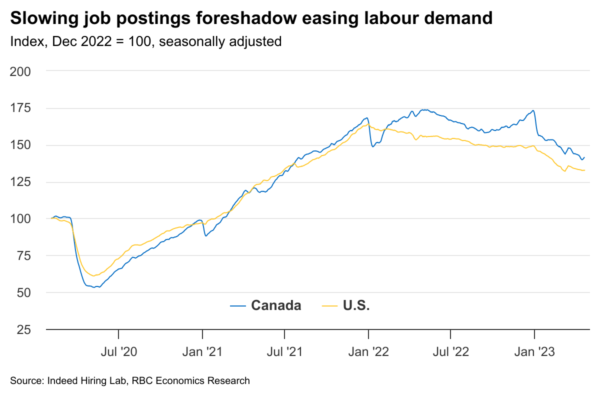

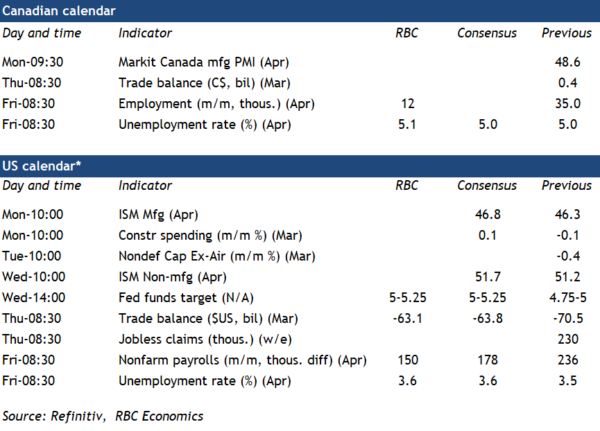

We expect Canadian employment edged up by about 12,000 in April—the smallest increase since September. That won’t be enough to prevent the unemployment rate from ticking higher as stronger levels of immigration boost the number of workers available for hire. Employment growth early in 2023 has been very strong, but cracks are emerging in the labour demand backdrop. The number of job openings has slowed. And businesses in the BoC’s Q1 Business Outlook Survey highlighted a sharp easing in the intensity of labour shortages. The ongoing Federal employees strike shouldn’t significantly impact the April employment data since those figures are drawn from the week before the strike started. Still, the loss of hours worked will cut into GDP measures that have already been showing signs of slowing. Our own estimate is that the strike will subtract 0.3 percentage points from April’s GDP growth following an initial estimate from Statistics Canada that output already edged lower (-0.1%) in March.

In the U.S., the Federal Reserve will also be watching labour market developments closely. We expect them follow through with one more 25 basis point interest rate hike next Wednesday, though developments in the U.S. job market have largely mirrored Canada’s. Strong headline employment gains have masked some early signs of softening in hiring demand, openings have declined by over a million through February and March and initial claims have been drifting higher. We look for a smaller, but still positive change in employment in April (up 150,000), alongside a tick higher in the unemployment rate. Early signs of labour market weakness are suggesting more deceleration down the road, in both hiring and wage growth. For now, unemployment remains very low and inflation is too high for the Fed’s comfort. But the central bank is likely still approaching the end of the current rate hiking cycle.

Week ahead data watch

The Canadian net trade surplus was likely a bit lower in March. We expect the energy trade surplus to have narrowed on a 4.6% pullback in crude oil prices. Statistics Canada’s advance estimate for March manufacturing sales was reportedly boosted by an increase in transportation equipment sales, which would increase both exports and imports.

Previously released advance estimates of goods trade balance in the U.S. showed a declining deficit, from $92.0B in February to $84.6B in March. We look for a smaller U.S. trade deficit in March, with exports higher by 2% and imports declining by 0.8%.

We expect to see 150,000 jobs to be added to the U.S. labour market in April, down slightly from the 236,000 increase in March. We look for a 0.1 percentage point increase in the unemployment rate, back to February’s 3.6% level.