- The Fed delivered a 25bp hike as widely expected by both consensus and markets. We think this marks the end of the Fed’s hiking cycle.

- Powell struck a very balanced tone in the press conference, not closing the door for another hike, but also emphasizing that policy is now clearly restrictive.

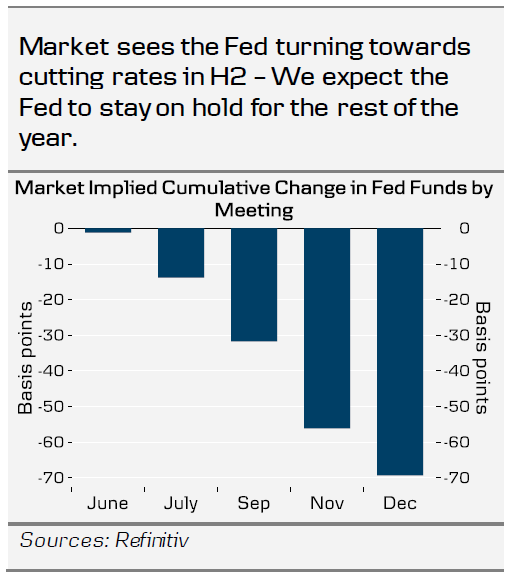

- EUR/USD was largely unchanged. We make no changes to our Fed call, see no rate cuts this year and expect EUR/USD to fall to 1.06 in 6M.

The Fed delivered a balanced message to the markets by hiking rates by 25bp hike, but also removing the section of the press statement saying that ‘The Committee anticipates that some additional policy firming may be appropriate’. Powell did not close the door for further hikes, but we think this marks the end of the Fed’s hiking cycle.

Powell did not provide any estimates on how much the banking sector turmoil has affected the policy rate considerations, but he referred to the upcoming May release of the Senior Loan Officer Opinion Survey, noting that the slowing pace of lending has been ‘broadly consistent’ with the Fed’s expectations.

The combination of positive real yields, continuing QT and some credit tightening means that overall financial conditions are now restrictive . Furthermore, simply maintaining nominal policy rates at the current level continues to passively tighten monetary policy due to the yield curve inversion. And as oil prices have moved lower, a further decline in inflation expectations could help push real yields even higher.

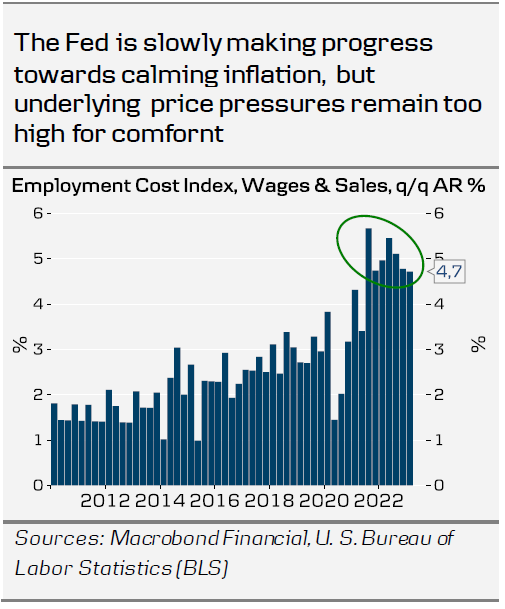

Powell noted that it is also still too early to discuss rate cuts. Core services CPI ex. housing & healthcare rose by 0.61% m/m in March, while wages & salaries in the Employment Cost Index rose by 1.2% q/q in Q1. The Fed still faces the risk of inflation stabilizing at a too elevated level, even if wage pressures from labour markets seem to be gradually easing.

Powell was also asked about the debt ceiling, and while some participants had raised it as a risk to the outlook, Powell simply underscored that the Fed cannot protect the economy from a default, largely as expected.

Most leading indicators have pointed towards accelerating growth momentum in April, and many price indicators have also picked up. Markets do not foresee the Fed making changes in June, but the main risk for another hike lies in the two CPI prints ahead of the meeting. For April CPI next week, we forecast +0.4% m/m for headline and +0.3% m/m for core, although the Cleveland Fed sees some upside risks to our estimate.

For now, we stick to our view that the Fed will maintain rates unchanged for the remainder of the year. Markets remained relatively stable throughout the meeting, with EUR/USD stabilizing around 1.1050. With markets pricing around 72bp worth of cuts for the rest of the year, if we are right in our call, relative rates should add broad support to the USD in H2. Combined with relative terms of trade, growth differentials and relative unit labour cost, we expect EUR/USD to head lower towards 1.06 in 6M. That said, a hawkish 50bp hike from the ECB tomorrow could still drive the cross higher in the near-term.