Key Highlights

- USD/JPY could rise further if it clears the 134.20 resistance.

- It is facing a major bearish trend line with resistance near 134.25 on the 4-hour chart.

- EUR/USD is struggling to gain momentum above the 1.1075 resistance.

- The US Personal Income could increase by 0.2% in March 2023 (MoM).

USD/JPY Technical Analysis

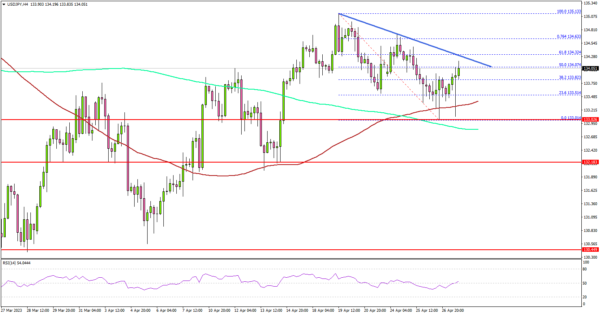

The US Dollar started a downside correction from the 135.15 zone against the Japanese Yen. USD/JPY declined below 134.00 but remained supported near 133.00.

Looking at the 4-hour chart, the pair remained stable above the 133.00 zone, the 100 simple moving average (red, 4 hours), and the 200 simple moving average (green, 4 hours).

The pair is now attempting a fresh increase above the 133.50 resistance. Immediate resistance on the upside is near the 134.20 level. There is also a major bearish trend line forming with resistance near 134.25 on the same chart.

The next major resistance is near the 134.60 level. A clear upside break and close above the 134.60 resistance might send the pair toward 135.00.

The next key resistance is near the 135.15 zone. Any more gains might send the pair toward 136.20. On the downside, there is major support near 133.40 and the 100 simple moving average (red, 4 hours).

The next major support sits near the 133.00 level, below which the pair might accelerate lower. In the stated case, USD/JPY could visit the 132.20 support zone.

Looking at EUR/USD, the pair attempted a fresh increase above the 1.1075 resistance but failed to gain bullish momentum.

Economic Releases

- Euro Zone Gross Domestic Product for Q1 2023 (Prelim) (QoQ) – Forecast 0.2%, versus 0% previous.

- US Personal Income for March 2023 (MoM) – Forecast +0.2%, versus +0.3% previous.