Selloff in Australian and to a lesser extent Canadian Dollar is the main theme in the markets today, but market directions are not clear elsewhere. Euro’s rally attempt against Dollar and Yen faltered following deep retreat in European benchmark yields. But the common currency is making progress in upside breakout against Sterling. Meanwhile, Yen and Swiss Franc are gaining ground as US and European yields fall. Dollar’s performance is mixed for now, and further guidance from overall risk sentiment may be needed. However, the greenback could face deeper declines against Yen if treasury yield weakness persists.

Technically, 10-year yield’s gap down and break of 3.460 support now suggests that recovery from 3.253 has completed after rejection by 55 D EMA. If TNX fails to close above 3.460, deeper decline would then be likely back to 3.253 support below below, to extend the whole correction from 4.333. If this scenario unfolds, USD/JPY may also fall below the 132.03 support level.

In Europe, at the time of writing, FTSE is down -0.20%. DAX is down -0.05%. CAC is down -0.60%. Germany 10-year yield is down -0.069 at 2.440. Earlier in Asia, Nikkei rose 0.09%. Hong Kong HSI dropped -1.71%. China Shanghai SSE dropped -0.32%. Singapore Strait Times dropped -0.84%. Japan 10-year JGB yield rose 0.0075 to 0.480.

Aussie down broadly following free fall in Copper

Australian Dollar is trading broadly lower today, even against New Zealand Dollar. Risk sentiment isn’t much of a factor contributing to selloff considering that major European indexes are just in slight decline. Instead, the free fall in copper price might be a larger factor. But for sure, some traders could have jumped out of Aussie ahead of tomorrow’s CPI release too, which is crucial to RBA rate decision on May 2, i.e., next Tuesday.

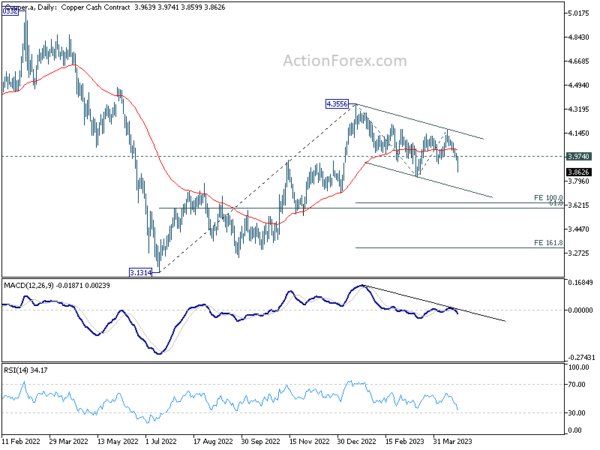

As for Copper, the fall from 4.1743 is accelerating notably today. Deeper decline is expected as long as 3.3974 resistance holds, to 3.8229 support and below. Price structures from 4.3556 (Jan high) are so far corrective looking. Hence, strong support should emerge ahead of 100% projection of 4.3556 to 3.8229 from 4.1743 at 3.6416 to complete the correction, and bring sustainable rebound. However, sustained break of 3.6416 could risk more downside acceleration back towards 3.1314 (2022 low).

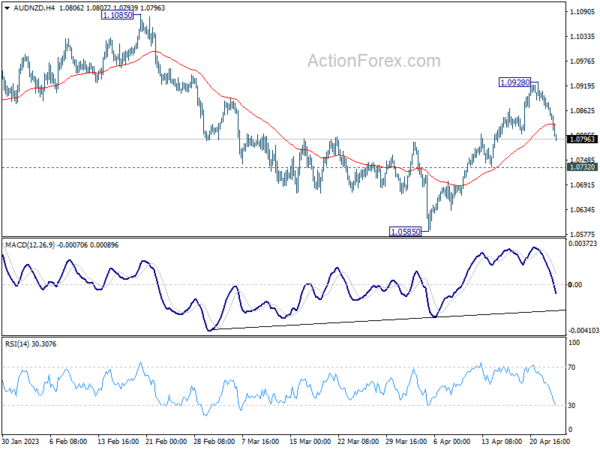

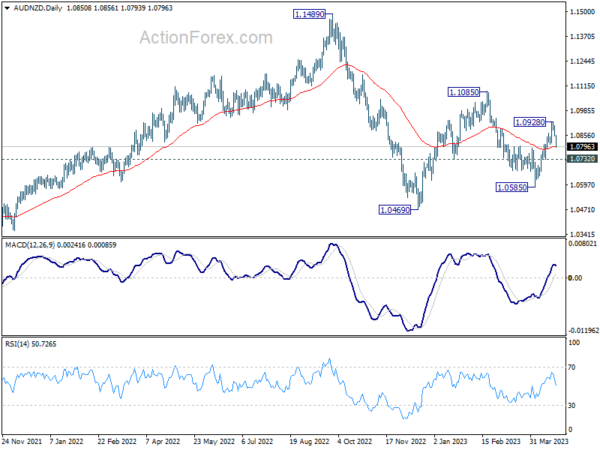

AUD/NZD’s steep fall from 1.0928 and firm break of 55 4H EMA indicates short term topping. It also raises the chance that whole rebound from 1.0585 has completed. Deeper decline is now in favor to 1.0732 support. Firm break there will pave the way back to 1.0585. Also, it’s a bit early to determine, but fall from 1.0928 could also be the third leg of the pattern from 1.1085. Hence, any downside acceleration would push AUD/NZD back to 1.0469 low easily.

