Australian Dollar surges as markets approach the US session, with investors eyeing RBA rate decision tomorrow. Although it seems reasonable to expect a pause in interest rate hikes, some financial institutions, such as ANZ and NAB, predict a 25bps increase. The Aussie’s rally could be driven by speculation of a hawkish surprise, but the situation could reverse quickly if RBA doesn’t disappoint.

In the currency markets, Canadian Dollar is performing strongly, while WTI oil continues to flirt with the 80 mark due to OPEC’s unexpected extra production cut. Conversely, Dollar, Yen, and Swiss Franc face pressure, and Euro and Sterling are mixed for the time being.

From a technical standpoint, AUD/CAD’s robust rebound may signify a short-term bottom at 0.8984, just before the 61.8% retracement of 0.8596 to 0.9545 at 0.8959. In the near term, the rebound is likely to continue. However, a decisive break of the 0.9229 resistance is required to confirm the end of the downtrend from 0.9545 and a bullish reversal. If this fails to occur, a bearish outlook persists for a decline beyond 0.8984 at a later stage.

In Europe, at the time of writing, FTSE is up 0.60%. DAX is down -0.10%. CAC is up 0.36%. Germany 10-year yield is up 0.0277 at 2.321. Earlier in Asia, Nikkei rose 0.52%. Hong Kong HSI rose 0.04%. China Shanghai SSE rose 0.72%. Singapore Strait Times rose 0.68%. Japan 10-year JGB yield rose 0.0409 to 0.371.

UK PMI manufacturing finalized at 47.9, fell back into contraction

UK PMI Manufacturing was finalized at 47.9 in March, down from February’s 7-month of 49.3. The index has stayed below the neutral 50 mark for eight successive months.

Rob Dobson, Director at S&P Global Market Intelligence, highlighted that UK manufacturing production “fell back into contraction” at the end of the first quarter due to subdued market conditions. While total new orders saw a slight increase after a nine-month contraction, order book levels remain low. New export order declines continue to impact demand, despite a modest recovery in the domestic market.

However, Dobson pointed to positive developments in pricing and supply during March. Input price inflation reached its lowest level since June 2020, and although selling prices decelerated, they remained higher than input costs, offering some relief for manufacturers’ margins. Supply chains continued to recover, with March witnessing the greatest improvement in average vendor lead times in the survey’s 31-year history. Dobson noted that this development “should hopefully filter through to further cost reductions and lessen the disruption to production workflows in the coming months.”

Eurozone PMI manufacturing finalized at 47.3, remains in troubled waters

Eurozone PMI Manufacturing was finalized at 47.3 in March, down from February’s 48.5, a 4-month low. Looking at some member states, Greece (52.8, 10-month high) and Spain (51.3, 9-month high) improved. Others deteriorated including Italy (51.1, 2-month low), Ireland (49.7, 3-month low), France (47.3, 5-month low), the Netherlands (46.4, 4-month low), Germany (44.7, 34-month low), and Austria (44.7, 34-month low).

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, highlighted that Eurozone manufacturing “remains in troubled waters” as factories report an eleventh consecutive month of falling demand due to factors such as surging living costs, tighter monetary policy, inventory destocking, and low customer confidence.

He also pointed out that the lack of demand has shifted pricing power from sellers to buyers, and lower energy prices have helped reduce costs. As a result, “prices paid for inputs by factories are now falling sharply on average,” and slower increases in selling prices should eventually lead to lower consumer prices for goods.

Swiss CPI slowed to 2.9% yoy in Mar, core CPI down to 2.2% yoy

Swiss CPI rose 0.2% mom in March, below expectation of 0.4% mom. Core CPI (excluding fresh and seasonal products, energy and fuel) rose 0.2% mom. Domestic products prices dropped -0.1% mom. Imported products prices rose 0.9% mom.

Compared with the same month of the previous year, CPI slowed from 3.4% yoy to 2.9% yoy, below expectation of 3.2% yoy. Core CPI slowed from 2.4% yoy to 2.2% yoy. Domestic products prices slowed from 2.9% yoy to 2.7% yoy. Imported products prices slowed from 4.9% yoy to 3.8% yoy.

Japan Tankan: Manufacturing deteriorates while non-manufacturing improves

In Q1, Japan’s Tankan large manufacturing index dropped for the fifth consecutive quarter, falling from 7 to 1, below the expected 3, and marking the lowest level since December 2020. The large manufacturing outlook also tumbled from 6 to 3, missing the anticipated 4. This decline was attributed to rising raw material and fuel costs, slowing overseas growth, and slumping chip demand.

Conversely, the non-manufacturing index improved for the fourth straight quarter, ticking up from 19 to 20, in line with expectations. The non-manufacturing outlook rose from 11 to 15, although it fell short of the expected 16.

Despite these mixed results, large Japanese firms plan to increase capital expenditure by 3.2% in the fiscal year that began in April, which is lower than the market’s forecast for a 4.9% gain. The Tankan survey also revealed that Japanese firms anticipate inflation to reach a record 2.8% a year from now and remain above the BoJ’s target for the next three to five years.

Japan PMI manufacturing finalized at 49.2, signs of improvement at the end of Q1

Japan PMI Manufacturing was finalized at 49.2 in March, up from prior month’s 47.7.

Economist Usamah Bhatti from S&P Global Market Intelligence highlighted that the Japanese manufacturing sector showed signs of improvement at the end of Q1 2023, despite marking a fifth consecutive contraction.

Output and new orders experienced their softest declines in five months, but subdued market demand persisted in both domestic and international markets.

The lack of new incoming business led to firms preparing for an eventual rise in demand, with backlogs of work falling sharply for the sixth consecutive month. Additionally, manufacturers were increasingly stockpiling finished goods.

