock indices’ robust performances. Firstly, it is the broad-based USD dollar weakness that also led to a drop in the USD/CNH (offshore yuan) to print a 5-day low of 6.8965 which implied a lower cost of funding on US dollar-dominated corporation debts in Asia.

Secondly, it is momentum driven; both Hang Send Index and Hang Seng China Enterprise Index have managed to retest and staged a rebound right at their respective 200-day moving averages yesterday where it has triggered by positive follow-through today supported by a weaker US dollar. Short-term traders chased such bullish technical signals which in turn created a positive feedback loop.

Hong Kong 33 Technical Analysis – Positive elements sighted at key 200-day moving average

Fig 2: Hong Kong 33 trend as of 4 May 2023 (Source: TradingView, click to enlarge chart)

The recent multi-week decline of -7% seen on the Hong Kong 33 Index (a proxy for the Hang Seng Index futures) from its 17 April 2023 high of 20,873 has managed to retest, staged a rebound and formed a “higher low” right at its key 200-day moving average where it has traded above it since 22 March 2023.

Current price actions suggest the Index may now have started to evolve into a short-term ascending channel in place since the 20 March 2023 low of 18,831 which implies a potential short-term uptrend may be in progress above the 19,500 key short-term pivotal support.

A clearance above the 20,300 intermediate resistance may see the next resistance coming in at 21,020 in the first step. However, a break with a four-hour close below 19,500 invalidates the short-term uptrend to expose the next support at 18,900.