ECB Lane: Inappropriate to leave deposit rate at current 3%

ECB Chief Economist Philip Lane revealed in an interview with French newspaper Le Monde that the central bank will likely raise interest rates again at their May 4 meeting, stating, “This is still not the right time to stop.” While Lane did not specify the rate hike’s magnitude, he said that “it would be inappropriate to leave our deposit rate at the current level of 3%.”

Lane acknowledged the decline in Eurozone inflation from 10.6% last October to 6.9% in March as a positive development, easing pressure on living costs. He expects inflation to continue falling due to supply chain bottleneck improvements and the reversal of the energy situation. However, Lane stressed that the most crucial aspect for central banks is “making sure that we get close to our target of 2% within a reasonable time period.”

Lane does not believe the current situation resembles the 1970s-style persistent inflation, but he cautioned against the risk of ending up in such a scenario. Lane underlined the importance of ECB raising interest rates to ensure a “timely” return to the 2% inflation target. Regarding the European economy, he noted that while it is not stagnant, it follows a more modest path than expected prior to the pandemic and the Russian war against Ukraine.

BoJ Governor Ueda stresses need for continued monetary easing

BoJ Governor Kazuo Ueda addressed parliament today, emphasizing, “In light of current economic, price and financial developments, it’s appropriate to maintain monetary easing, now conducted through yield curve control.”

Ueda reiterated the importance of keeping Japan’s monetary policy loose to achieve the 2% inflation target in a sustainable and stable manner, along with wage hikes. He added that if wage growth and inflation accelerate faster than expected and require tightening monetary policy, BoJ is prepared to respond by raising interest rates.

Despite this, Ueda warned of the risk of inflation falling further below expectations, calling it “very worrying.” He noted that “the risk of inflation undershooting forecasts is bigger than the risk of overshooting,” emphasizing the need to maintain the BoJ massive stimulus for the time being.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0992; (P) 1.1021; (R1) 1.1076; More…

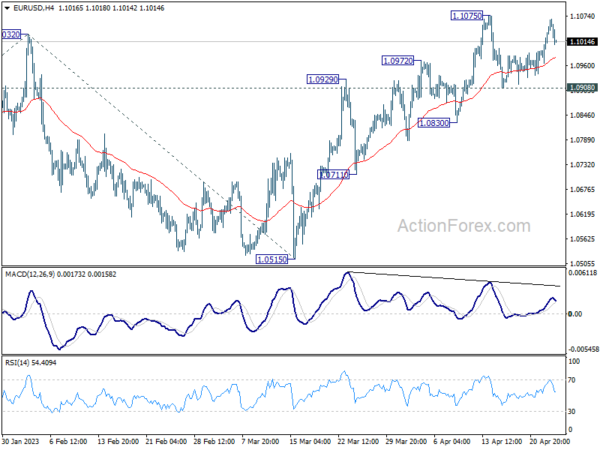

Intraday bias in EUR/USD remains neutral for the moment. Rejection by 1.1075 resistance indicates that consolidation from there is extending. But overall outlook will remain bullish as long as 1.0908 support holds. Break of 1.1075 will resume larger up trend from 0.9534 to 1.1273 fibonacci level. Break there will target 61.8% projection of 0.9534 to 1.1032 from 1.0515 at 1.1441.

In the bigger picture, rise from 0.9534 (2022 low) is in progress for 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273. Sustained break there will solidify the case of bullish trend reversal and target 1.2348 resistance next (2021 high). This will now remain the favored case as long as 1.0515 support holds, even in case of deeper pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Mar | 1.60% | 1.60% | 1.80% | 1.70% |

| 06:00 | CHF | Trade Balance (CHF) Mar | 4.53B | 4.20B | 3.31B | |

| 06:00 | GBP | Public Sector Net Borrowing (GBP) Mar | 20.7B | 12.2B | 15.9B | |

| 13:00 | USD | S&P/Case-Shiller Home Price Indices Y/Y Feb | 0.40% | 1.80% | 2.50% | 2.60% |

| 13:00 | USD | Housing Price Index M/M Feb | 0.50% | -0.20% | 0.20% | 0.10% |

| 14:00 | USD | Consumer Confidence Apr | 104.1 | 104.2 | ||

| 14:00 | USD | New Home Sales Mar | 630K | 640K |