Japanese Yen is extending its rally in the early US session holding on to its gains and emerging as the second strongest currency for the week, just behind Swiss Franc. Despite persistently above-target inflation data, it remains unlikely that BoJ will make a shift in monetary policy next week. Additionally, the lack of volatility in 10-year JGB yield suggests traders are not betting on any changes to yield curve control. However, it’s worth noting that BoJ has a history of surprising the markets, and traders should remain cautious.

Elsewhere in the currency markets, Euro is firmer after PMI data indicated a two-tracked economy gaining momentum, led by the services sector. Swiss Franc is also strong alongside Euro, but British pound lags behind after mixed data. Commodity currencies are the week’s worst performers, with a few hours remaining to determine the weakest. Dollar is currently mixed but appears vulnerable against both Euro and Swiss Franc.

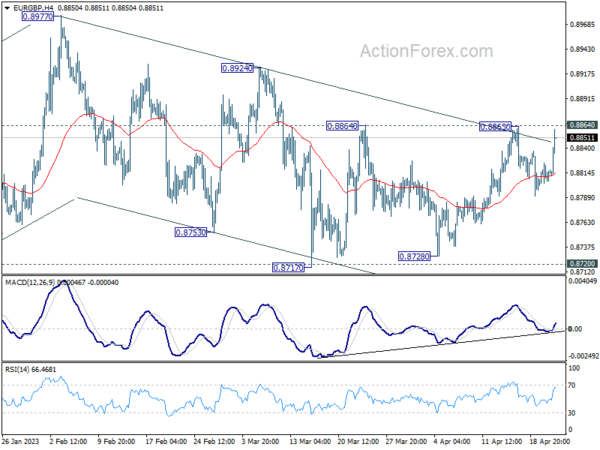

Technically, EUR/GBP is worth a watch before weekly close. Decisive break of 0.8864 resistance should clear the near term outlook and indicate that corrective fall from 0.8977 has completed. Strong rally should be seen to 0.8924. Firm break there will likely resume whole rally from 0.8545 through 0.8977.

In Europe, at the time of writing, FTSE is up 0.09%. DAX is down -0.12%. CAC is down -0.01%. Germany 10-year yield is up 0.0198 at 2.466. Earlier in Asia, Nikkei dropped -0.33%. Hong Kong HSI dropped -1.57%. China Shanghai SSE dropped -1.95%. Singapore Strait Times rose 0.25%. Japan 10-year JGB yield dropped -0.0081 to 0.462.

Canada retail sales down -0.2% mom in Feb, smaller than expected

Canada retail sales contracted -0.2% mom to CAD 66.3B in February, better than expectation of -0.6% mom. Sales decreased in 4 of 9 subsectors, representing 48.0% of retail trade. The decrease was led by lower sales at gasoline stations and fuel vendors (-5.0%) and general merchandise retailers (-1.6%).

Core retail sales—which exclude gasoline stations and fuel vendors and motor vehicle and parts dealers—increased 0.1% mom.

In volume terms, retail sales decreased -0.7% mom in February.

Advance estimate suggests that sales decreased another -1.4% mom in March.

ECB Officials Highlight Persistent Core Inflation, Emphasize Data-Dependent Approach

ECB Vice President Luis de Guindos recently highlighted the persistence of core inflation, stating that it may be more persistent than markets anticipated. He emphasized that “core inflation remains very sticky,” and while he believes it will eventually come down, the starting point is very high.

De Guindos also stressed that ECB will continue to communicate monetary policy on a meeting-by-meeting basis, with a data-dependent approach, rather than shifting to a forward-guidance strategy for several months. He added, “I believe that the current approach will be maintained for a few months until the evolution of inflation and the effects of our measures become clearer.”

In a separate statement, ECB Governing Council member Ignazio Visco echoed de Guindos’ concerns regarding stubborn core inflation. He emphasized the need for caution when setting policy, recommending that decisions be made on a meeting-by-meeting basis.

ECB Rehn: No reason to abandon restrictive policy prematurely

ECB Governing Council member Olli Rehn emphasized the importance of maintaining a proactive, balanced policy in the current monetary policy landscape. According to Rehn, the central bank has moved into an area that restricts aggregate demand, and he argued against abandoning this stance prematurely.

Rehn stated, “In monetary policy, we have moved into an area that restricts aggregate demand, and there is no reason for us to abandon it or exit it prematurely.” He added, “The path to sustainable growth is narrow, but it can be traversed with a proactive, balanced policy.”

Rehn further explained that by adhering to this approach, “we can achieve our goals without causing unnecessary costs to the economy – also because now the central banks are independent and not subject to political pressure, as in the 1970s.”