While input cost inflation slowed to its lowest rate since August 2021, selling price inflation remained high and accelerated, as Japanese goods producers partially passed on higher cost burdens to clients.

China Caixin PMI manufacturing dropped to 50, slowdown of recovery

China Caixin PMI Manufacturing dropped from 51.6 to 50.0 in March, below expectation of 51.7. It signalled stable business conditions at the end of the first quarter.

Wang Zhe, Senior Economist at Caixin Insight Group said: “In a nutshell, the economy saw a marginal slowdown of recovery in March as the expansion in both manufacturing supply and demand significantly weakened from the previous month.

“Overseas demand dragged, employment worsened, inventories dropped slightly, prices remained largely stable, logistics was gradually restored to normal, and businesses were still highly confident in the economic outlook.”

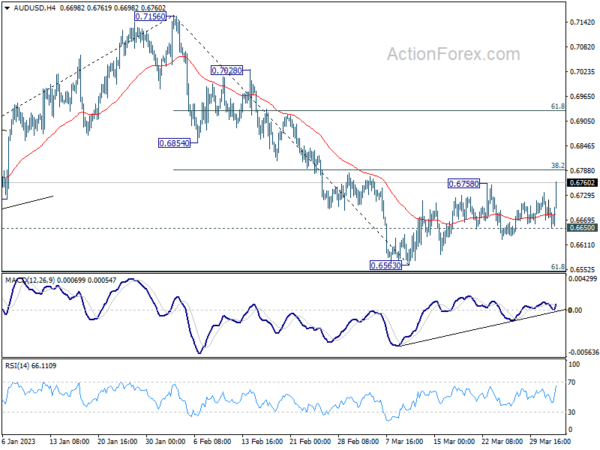

AUD/USD Mid-Day Report

Daily Pivots: (S1) 0.6657; (P) 0.6698; (R1) 0.6725; More…

AUD/USD’s breach of 0.6758 suggests that rebound from 0.6563 short term bottom is resuming. Intraday bias is back on the upside for 38.2% retracement of 0.7156 to 0.6563 at 0.6790. Break will target 61.8% retracement at 0.6929. However, break of 0.6650 support will turn bias back to the downside for 0.6563 low again.

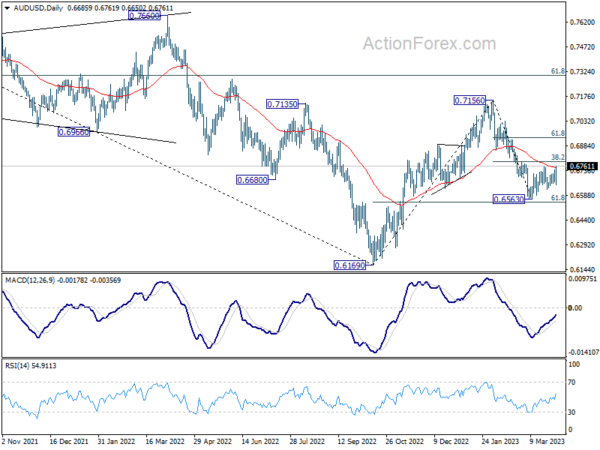

In the bigger picture, as long as 61.8% retracement of 0.6169 to 0.7156 at 0.6546 holds, the decline from 0.7156 is seen as a correction to rally from 0.6169 (2022 low) only. Another rise should still be seen through 0.7156 at a later stage. However, sustained break of 0.6546 will raise the chance of long term down trend resumption through 0.6169 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Tankan Large Manufacturing Outlook Q1 | 3 | 4 | 6 | |

| 23:50 | JPY | Tankan Large Manufacturing Index Q1 | 1 | 3 | 7 | |

| 23:50 | JPY | Tankan Non – Manufacturing Outlook Q1 | 15 | 16 | 11 | |

| 23:50 | JPY | Tankan Non – Manufacturing Index Q1 | 20 | 20 | 19 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q1 | 3.20% | 9.90% | 19.20% | |

| 00:30 | JPY | Manufacturing PMI Mar F | 49.2 | 48.6 | 48.6 | |

| 01:00 | AUD | TD Securities Inflation M/M Mar | 0.30% | 0.40% | ||

| 01:30 | AUD | Building Permits M/M Feb | 4.00% | 10.20% | -27.60% | -27.10% |

| 01:45 | CNY | Caixin Manufacturing PMI Mar | 50 | 51.7 | 51.6 | |

| 06:30 | CHF | CPI M/M Mar | 0.20% | 0.40% | 0.70% | |

| 06:30 | CHF | CPI Y/Y Mar | 2.90% | 3.20% | 3.40% | |

| 07:30 | CHF | SVME PMI Mar | 47 | 48.9 | 48.9 | |

| 07:45 | EUR | Italy Manufacturing PMI Mar | 51.1 | 51 | 52 | |

| 07:50 | EUR | France Manufacturing PMI Mar F | 47.3 | 47.7 | 47.7 | |

| 07:55 | EUR | Germany Manufacturing PMI Mar F | 44.7 | 44.4 | 44.4 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Mar F | 47.3 | 47.1 | 47.1 | |

| 08:30 | GBP | Manufacturing PMI Mar F | 47.9 | 48 | 48 | |

| 13:30 | CAD | Manufacturing PMI Mar | 52.4 | |||

| 13:45 | USD | Manufacturing PMI Mar F | 49.3 | 49.3 | ||

| 14:00 | USD | ISM Manufacturing PMI Mar | 47.5 | 47.7 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Mar | 50 | 51.3 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Mar | 49.1 | |||

| 14:00 | USD | Construction Spending M/M Feb | 0.00% | -0.10% | ||

| 14:30 | CAD | BoC Business Outlook Survey |