Euro is on the rise today, pulling Sterling and Swiss Franc along with it. Slightly higher-than-expected German inflation data is sparking speculation of a potential upside surprise in Eurozone CPI tomorrow. This development, coupled with recent hawkish rhetoric from ECB officials, suggests further tightening are on the horizon, provided banking troubles don’t resurface.

Dollar and Yen are experiencing a broad sell-off. Although US benchmark treasury yields are rising amid stabilizing sentiment, they are clearly outpaced by their German and British counterparts. Commodity currencies are not seeing significant gains, despite overall sentiment, as BoC has already paused and both RBA and RBNZ are nearing a pause.

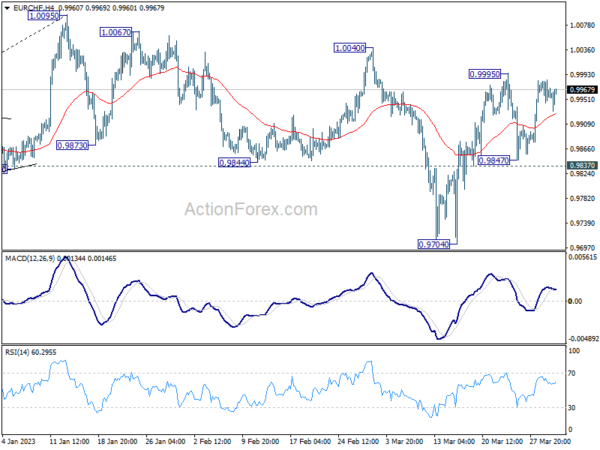

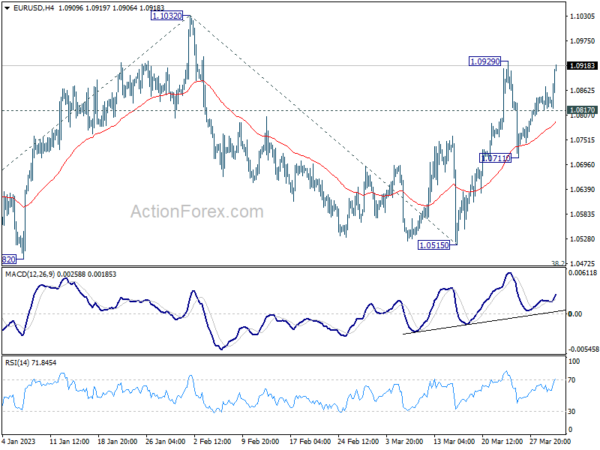

From a technical perspective, as Euro leads Sterling and Franc, focus is on 0.9995 resistance in EUR/CHF and 0.8864 resistance in EUR/GBP. Breaking these two levels will further strengthen EUR/USD’s momentum through 1.0929 resistance towards 1.1032 high and increase the likelihood of breaking through this level to resume the larger uptrend.

In Europe, at the time of writing, FTSE is up 0.72%. DAX is up 0.93%. CAC is up 0.99%. Germany 10-year yield is up 0.047 at 2.374. UK 10-year gilt yield is up 0.047 at 3.518. Earlier in Asia, Nikkei dropped -0.36%. Hong Kong HSI rose 0.58%. China Shanghai SSE rose 0.65%. Singapore Strait Times dropped -0.16%. Japan 10-year JBG yield rose 0.0191 to 0.326.

US initial jobless claims rose to 198k, above expectations

US initial jobless claims rose 7k to 198k in the week ending March 25 above expectation of 195k. Four-week moving average of initial claims rose 2k to 198k. Continuing claims rose 4k to 1689k in the week ending March 18. Four-week moving average of continuing claims rose 10k to 1692k.

Also released, Q4 GDP growth was finalized at 2.6% while price index was finalized at 3.9%.

Swiss KOF dipped to 98.2, negative signals from manufacturing, services and construction

Swiss KOF Economic Barometer dropped slightly from 98.9 to 98.2 in March, below expectation of 100.5, staying below average value of 100.

According to KOF, the dip in the overall barometer reading is mainly due to negative signals emerging from the manufacturing, services, and construction sectors. However, these negative developments are partially offset by the positive performance of the Swiss exports indicator bundle. Meanwhile, other indicators incorporated in the barometer exhibit minimal changes.

