Dollar was sold off broadly overnight after Fed indicated openness to a pause in tightening after raising interest rate by 25bps. Yet, selloff is relatively limited after Chair Jerome Powell ruled out a rate cut this year. Indeed, major stock indexes ended slightly lower, as weighed by persistent concerns over regional banks in the US.

Indeed, Canadian Dollar is the worst performer for the week so far, as dragged down by the steep decline in oil prices. Dollar is only second worst, followed by Sterling. Swiss Franc and Yen are the best performers as supported by decline in global benchmark yields, and risk-off sentiment. Euro is mixed for now, awaiting ECB rate decisions.

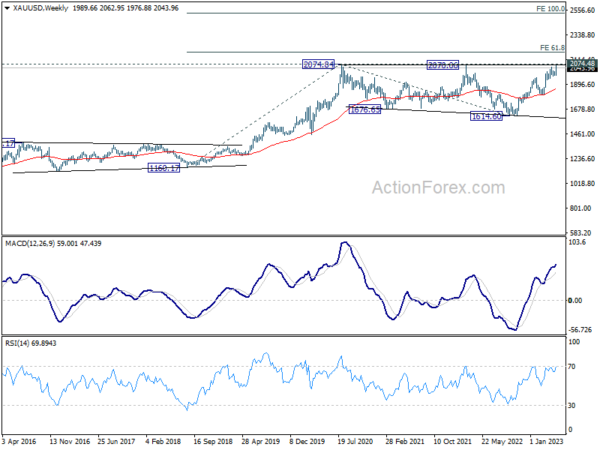

Technically, Gold rode on Dollar weakness and risk-aversion, breaking through 2048.26 short term top overnight. Immediate focus is now on 2074.48 record high. Decisive break there will confirm long term up trend resumption. Next medium term target will be 61.8% projection of 1160.17 to 2074.84 from 1614.60 at 2179.86. In any case, near term outlook will stay bullish as long as 1976.88 support holds.

In Asia, at the time of writing, Japan is still on holiday. Hong Kong HSI is up 0.98%. China Shanghai SSE is up 0.65%. Singapore Strait Times is down -0.09%. Overnight, DOW dropped -0.80%. S&P 500 dropped -0.70%. NASDAQ dropped -0.46%. 10-year yield dropped -0.036 to 3.403.

Fed Powell leaves door open for June pause but rules out rate cut

US stocks, treasury yields, and Dollar closed lower following FOMC rate decision and post-meeting press conference. Although Fed opened the door for a possible pause in June, no confirmation was provided, and a rate cut by year-end was ruled out.

Despite softening its hawkish tone, Fed Chair Jerome Powell did not explicitly confirm a pause following yesterday’s 25bps rate hike. Powell noted that “we’re closer, or maybe even there” regarding the terminal rate of the current tightening cycle. From June onward, policy decisions will be made on a “meeting-by-meeting” basis, with Fed “prepared to do more” if necessary.

Powell also dismissed the possibility of a rate cut this year. He said, “We on the committee have a view that inflation is going to come down not so quickly, it will take some time,” and “in that world, if that forecast is broadly right, it would not be appropriate to cut rates” this year.

Regarding the economy, Powell expressed optimism, stating, “the case of avoiding a recession is in my view more likely than that of having a recession.”

Additional readings on FOMC:

- FOMC Signal a Conditional Pause

- Fed Review – A Balanced End to the Hiking Cycle

- FOMC Raises Rates by 25 bps But Signals “Hawkish Pause”

DOW is holding above 32233.85 near term support after the pull back this week. It’s probably also trying to draw support from 55 D EMA (now at 33359.36). Another rally is still in favor through 34712.28 resistance to 61.8% projection of 68220.94 to 34712.28 from 31429.82 at 35169.54. However, firm break of 332.33.85 will argue that the pattern from 34712.28 has started another falling leg back towards 31429.82 support. Now that there is no breakthrough after FOMC, the markets will look into tomorrow’s non-farm payroll for inspirations.

