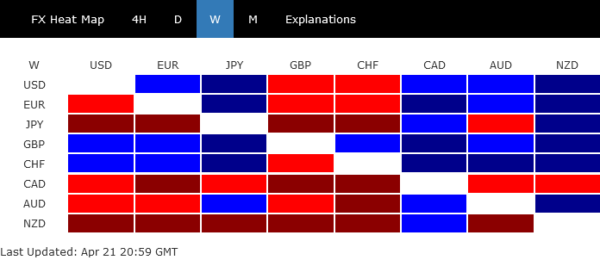

Last week, market movements centered around central bank policy expectations, with limited clear alternate influences. Comments from Fed officials and recent economic data suggest that Fed’s tightening cycle is not over yet. This pushed US Treasury yields higher, but stock market indexes remained relatively stable. The steady market sentiment slightly restrained Dollar’s rally momentum, leading to a mixed performance.

In the UK, higher-than-expected inflation figures reinforced the possibility of additional rate hikes. Swiss Franc also gained strength based on expectations of further SNB rate hikes in the second quarter. While Euro trailed behind the Pound and Franc, it held its ground against other currencies. It is important to note that Dollar, Euro, Sterling, and Swiss Franc all closed against each other within their previous week’s range, indicating limited progress.

Conversely, commodity currencies and Yen struggled last week. Cooling inflation data weighed down Kiwi and Loonie, while Aussie fared slightly better. However, the prevailing view remains that any RBA rate hike in May would likely be the final one in this cycle. Despite Japan experiencing higher inflation by their own standards, it is not expected that BoJ will alter its ultra-loose monetary policy in the near future.

Commodity Currencies Struggle on Central Bank Policy Outlook

Commodity currencies closed the week as the worst performers, despite resilience in US and European equities. The selloff in commodity currencies was driven primarily by the anticipated monetary paths for their respective central banks rather than risk aversion.

BoC has held interest rates steady at 4.50% in their last two meetings. With March’s CPI data showing a slowdown in inflation to 4.3% yoy, there is currently no significant evidence to “accumulate” to prompt BoC to reconsider tightening.

New Zealand’s Q1 CPI rose by a mere 1.2% qoq, significantly lower than RBNZ’s forecast of 1.8% qoq. Annual reading also slowed from 7.2% yoy to 6.7% yoy, missing expectation and was well below RBNZ’s projection of a rise to 7.3% yoy. The data raised hopes that the next 25bps move in May to 5.50% could be the last in the tightening cycle. Some even speculate that RBNZ might pause next month.

RBA minutes revealed that a rate hike was considered at this month’s meeting. Expectations for a final rate hike in May are contingent on Q1 CPI data to be released on April 26, and new economic projections at May meeting. Even if another raise is delivered, it would likely be the last in the RBA’s tightening cycle.

On the other hand, in the UK CPI remained stubbornly high and just ticked slightly down from 10.4% to 10.1% yoy in March. Core CPI was unchanged at 6.2%. The case for another hike by BoE in May is strong, and there could be more onwards. ECB officials have made it clear that tightening is not finished, and the strong rebound in Eurozone growth, led by services, gives the ECB more room to focus on fighting inflation. Meanwhile, markets are pricing in an 89% chance of another 25bps Federal Reserve rate hike in May, with the probability of a rate cut in September dropping below 50%.

