With the banking crisis reviving fears that the Fed may need to start cutting rates later this year, market participants may look for their next clue on whether this could be true or not in the US employment report for March, scheduled to be released on Friday at 12:30 GMT. Such expectations have weighed on the US dollar recently, but will a positive surprise in the jobs report be enough to bring the currency back to life?

Investors maintain Fed cut bets

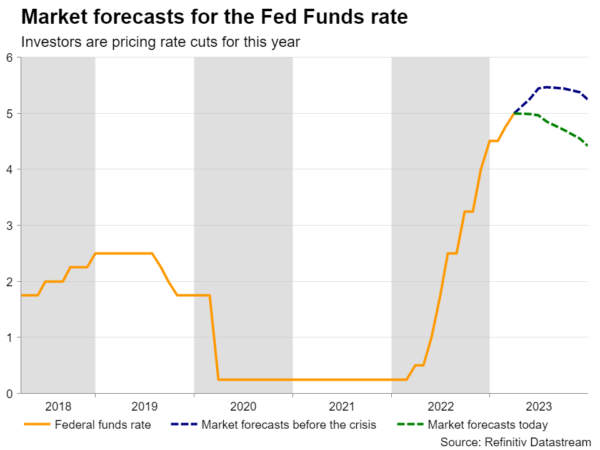

Despite Chair Powell pushing against rate cut expectations at the press conference following the last FOMC meeting, investors put no faith in his words. They kept selling the US dollar, spellbound by the change in the Committee’s forward guidance. Instead of repeating that more rate increases are needed, Fed officials noted that “some additional policy firming may be appropriate”. The word ‘may’ was interpreted as opening the door to a pause as soon as at the May gathering, although the updated dot plot continued pointing to another quarter-point hike and essentially no rate cuts in 2023.

In the aftermath of the meeting, several policymakers kept the door open to more rate increments, with Boston and Minneapolis Fed Presidents Susan Collins and Neel Kashkari saying that there is more work to be done to bring inflation down to the 2% target. However, Kashkari is a well-known advocate of higher rates and thus, his comments came to no one’s surprise. Collins added that despite remaining strong and resilient, banks are likely to pull back on offering credit following the latest turmoil, which may partially offset the need for additional rate increases. The same view was shared by Richmond Fed President Thomas Barkin.

Combined with the further slowdown in the core PCE index for February, the Fed’s favorite inflation metric, these remarks allowed market participants to maintain their rate cut bets, while being evenly split on whether the Fed should hike by another 25bps in May or not. Headlines over the weekend that Saudi Arabia and other OPEC+ oil producers agreed to output cuts, tipped the scale towards hitting the hike button one last time, with the probability rising to 65%, but 50bps worth of rate cuts by the end of the year remained firmly on the table.

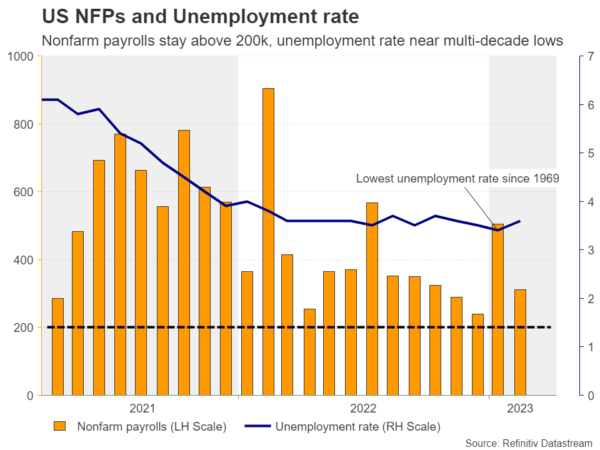

US labor market remains tight

On Friday, nonfarm payrolls are expected to have slowed to 238k in March from 311k, but combined with an unemployment rate of 3.6%, that number seems consistent with a still-tight labor market. What’s more, the S&P Global composite PMI survey said that the rate of total job creation was the fastest in six months in March and thus, the risks surrounding the NFP print may be tilted to the upside.

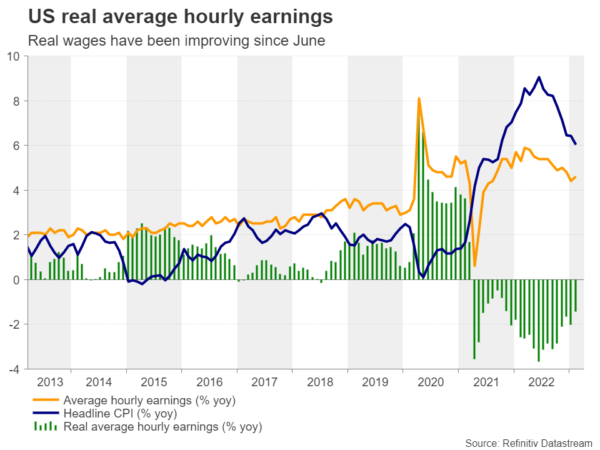

Average hourly earnings are expected to have slowed to 4.3% y/y from 4.6%, but the S&P survey pointed to greater wage bills during the month, so, there may be upside risks. With inflationary pressures in the US easing notably since peaking during the summer, this could mean further improvement in real wage growth. That said, improving wages could also translate into improving consumer confidence and demand in the coming months, which could refuel inflation.

Therefore, a report pointing to further tightening of the labor market could increase the probability for another 25bps hike at the upcoming Fed meeting, with market participants perhaps scaling back some of the rate cut basis points they are anticipating.

Dollar could strengthen, but too early for a bullish reversal

This could prove supportive for the US dollar, but calling for a bullish reversal would still seem unwise. Ahead of the May FOMC meeting, market participants will still have to digest the CPI numbers for March, as well as the first GDP estimate for Q1. Downside surprises in these releases and/or new headlines spreading fresh fears about the stability of the banking sector could very well prompt market participants to start pricing in a May pause again and more rate cuts towards the end of the year.

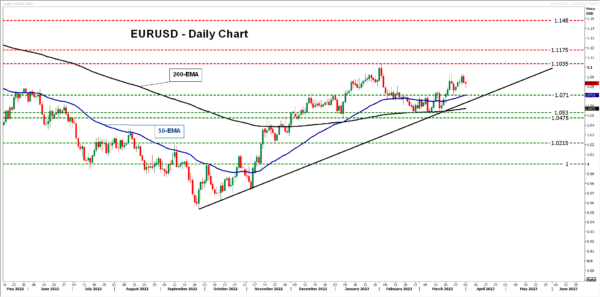

For now, any dollar strength resulting from Friday’s employment data could be seen as a corrective recovery. Euro/dollar could slide back below 1.0800, but with the ECB expected to continue hiking more aggressively than the Fed, the bulls could recharge from near the crossroads of the 1.0710 barrier and the uptrend line drawn from the low of September 28. They could aim for another test at around 1.1035, marked by the peak of February 2, or even at the 1.1175 zone, which offered strong support between November 24, 2021, and February 25, 2022, and acted as resistance on March 31, 2022. If the pair emerges above that zone, the uptrend may then extend towards the 1.1480 area, which stopped the bulls between January 14 and February 11, 2022.

For the near-term outlook to turn bearish, a decisive break below 1.0475 may be needed. Euro/dollar will be already below the pre-discussed uptrend line, while the break below 1.0475 will confirm a lower low on both the daily and weekly charts. The sellers could then get encouraged to dive towards the low of November 21 at 1.0215, the break of which may allow them to put parity back on their radars.