IMF Srinivasan highlights uncertainty in Japan’s monetary policy and potential impacts

Krishna Srinivasan, director of IMF’s Asia and Pacific Department, has expressed concerns over uncertainty in Japan’s monetary policy direction amid rising inflation.

He stated in a press briefing, “Japanese government bond yields have increased notably since October. Changes in Japan’s monetary policy that lead to further increases in government bond yields could have global spillovers through Japanese investors, who have large investment positions in debt instruments abroad.”

Srinivasan also warned that portfolio rebalancing by these investors could potentially trigger a rise in global yields, “causing portfolio outflows for some countries”.

Regarding China, he noted that over the medium term, a slowdown in productivity and investment is expected, which would lower growth below 4 percent by 2028. This could have profound adverse implications for the rest of the region, given their strong trade linkages with China.

Srinivasan also highlighted the risk of the global economy fragmenting into trading blocs, saying, “If this happens, the larger exposures will be to Asian economies that currently export significantly to the US and Europe, and those that are currently part of global value chains that see them export intermediate goods to China for use in Chinese exports.”

China Caixin PMI manufacturing contracts in Apr, demand softens and prices plunge

China’s Caixin PMI Manufacturing dropped to 49.5 in April, down from 50.0 and below the expected 50.8, marking the first contraction reading in three months. According to Caixin, output expanded only marginally due to softening demand conditions. Input costs and selling prices fell at the quickest pace in over seven years.

Wang Zhe, Senior Economist at Caixin Insight Group said: “In a nutshell, manufacturing activity weakened in April. Manufacturing supply saw a marginal slowdown of expansion, demand dipped month-on-month, the labor market worsened further, logistics was relatively smooth, inventories remained stable, and prices plunged. Despite all these factors, businesses maintained high confidence in the economic outlook.”

ECB to hike today, 25bps or 50bps?

As ECB gears up for its seventh consecutive interest rate hike in a row today, market participants are divided on the size of the increase. While the majority expect a 25bps hike, which would bring the main refinancing rate to 3.75% and the deposit rate to 3.25%, a 50bps move cannot be totally ruled out.

The size of the hike carries significant implications for the market. A 50bps increase would suggest that the tightening cycle could extend beyond June, even if it slows down then. However, a 25bps hike would create more ambiguity for July meeting. Ultimately, the path forward will still heavily depend on the next round of economic projections, only available at June meeting.

Suggested readings on ECB:

- ECB Set to Raise Rates, But By How Much?

- How Will ECB Meeting Affect EUR?

- ECB Preview: The Art of Compromise

EUR/CHF’s recovery from 0.9774 has been underwhelming, stalling at 0.9878 before reversing course. It seems that price actions from 0.9995 are forming a triangle consolidation pattern. While a break below 0.9774 cannot be ruled out, any downside should be limited. Conversely, breaking 0.9878 resistance would indicate that the rise from 0.9704 is set to resume through 0.9995. Let’s see how it plays out.

Looking ahead

Other than ECB rate decision, Germany trade balance, Eurozone PMI services final and PPI, UK PMI services final and M4 money supply will be featured in European session. Later in the day, US will release jobless claims and trade balance. Canada will release trade balance and Ivey PMI.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1010; (P) 1.1051; (R1) 1.1103; More…

