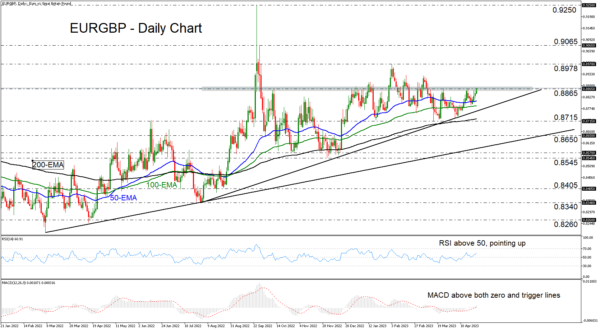

EURGBP has been edging north since April 19 when it hit support slightly above the 100-day exponential moving average (EMA). The pair is trading above all three of the plotted EMAs, as well as above the uptrend line drawn from the low of August 3, which paints a positive medium-term picture.

Our short-term oscillators make the outlook even brighter. The RSI moved higher after rebounding from its 50 line, while the MACD lies above both its zero and trigger lines, pointing up. Both indicators detect upside momentum and support the notion of some further advances.

Today, EURGBP poked its nose above the key barrier of 0.8865, a move that may have opened the door for advances towards the peak of February 3 at around 0.8978. If the bulls are unwilling to let the driver’s seat go, they may extend their march towards the high of September 28 at around 0.9065.

For the outlook to turn bearish, the pair may need to tumble all the way below the 0.8545 area, marked by the low of December 1. Such a slide would take the action below a longer-term uptrend line taken from the low of March 7, and may see scope for extensions towards the 0.8405 territory, marked by the low of August 24.

To wrap up, EURGBP continues to trade above the uptrend line taken from the low of August 3 and above all the plotted EMAs, which suggests that the pair may be destined to continue traveling north for a while longer.