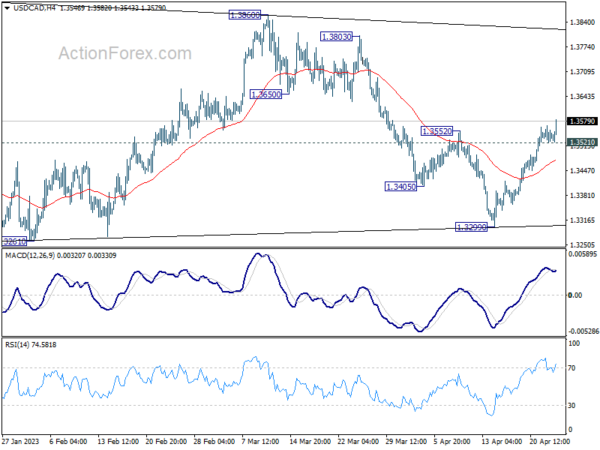

Daily Pivots: (S1) 1.3521; (P) 1.3544; (R1) 1.3565; More….

USD/CAD’s break of 1.3552 resistance argues that decline from 1.3860 has completed. More importantly, whole corrective pattern from 1.3976 has finished with three waves to 1.3299. Intraday bias is back on the upside for further rise to 1.3860/3976 resistance zone. Decisive break there will resume larger up trend. On the downside, below 1.3521 minor support will delay the bullish case and turn intraday bias neutral first.

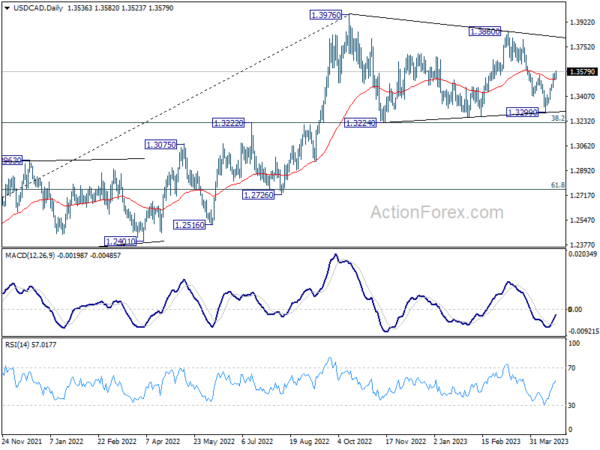

In the bigger picture, the up trend from 1.2005 (2021 low) is still in progress. Break of 1.3976 will confirm resumption and target 61.8% projection of 1.2401 to 1.3976 from 1.3261 at 1.4234. Firm break there will pave the way to long term resistance zone at 1.4667/89 (2016, 2020 highs). On the downside, sustained break of 55 W EMA (now at 1.3302) is needed to confirm medium term topping. Otherwise, outlook will remain bullish even in case of deep pull back.