Dollar is attempting to rebound in early trading sessions, as market sentiment is shaken by disappointing US retail sales data. Furthermore, a top Fed official has cautioned that interest rates could remain high for a more extended period than previously anticipated by the market. Nevertheless, the greenback continues to be one of the week’s worst performers, alongside the Japanese yen. On the other end of the spectrum, Swiss Franc remains the top performer, now followed by Canadian Dollar and the Australian Dollar.

From a technical standpoint, it is too early to declare that the dollar has reached its bottom despite today’s recovery. At a minimum, EUR/USD would have to breach the 1.0972 resistance-turned-support level. In addition, USD/CHF would need to break through the 0.8973 resistance level to signal that a more robust recovery is underway. Otherwise, risk will remain on the downside, and selling pressure could resurface at any moment.

In Europe, at the time of writing, FTSE is up 0.61%. DAX is up 0.48%. CAC is up 0.44%. Germany 10-year yield is up 0.026 at 2.401. Earlier in Asia, Nikkei rose 1.20%. Hong Kong HSI rose 0.46%. China Shanghai SSE rose 0.60%. Singapore Strait Times rose 0.25%. Japan 10-year JGB yield dropped -0.0041 to 0.461.

US retail sales down -1% mom in Mar, ex-auto sales down -0.8% mom

US retail sales contracted -1.0% mom to USD 691.7B in March, worse than expectation of -0.5% mom. Total sales for January through March period were up 5.4% from the same period a year ago.

For the month, ex-auto sales dropped -0.8% mom to USD 562.9B, below expectation of -0.4% mom. Ex-gasoline sales decreased -0.6% mom to USD 636.5B. Ex-auto and gasoline sales declined -0.3% mom to USD 507.6B.

Fed’s Waller: Not much progress on inflation, my job is not done

In a speech, Fed Governor Christopher Waller expressed concern over the persistently high inflation rates and emphasized the need for the continuation of tighter monetary policies.

Waller stated, “Whether you measure inflation using the CPI or the Fed’s preferred measure of personal consumption expenditures, it is still much too high and so my job is not done.”

“I interpret these data as indicating that we haven’t made much progress on our inflation goal, which leaves me at about the same place on the economic outlook that I was at the last FOMC meeting, and on the same path for monetary policy,” he added.

His outlook remains consistent with the stance from the last FOMC meeting, indicating a steadfast commitment to tightening monetary policy. He emphasized that “the labor market continues to be strong and quite tight, and inflation is far above target, so monetary policy needs to be tightened further.”

The Fed Governor also emphasized that, given the current circumstances, “monetary policy will need to remain tight for a substantial period of time, and longer than markets anticipate.”

Fed Bostic: Recent data consistent with one more rate hike

In a recent interview with Reuters, Atlanta Fed President Raphael Bostic discussed the implications of this week’s slowing consumer price increases and falling producer price inflation. According to Bostic, these developments are in line with the possibility of one more rate hike, as momentum suggests a trajectory towards 2% inflation.

Bostic expressed that the aggressive rate increases over the past year are just beginning to “bite” the economy, justifying a pause after one more rate increase. This pause would allow for an assessment of the economy and inflation’s progression while aiming to minimize the impact on growth and employment.

Despite the current economic landscape, Bostic remains optimistic, believing that unemployment won’t need to surpass 4% and that the economy can continue to grow, albeit at a slower pace. He attributes the persistent consumer demand and robust hiring to the economic distortions caused by the trillions of dollars in government support provided during the COVID-19 pandemic.

ECB’s Lagarde expects inflation to continue falling with receding price pressures

In a speech, ECB President Christine Lagarde anticipates Eurozone inflation to continue falling as lagged price pressures recede and tighter monetary policy increasingly affects demand. However, she notes that historically high wage growth, driven by tight labor markets and compensation for high inflation, will support core inflation over the projection horizon, as it gradually returns to rates around the ECB’s target.

Lagarde admits that this outlook is shrouded in uncertainty, with both upside and downside risks. She states, “Stronger than expected pipeline pressures or higher than anticipated increases in wages or profits could drive up inflation, while financial market tensions and falling energy prices could lead to faster disinflation.”

ECB staff projections predict that Eurozone economy will recover in the coming quarters, driven by a strong labor market, resolved supply bottlenecks, and moderating inflation. Nevertheless, Lagarde acknowledges that risks to the growth outlook lean towards the downside, with persistently elevated financial market tensions potentially dampening confidence and tightening broader credit conditions more than anticipated. Russia’s ongoing war against Ukraine remains a significant downside risk to the economy, potentially raising energy and food costs once more.

