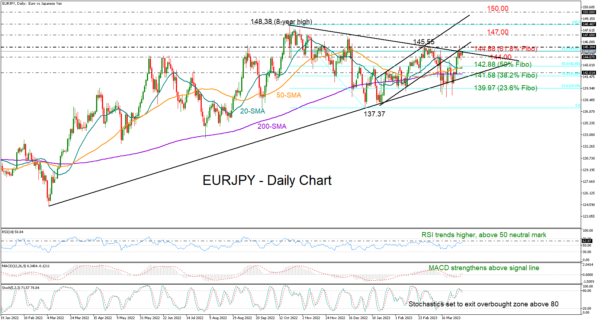

EURJPY has been in quiet trading mode over the past couple of days, being constrained within the 144.00-144.88 zone. The pair lost momentum after its impressive rebound stuck around the 61.8% Fibonacci retracement of the 148.38-137.37 downleg last week.

Overbought conditions have yet to be confirmed. Although the Stochastic oscillator looks for a downside reversal after peaking above 80, the rising RSI has yet to reach its 70 overbought level. Meanwhile, the MACD continues to strengthen within the positive area, reflecting improving market sentiment.

Yet, for the recovery to continue, the bulls will need to pierce through the 144.88 wall and enter the broken bullish channel above 145.35. If that turns out to be the case, the pair would next target the channel’s upper boundary seen around 148.40 and near October’s top. Breaking that ceiling, the spotlight will immediately fall on the 150.00 psychological level, where the pair peaked in 2014.

Alternatively, a close below 144.00 could activate fresh selling pressures, bringing the 50% Fibonacci mark of 142.88 under the spotlight. Failure to hold here could squeeze the price straight to the crucial support trendline, which has been holding up the market for more than a year now. Notably, the 200-day simple moving average (SMA) and the 38.2% Fibonacci of 141.58 are also in the neighborhood. Hence, a decisive step lower is expected to press the price aggressively towards the 23.6% Fibonacci of 139.97.

In brief, EURJPY is trading neutral at the moment, with investors likely waiting for a clear break above the 144.88-145.35 region or below 144.00 to direct the market accordingly.