Eurozone PMIs: Unevenly distributed growth but same optimism

Eurozone PMI Manufacturing declined from 47.3 to 45.5 in April, hitting a 35-month low. On the other hand, PMI Services rose from 55.0 to 56.6, a 12-month high. PMI Composite rose from 53.7 to 54.4, an 11-month high.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said: “The HCOB Purchasing Managers’ Indices for the euro zone show a very friendly overall picture of an economy that continues to recover. However, a closer look reveals that growth is very unevenly distributed…”

“For the further, companies are rather positive not only in the services sector but also for the manufacturing sector. According to the companies surveyed, the reasons for this optimism include a diminishing fear of a resurgence of the energy crisis, supply chains that are functioning better again, and the expectation that inflation has passed its zenith. The latter is coupled with the hope that the ECB will pause its interest rate hikes soon.”

Also released, Germany PMI Manufacturing fell from 44.7 to 44.0, a 35-month low. PMI Services rose from 53.7 to 55.7, a 12-month high. PMI Composite rose from 52.6 to 53.9, a 12-month high.

France PMI Manufacturing dropped from 47.3 to 45.5, a 35-month low. PMI Services rose from 53.9 to 56.3, an 11-month high. PMI Composite rose from 52.7 to 53.8, also an 11-month high.

UK PMI composite rose to 53.9, lopsided growth but gained momentum

UK PMI Manufacturing fell from 47.9 to 46.6 in April, a 4-month low. PMI Services jumped from 52.9 to 54.9, a 12-month high. PMI Composite rose from 52.2 to 53.9, also a 12-month high.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

“Flash PMI surveys signalled an acceleration of economic growth to the fastest for a year in April, building on a modest return to growth in the first quarter of the year.

“Growth is lopsided, however, with surging demand for services contrasting with an ongoing downturn in demand for goods. Even within the service sector, growth is dependent on consumers switching spending from goods to services and a revival of financial services activity, both of which are areas susceptible to the impact of higher interest rates and the ongoing cost of living squeeze. Business services and manufacturing are clearly struggling.

“However, for now the key takeaway is that the economy as a whole is not only showing encouraging resilience but has gained growth momentum heading into the second quarter, the latest PMI reading broadly indicative of GDP rising at a robust quarterly rate of 0.4%.

“Inflationary pressures have meanwhile continued to cool in manufacturing, but price pressures have picked up in services following the resurgence of demand.

“This combination of faster growth and elevated price pressures put a twelfth rate hike by the Bank of England an increasingly done deal when it next meets on 11th May, and will add to speculation that further hikes may be needed.”

UK retail sales volume down -0.9% mom in Mar, value down -0.9% mom

In volume term, UK retail sales fell -0.9% mom in March, below expectation of -0.5% mom. Ex-fuel sales declined -1.0% mom, below expectation of -0.7% mom. For the year, retail sales was down -3.1% yoy while ex-fuel sales was down -3.2% yoy, versus expectation of -3.1% for both.

In value term, retail sales was down -0.9% mom and up 4.5% yoy. Ex-fuel sales was down -0.6% mom and up 6.0% yoy.

Australian PMIs reveal divergence between manufacturing and services, RBA rate hike likely in May

Australia’s April PMI Manufacturing has dropped to a 35-month low at 48.1, down from 49.1, while PMI Services jumped to a 10-month high of 52.6, up from 48.6. The PMI Composite also reached a 10-month high at 52.2. The data reveals a growing divergence between the performance of Australia’s manufacturing and service sectors.

Warren Hogan, Chief Economic Advisor at Judo Bank, said, “Manufacturing activity remains soft, a reflection of weaker demand for goods and a gradual slowdown in construction activity in Australia. The April flash results for the services sector have bounced strongly, bringing into question the broader economic slowdown.”

Hogan dismissed the idea of a recession, stating that the results point to a lift in Australia’s economic momentum through mid-2023. However, he noted that the risk to inflation is from excess demand in the economy, putting upward pressure on domestic prices in energy, housing, and labor markets.

With the RBA Board set to meet in early May, Hogan believes the April flash PMI, strong employment outcomes in March, and a resurgence in parts of the housing market all suggest that another 25bp rate hike in May is more likely than not, depending on the March quarter CPI to be released on April 26th.

Japan PMIs: Private sector expands driven by resurgent service economy

Japan’s PMI Manufacturing in April slightly rose from 49.2 to 49.5, missing expectations of 49.9. PMI Services experienced a slight drop from 55.0 to 54.9, while PMI Composite fell from 52.9 to 52.5. Despite this, the country’s private sector continued to expand solidly at the beginning of Q2, with the service economy’s resurgence helping to offset the weak manufacturing sector performance.

Annabel Fiddes, Economics Associate Director at S&P Global Market Intelligence, said, “Inflows of total new business increased at the quickest pace for nearly a year-and-a-half as services companies registered a steep upturn in sales amid reports of stronger demand conditions and improved customer numbers.” Fiddes also noted signs of cost pressures easing, with overall input costs rising to the weakest extent in 15 months in April.

Regarding the year-ahead outlook, optimism in the service sector hit a record high in April, but weakened among manufacturers. While service providers anticipate further improvements in demand and operating conditions as the impact of COVID-19 fades, some manufacturers expressed concerns over the economic outlook, rising costs, and component shortages.