NZ ANZ business confidence dipped to -43.4, slowdown aligns with RBNZ’s intentions

New Zealand ANZ Business Confidence index in March experienced a slight dip, moving from -43.3 to -43.4, while the Own Activity Outlook improved marginally, rising from -9.2 to -8.5. However, export intentions, investment intentions, employment intentions, and pricing intentions all experienced declines. Cost expectations also fell from 88.3 to 86.4, but profit expectations rose from -37.7 to -33.9. Inflation expectations dropped from 5.94 to 5.82. According to ANZ, firms are cautious but persevering, with indicators suggesting a soft landing.

Although the activity indicators are subdued, the labor market tightness is gradually shifting, and inflation and cost indicators are easing slowly. Nevertheless, the challenging environment is putting pressure on expected profitability as firms navigate high cost inflation and uncertain future demand. ANZ noted that the winter season might reveal more challenges as tourist numbers decline, but for now, the slowdown appears to align with RBNZ’s intentions.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0818; (P) 1.0845; (R1) 1.0872; More…

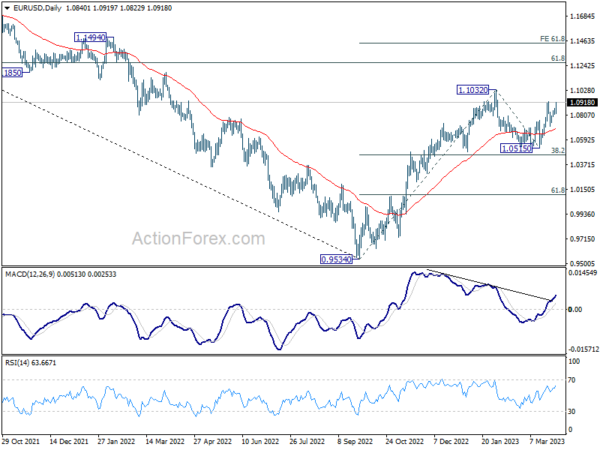

Immediately focus is now on 1.0929 resistance in EUR/USD. Break there will resume the rally from 1.0515 to retest 1.1032 high. Decisive break there will resume larger up trend from 0.9534 to 1.1273 fibonacci level next. On the downside, though, break of 1.0711 will turn bias to the downside to extend the corrective pattern from 1.1032 with another decline.

In the bigger picture, rise from 0.9534 (2022 low) is in progress with 38.2% retracement of 0.9534 to 1.1032 at 1.0460 intact. The strong support from 55 week EMA (now at 1.0623) was also a medium term bullish sign. Next target is 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273. Sustained break there will solidity the case of bullish trend reversal and target 1.2348 resistance next (2021 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:00 | NZD | ANZ Business Confidence Mar | -43.4 | -43.3 | ||

| 07:00 | CHF | KOF Leading Indicator Mar | 98.2 | 100.5 | 98.9 | |

| 08:00 | EUR | Italy Unemployment Feb | 8.00% | 8.00% | 7.90% | 8.00% |

| 08:00 | EUR | ECB Economic Bulletin | ||||

| 09:00 | EUR | Eurozone Economic Sentiment Mar | 99.3 | 99.7 | 99.7 | |

| 09:00 | EUR | Eurozone Industrial Confidence Mar | -0.2 | 0.9 | 0.5 | 0.4 |

| 09:00 | EUR | Eurozone Services Sentiment Mar | 9.4 | 10.1 | 9.5 | |

| 09:00 | EUR | Eurozone Consumer Confidence Mar F | -19.2 | -19.2 | -19.2 | |

| 12:00 | EUR | Germany CPI M/M Mar P | 0.80% | 0.70% | 0.80% | |

| 12:00 | EUR | Germany CPI Y/Y Mar P | 7.40% | 7.30% | 8.70% | |

| 12:30 | USD | Initial Jobless Claims (Mar 24) | 198K | 195K | 191K | |

| 12:30 | USD | GDP Price Index Q4 F | 3.90% | 3.90% | 3.90% | |

| 12:30 | USD | GDP Annualized Q4 F | 2.60% | 2.70% | 2.70% | |

| 14:30 | USD | Natural Gas Storage | -55B | -72B |