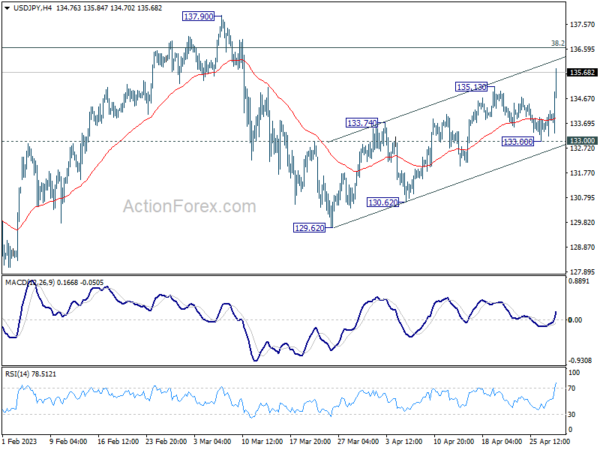

Daily Pivots: (S1) 133.42; (P) 133.81; (R1) 134.38; More…

USD/JPY’s rebound from 129.62 resumed by breaking through 135.13 resistance today. Intraday bias is back on the upside with focus on near term channel resistance (now at 136.17). Sustained break there will raise the chance of resumption of whole rise from 127.20, and target 137.90 resistance and above. For now, further rally will remain in favor as long as 133.00 support holds, in case of retreat.

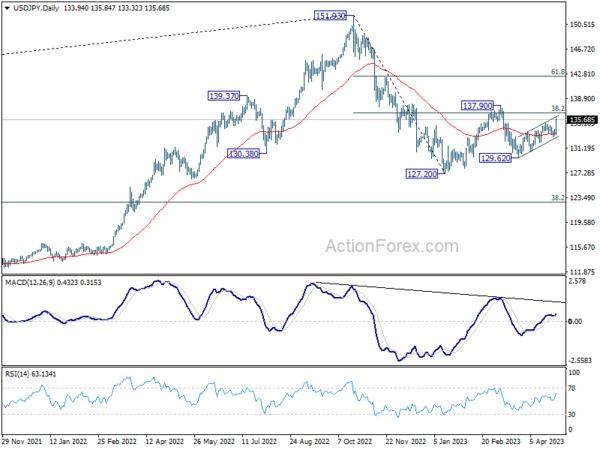

In the bigger picture, price actions from 151.93 high are currently seen as a corrective pattern to the long term up trend. The first leg should have completed at 127.20. Rebound from there is seen as the second leg. Sustained break of 31.8% retracement of 151.93 to 127.20 at 136.34 will bring stronger rebound to 142.48. Meanwhile, break of 129.62 will argue that the third leg is starting to 61.8% projection of 151.93 to 127.20 from 137.90 at 122.61.