GBP/CAD and EUR/AUD Ready to Resume Up Trend, NZD/USD Down

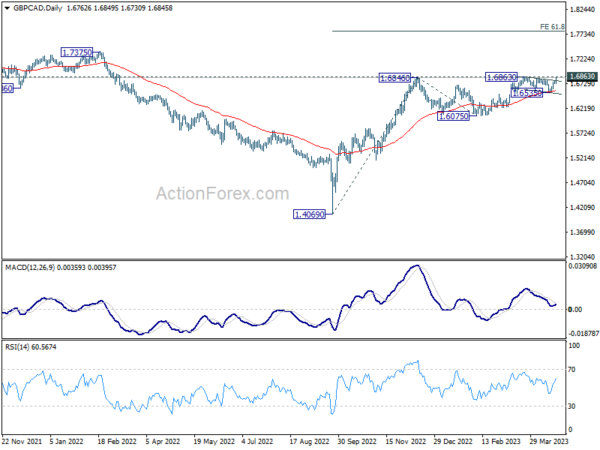

GBP/CAD’s consolidation pattern from 1.6863 should have completed at 1.6536 after drawing support form 55 D EMA. Immediate focus is now on 1.6863 after last week’s strong rally. Decisive break there will confirm resumption of whole up trend from 1.4069 (2022 low). Next target would be 61.8% projection of 1.4069 to 1.6846 from 1.6075 at 1.7791.

More importantly, it should be noted that both 55 W EMA (now at 1.6780) and 38.2% retracement of 2.0971 (2015 high) to 1.4069 at 1.6706 should be considered decisively taken out on up another sustainable upmove. That would add to the case of long term trend reversal, and bring further rise to 61.8% retracement at 1.8334 and above in the medium term.

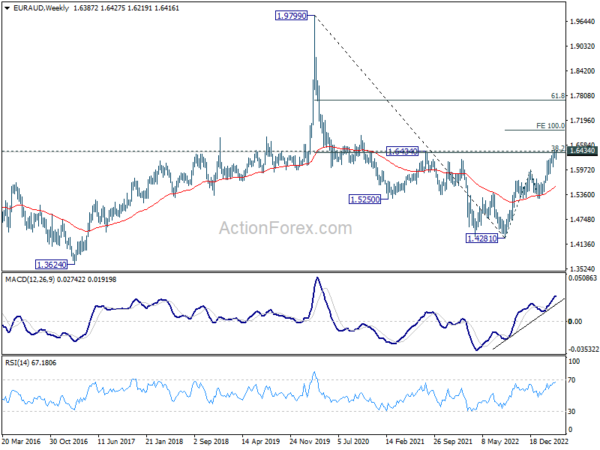

EUR/AUD’s pull back from 1.6444 might have completed at 1.6219. With the late rebound, immediate focus is now on 1.6434/44 resistance zone. Decisive break there will resume the larger up trend from 1.4281 to 100% projection of 1.4281 to 1.5976 from 1.5254 at 1.6949.

More importantly, sustained break of 1.6434 cluster resistance (38.2% retracement of 1.9799 to 1.4281 at 1.6389) will add to the case that EUR/AUD is already reversing whole down trend from 1.9799 (2020 high). Stronger rally would be seen to 61.8% retracement at 1.7691 in the medium term.

