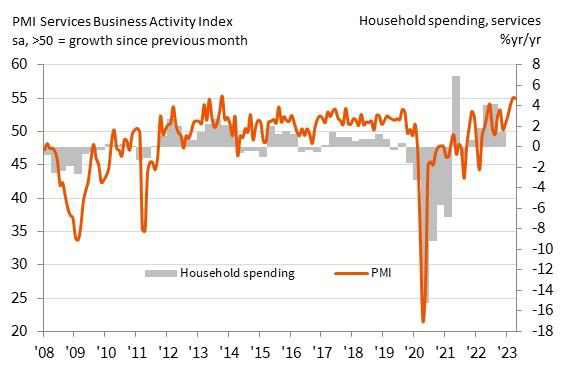

Japan’s PMI Manufacturing in April slightly rose from 49.2 to 49.5, missing expectations of 49.9. PMI Services experienced a slight drop from 55.0 to 54.9, while PMI Composite fell from 52.9 to 52.5. Despite this, the country’s private sector continued to expand solidly at the beginning of Q2, with the service economy’s resurgence helping to offset the weak manufacturing sector performance.

Annabel Fiddes, Economics Associate Director at S&P Global Market Intelligence, said, “Inflows of total new business increased at the quickest pace for nearly a year-and-a-half as services companies registered a steep upturn in sales amid reports of stronger demand conditions and improved customer numbers.” Fiddes also noted signs of cost pressures easing, with overall input costs rising to the weakest extent in 15 months in April.

Regarding the year-ahead outlook, optimism in the service sector hit a record high in April, but weakened among manufacturers. While service providers anticipate further improvements in demand and operating conditions as the impact of COVID-19 fades, some manufacturers expressed concerns over the economic outlook, rising costs, and component shortages.