Key Highlights

- Crude oil prices gained pace and cleared the $80 resistance.

- It is now facing resistance near $81.60 on the 4-hour chart.

- EUR/USD and GBP/USD are showing signs of more gains.

- The US CPI could decline from 6% to 5.2% in March 2023 (YoY).

Crude Oil Price Technical Analysis

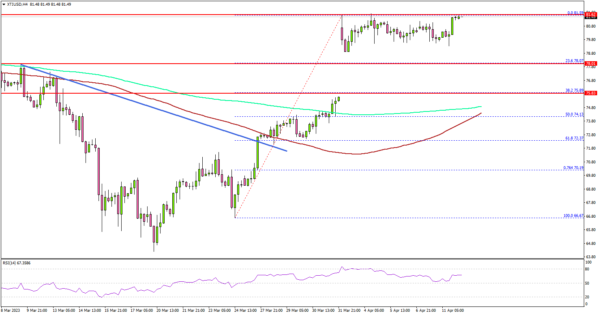

Crude oil prices started a fresh increase above the $74 resistance against the US Dollar. The price was able to clear the $78 resistance to move further into a positive zone.

Looking at the 4-hour chart of XTI/USD, the price even settled above the $78.50 pivot level, the 100 simple moving average (red, 4-hour), and the 200 simple moving average (green, 4-hour).

Finally, there was a break above the $80 barrier. The price is now facing resistance near the $81.60 zone and recently started a consolidation phase. The next major resistance is near the $82.50 zone.

A clear move above the $82.50 resistance could open the doors for another steady increase toward $83.80 or even $84.00. If not, there is a risk of a downside correction after the FOMC meeting minutes.

Immediate support is now forming near the $78.00 zone. The next major support sits near the $76.00 level. Any more losses might call for a test of the $74.00 support zone or the 100 simple moving average (red, 4-hour) in the coming days.

Looking at EUR/USD, the pair is holding gains above the 1.0820 level and might aim for a fresh increase above the 1.0925 level.

Economic Releases to Watch Today

- US Consumer Price Index for March 2023 (MoM) – Forecast +0.3%, versus +0.4% previous.

- US Consumer Price Index for March 2023 (YoY) – Forecast +5.2%, versus +6.0% previous.

- US Consumer Price Index Ex Food & Energy for March 2023 (YoY) – Forecast +5.6%, versus +5.5% previous.

- BoC Interest Rate Decision – Forecast 4.5%, versus 4.5% previous.

- FOMC Minutes.