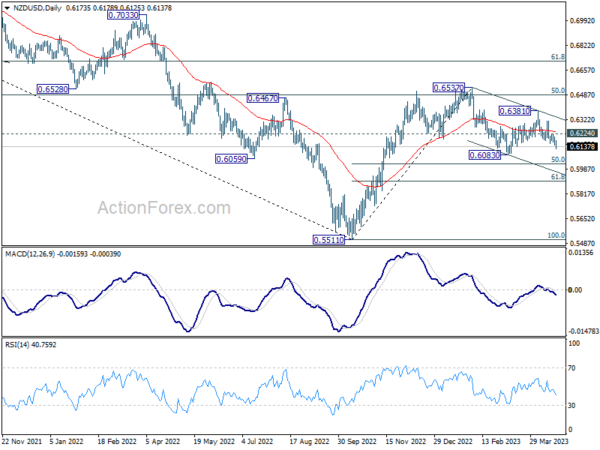

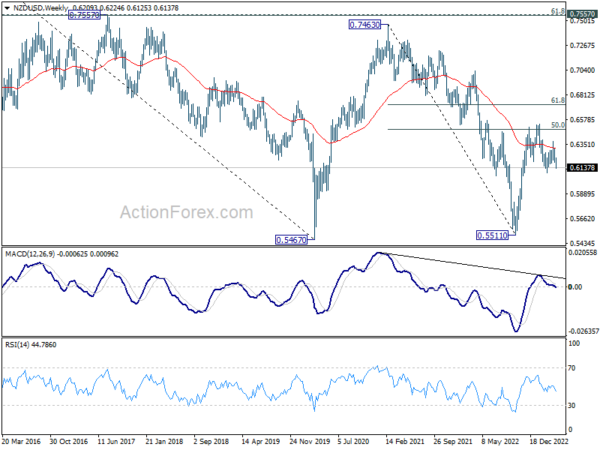

NZD/USD also gyrated lower last week. Current development suggests that the decline from 0.6537 is still in progress. Deeper fall is expected as long as 0.6224 resistance holds, to 0.6083 support and below. For now, such decline is seen as a corrective move. Without downside acceleration, strong support should be seen around 50% retracement of 0.5511 to 0.6537 at 0.6024 to bring rebound.

However, it should also be noted that medium term outlook in NZD/USD is leaning more towards the bearish side, after failing to sustain above 55 W EMA (now at 0.6307) on multiple attempts. Any downside acceleration could prompt more sustainable selloff through 61.8% retracement of 0.5511 to 0.6537 at 0.5903 towards 0.5511 low in the medium term.

US Stocks Resilient in Tight Range, Yields Attempting Rally

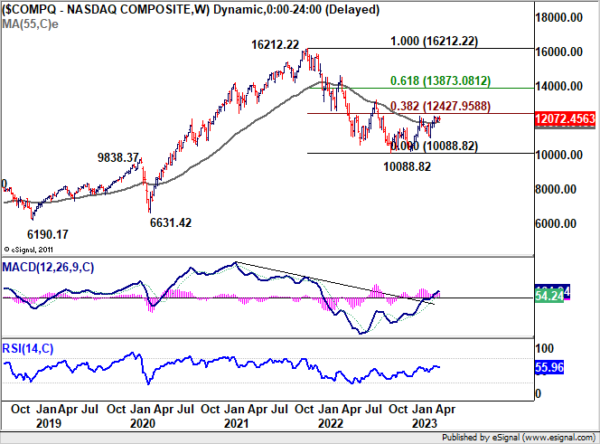

It was a relatively light week in the US last week. Major stock indexes were sluggish but stayed resilient in spite of expectations that interest rates will stay high for longer. NASDAQ lost some upside momentum just ahead of 12269.55 resistance and extended sideway trading. For now, near term outlook will remain bullish as long as 55 D EMA holds (now at 11768.89). The key barrier lies in 38.2% retracement of 16212.22 to 10088.82 at 12427.95. Rejection by this fibonacci resistance will keep the case of down trend resumption alive and favor another fall through 10088.82 at a later stage. However, sustained trading above 12427.95 will be a bullish signal that should at least set the stage for stronger rally to 61.8% retracement at 13873.08.

US 10-year yield hit as high as 3.639 last week but failed to close above 3.610 resistance, nor 55 D EMA (now at 3.582). For now, further rise is expected as long as 3.460 minor support holds. The favored case is that whole correction from 4.333 has completed with three waves down to 3.351, just ahead of 55 W EMA (now at 3.258). Sustained break of 3.610 will add to this bullish case and target 4.091 resistance next. However, break of 3.460 will indicate rejection by 3.610 and the 55 D EMA, and open up deeper fall through 3.351 to extend the correction from 4.333.

Dollar Index Struggles to Extend Gains, Outlook Depends on Risk Sentiment and Yields

Dollar index edged higher last week but struggled to extend gain. For now, the favored case is that fall from 105.88 is the second leg of the corrective pattern from 100.82, and has completed at 100.78. Break of 102.80 resistance would support this view and potentially trigger a stronger rally back to the 105.88 resistance as the third leg of the pattern.

However, decisive break below 100.82 would dampen this view, and resume the whole down trend from 114.77 instead. In this case, DXY may only find enough support for rebound at 55 M EMA (now at 97.76), which is near to 38.2% retracement of 70.69 to 114.77 at 97.93.

Ultimately, Dollar Index’s next move will depend heavily on both the trajectory of risk sentiment and treasury yields.

