Key Highlights

- EUR/USD extended gains above 1.1000 before the bears appeared.

- A key bullish trend line is forming with support near 1.0940 on the 4-hour chart.

- GBP/USD spiked above 1.2540 before it faced resistance.

- Crude oil prices started a consolidation phase above $80.

EUR/USD Technical Analysis

The Euro started another increase from the 1.0820 support against the US Dollar. EUR/USD broke many hurdles near 1.0880 to move into a bullish zone.

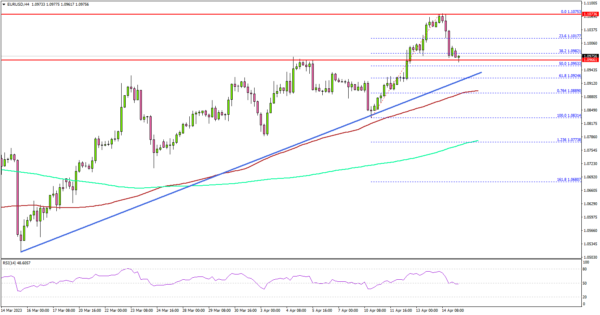

Looking at the 4-hour chart, the pair gained pace after it broke the 1.0920 resistance. The pair even settled above the 1.0950 level, the 200 simple moving average (green, 4 hours), and the 100 simple moving average (red, 4 hours).

It traded as high as 1.1075 before the bears appeared. Recently, there was a downside correction below the 1.1020 level. The pair dipped below the 38.2% Fib retracement level of the upward move from the 1.0831 swing low to the 1.1075 high.

The next major support is near the 1.0940 level. There is also a key bullish trend line forming with support near 1.0940 on the same chart.

The trend line is close to the 50% Fib retracement level of the upward move from the 1.0831 swing low to the 1.1075 high. A break below the trend line might push EUR/USD toward the 1.0890 level or the 100 simple moving average (red, 4 hours).

On the upside, the pair is facing resistance near the 1.1050 level. The next key resistance is near the 1.1075 zone. A clear move above the 1.1075 resistance might send the pair toward the 1.1150 zone. Any more gains might send the pair toward 1.1200.

Looking at GBP/USD, the pair climbed above the 1.2500 resistance zone before it faced sellers and started a short-term downside correction.

Economic Releases

- ECB’s President Lagarde speech.