BoJ Ueda foresees core inflation slowing, reiterates commitment to ultra-loose monetary policy

BoJ Governor Kazuo Ueda, who recently attended the G20 finance leaders’ meeting in Washington, expects core consumer inflation in Japan, currently around 3%, to slow below 2% by the latter half of this fiscal year. Ueda emphasized the central bank’s commitment to maintaining ultra-loose monetary policy in order to achieve its 2% inflation target in a stable and sustainable manner.

Ueda believes that “as our base scenario is for global growth to pick up after a period of slowdown, Japan’s wages will likely keep rising.” He added that the BoJ’s forecasts already factor in the possibility of a global economic slowdown, but a severe global recession is not considered in the baseline projection.

As for the upcoming April policy meeting, Ueda said, “It’s been just a week since I took office and now I am on a business trip. I’ll think about it closely once I’m back.” Market participants are closely watching the BoJ’s first policy meeting under Ueda’s leadership on April 27-28, where the board will release fresh quarterly growth and inflation forecasts extending through fiscal 2025.

NZ BNZ manufacturing dropped to 48.1, sector faces headwinds

New Zealand’s BusinessNZ Performance of Manufacturing Index fell from 51.7 in February to 48.1 in March, slipping back into negative territory after briefly reaching positive levels in January and February. The decline in the index signals challenges for the manufacturing sector.

A closer look at the data reveals that production dropped from 48.7 to 43.3, its lowest level since August 2021. Employment shrank from 55.2 to 47.1, while new orders dipped from 51.5 to 46.7, matching November 2022 levels. Finished stocks decreased from 55.1 to 48.4, and deliveries rose slightly from 52.2 to 53.8.

Catherine Beard, BusinessNZ’s Director of Advocacy, pointed out that the numbers behind the main March result indicate the manufacturing sector is facing significant headwinds. BNZ Senior Economist Craig Ebert added that although New Zealand’s March PMI was disappointing, it was “not especially negative in the longer-term context” and was in line with global manufacturing readings.

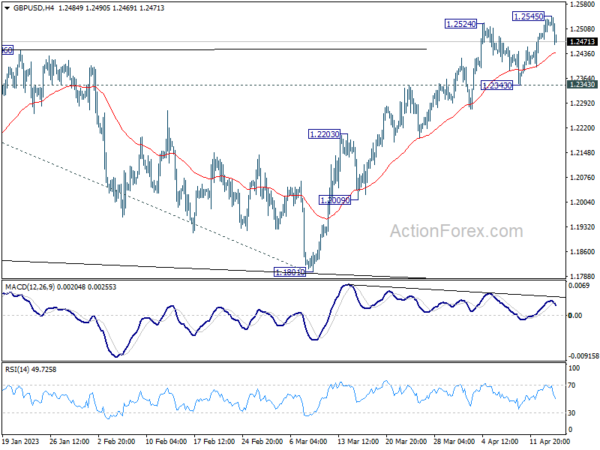

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2489; (P) 1.2513; (R1) 1.2547; More…

A temporary top is formed at 1.2545 with current retreat and intraday bias in GBP/USD is turned neutral first. Still, outlook will remain bullish as long as 1.2343 support holds. Above 1.2545 will target 1.2759 fibonacci level first. Firm break there will target 61.8% projection of 1.0351 to 1.2445 from 1.1801 at 1.3095.

In the bigger picture, the rise from 1.0351 medium term term bottom (2022 low) is in progress for 61.8% retracement of 1.4248 (2021 high) to 1.0351 at 1.2759. Sustained break there will add to the case of long term bullish trend reversal. Further break of 61.8% projection of 1.0351 to 1.2445 from 1.1801 at 1.3095 could prompt upside acceleration to 100% projection at 1.3895. For now, this will remain the favored case as long as 1.1801 support holds, even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PMI Mar | 48.1 | 51 | 52 | |

| 06:30 | CHF | Producer and Import Prices M/M Mar | 0.20% | -0.20% | -0.20% | |

| 06:30 | CHF | Producer and Import Prices Y/Y Mar | 2.10% | 2.70% | 2.70% | |

| 12:30 | CAD | Manufacturing Sales M/M Feb | -3.60% | -2.50% | 4.10% | |

| 12:30 | USD | Retail Sales M/M Mar | -1.00% | -0.50% | -0.40% | |

| 12:30 | USD | Retail Sales ex Autos M/M Mar | -0.80% | -0.40% | -0.10% | |

| 12:30 | USD | Import Price Index M/M Mar | -0.60% | -0.20% | -0.10% | |

| 13:15 | USD | Industrial Production M/M Mar | 0.4% | 0.20% | 0.00% | 0.2% |

| 14:00 | USD | Michigan Consumer Sentiment Index Apr P | 62.7 | 62 | ||

| 14:00 | USD | Business Inventories Feb | 0.20% | -0.10% |