Japan’s CPI core unchanged at 3.1%, core-core at highest since 1981

Japan’s CPI growth slowed from 3.3% yoy to 3.2% yoy, exceeding the expected 2.6% yoy increase. The CPI core (all items excluding food) remained unchanged at 3.1% yoy, in line with expectations. The CPI core-core (all items excluding food and energy) accelerated from 3.5% yoy to 3.8% yoy, surpassing the anticipated 3.4% yoy figure. This marks the 10th consecutive uptick and the highest level since December 1981.

New BOJ Governor Kazuo Ueda has recently committed to maintaining ultra-loose monetary policy. While no major changes to the bond yield control policy are expected at Ueda’s first policy-setting meeting next week, the spreading inflation from energy to the broader economy may keep market expectations alive that BOJ could begin phasing out its massive stimulus later this year. However, this will depend on whether wages increase sustainably and support consumption.

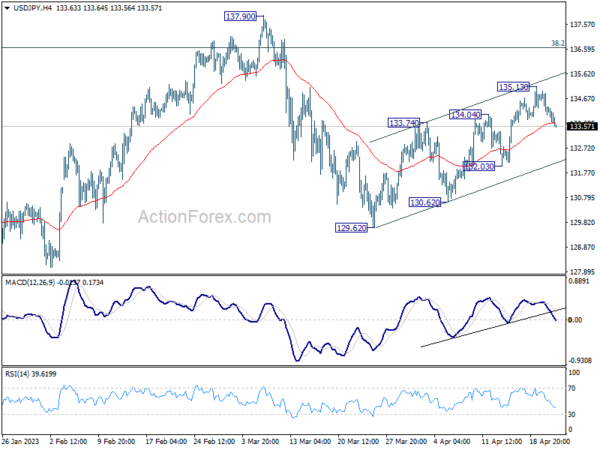

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 133.85; (P) 134.41; (R1) 134.82; More…

USD/JPY’s retreat from 135.13 extends lower today but stays above 132.03 support. Outlook is unchanged and intraday bias remains neutral first. Another rally will remain in favor as long as 132.03 support holds. On the upside, break of 135.13 will resume the choppy rebound from 129.62 towards 137.90 resistance next.

In the bigger picture, corrective pattern from 127.20 might be extending. But after all, down trend from 151.93 is expected to resume at a later stage. Break of 127.20 will resume this down trend and target 61.8% projection of 151.93 to 127.20 from 137.90 at 122.61. This will now be the favored case as long as 137.90 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:00 | AUD | Manufacturing PMI Apr P | 48.1 | 49.1 | ||

| 23:00 | AUD | Services PMI Apr P | 52.6 | 48.6 | ||

| 23:01 | GBP | GfK Consumer Confidence Apr | -30 | -35 | -36 | |

| 23:30 | JPY | National CPI Y/Y Mar | 3.20% | 2.60% | 3.30% | |

| 23:30 | JPY | National CPI Core Y/Y Mar | 3.10% | 3.10% | 3.10% | |

| 23:30 | JPY | National CPI Core-Core Y/Y Mar | 3.80% | 3.40% | 3.50% | |

| 00:30 | JPY | Manufacturing PMI Apr P | 49.5 | 49.9 | 49.2 | |

| 00:30 | JPY | Services PMI Apr P | 54.9 | 55 | ||

| 06:00 | GBP | Retail Sales M/M Mar | -0.90% | -0.50% | 1.20% | 1.10% |

| 06:00 | GBP | Retail Sales Y/Y Mar | -3.10% | -3.10% | -3.50% | |

| 06:00 | GBP | Retail Sales ex-Fuel M/M Mar | -1% | -0.70% | 1.50% | 1.40% |

| 06:00 | GBP | Retail Sales ex-Fuel Y/Y Mar | -3.20% | -3.10% | -3.30% | -3.00% |

| 07:15 | EUR | France Manufacturing PMI Apr P | 45.5 | 47.5 | 47.3 | |

| 07:15 | EUR | France Services PMI Apr P | 56.3 | 53.6 | 53.9 | |

| 07:30 | EUR | Germany Manufacturing PMI Apr P | 44 | 45.6 | 44.7 | |

| 07:30 | EUR | Germany Services PMI Apr P | 55.7 | 53.5 | 53.7 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Apr P | 45.5 | 48.2 | 47.3 | |

| 08:00 | EUR | Eurozone Services PMI Apr P | 56.6 | 54.6 | 55 | |

| 08:30 | GBP | Manufacturing PMI Apr P | 46.6 | 48.8 | 47.9 | |

| 08:30 | GBP | Services PMI Apr P | 54.9 | 52.9 | 52.9 | |

| 12:30 | CAD | Retail Sales M/M Feb | -0.20% | -0.60% | 1.40% | |

| 12:30 | CAD | Retail Sales ex Autos M/M Feb | -0.70% | 0.00% | 0.90% | |

| 13:45 | USD | Manufacturing PMI Apr P | 49.2 | 49.2 | ||

| 13:45 | USD | Services PMI Apr P | 51.8 | 52.6 |