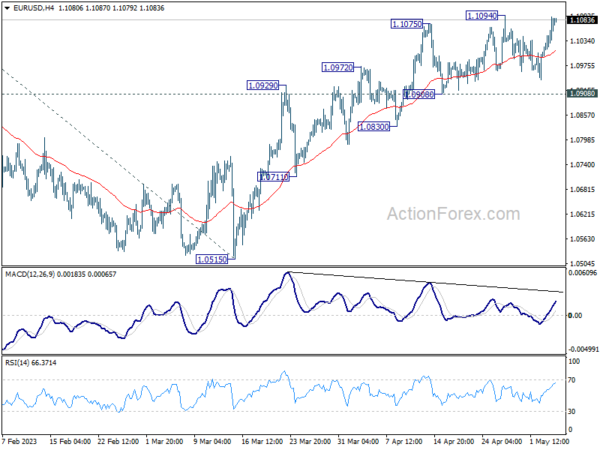

EUR/USD is still held below 1.1094 resistance despite current recovery. Intraday bias remains neutral first but further rise is expected. On the upside, firm break of 1.1094 will resume larger up trend to 1.1273 fibonacci level. Break there will target 61.8% projection of 0.9534 to 1.1032 from 1.0515 at 1.1441 However, considering bearish divergence condition in 4H MACD, break of 1.0908 support will indicate short term topping and turn bias back to the downside.

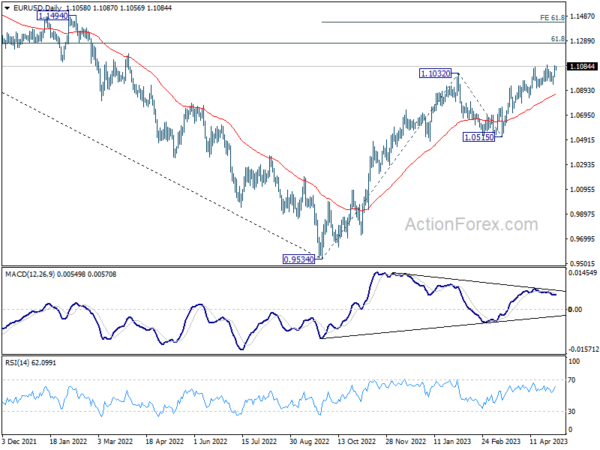

In the bigger picture, rise from 0.9534 (2022 low) is in progress for 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273. Sustained break there will solidify the case of bullish trend reversal and target 1.2348 resistance next (2021 high). This will now remain the favored case as long as 1.0515 support holds, even in case of deeper pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Mar | 7.00% | -9.00% | -9.40% | |

| 01:30 | AUD | Trade Balance (AUD) Mar | 15.27B | 13.00B | 13.87B | |

| 01:45 | CNY | Caixin Manufacturing PMI Apr | 49.5 | 50.8 | 50 | |

| 06:00 | EUR | Germany Trade Balance (EUR) Mar | 17.1B | 16.0B | ||

| 07:45 | EUR | Italy Services PMI Apr | 56 | 55.7 | ||

| 07:50 | EUR | France Services PMI Apr F | 56.3 | 56.3 | ||

| 07:55 | EUR | Germany Services PMI Apr F | 55.7 | 55.7 | ||

| 08:00 | EUR | Eurozone Services PMI Apr F | 56.6 | 56.6 | ||

| 08:30 | GBP | Mortgage Approvals Mar | 46K | 44K | ||

| 08:30 | GBP | Services PMI Apr F | 54.9 | 54.9 | ||

| 08:30 | GBP | M4 Money Supply M/M Mar | 0.10% | -0.40% | ||

| 09:00 | EUR | Eurozone PPI M/M Mar | -1.40% | -0.50% | ||

| 09:00 | EUR | Eurozone PPI Y/Y Mar | 13.20% | |||

| 12:15 | EUR | ECB Main Refinancing Rate | 4.00% | 3.50% | ||

| 12:30 | CAD | Trade Balance (CAD) Mar | 1.0B | 0.4B | ||

| 12:30 | USD | Initial Jobless Claims (Apr 28) | 235K | 230K | ||

| 12:30 | USD | Trade Balance (USD) Mar | -68.9B | -70.5B | ||

| 12:30 | USD | Nonfarm Productivity Q1 P | -0.70% | 1.70% | ||

| 12:30 | USD | Unit Labor Costs Q1 P | 8.40% | 3.20% | ||

| 12:45 | EUR | ECB Press Conference | ||||

| 14:00 | CAD | Ivey PMI Apr | 59 | 58.2 | ||

| 14:30 | USD | Natural Gas Storage | 51B | 79B |