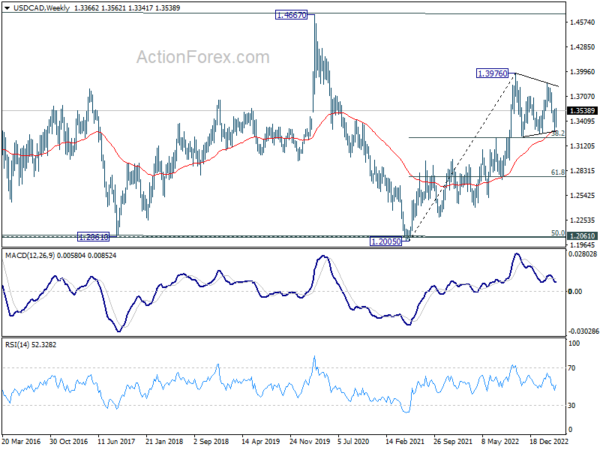

USD/CAD Weekly Outlook

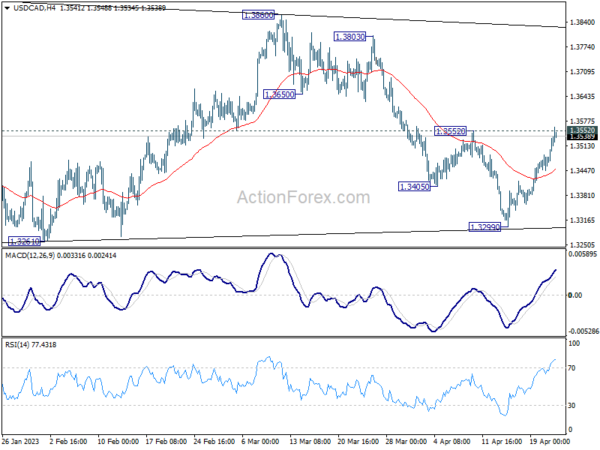

USD/CAD’s rebound from 1.3299 extended higher last week. Immediate focus is now on 1.3352 resistance. As noted before, price actions from 1.3976 are seen as a corrective pattern with fall from 1.3860 as the third leg. Decisive break of 1.3552 will argue that such corrective pattern has completed. Further rally should then be seen back to 1.3860/3976 resistance zone.

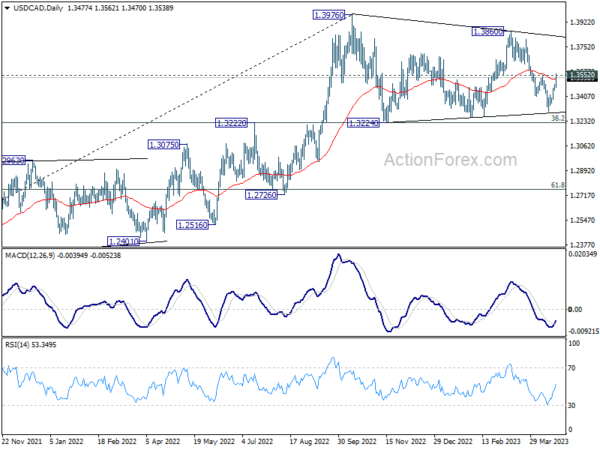

In the bigger picture, the up trend from 1.2005 (2021 low) is still in progress. Break of 1.3976 will confirm resumption and target 61.8% projection of 1.2401 to 1.3976 from 1.3261 at 1.4234. Firm break there will pave the way to long term resistance zone at 1.4667/89 (2016, 2020 highs). On the downside, sustained break of 55 W EMA (now at 1.3302) is needed to confirm medium term topping. Otherwise, outlook will remain bullish even in case of deep pull back.

In the longer term picture, price actions from 1.4689 (2016 high) are seen as a consolidation pattern only, which might have completed at 1.2005. That is, up trend from 0.9506 (2007 low) is expected to resume at a later stage. This will remain the favored case as 55 M EMA (now at 1.3012) holds.