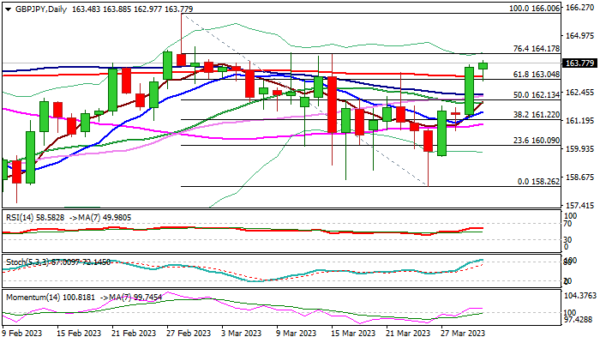

The GBPJPY cross is holding firm bullish tone after Wednesday’s 1.3% rally (the biggest daily gain since Feb 13) as renewed risk appetite on easing bank concerns deflated yen.

Wednesday’s strong bullish acceleration broke through a number of barriers and registered daily close above pivotal 163.04/15 levels (Fibo 61.8% of 166.00/158.26 / 200DMA), generating strong bullish signal.

Early Thursday’s action was a tad slower on thinner markets ahead of month / quarter end, as well as end of Japan’s fiscal year, but bulls so far hold grip and gain traction.

Daily studies turned to full bullish configuration, but stochastic is overbought and 14-d momentum turned sideways, suggesting that bulls may pause for consolidation.

Dips should ideally stay above 200DMA, though deeper pullback cannot be ruled out, with converged 30/100DMA (162.33) expected to contain and keep bullish structure intact.

Bulls eye immediate target at 164.17 (Fibo 76.4% / mid-March tops), break of which would open way towards 166.00 (Feb 28 spike high /2023 top).

Res: 164.17; 164.50; 165.00; 166.00.

Sup: 163.15; 162.97; 162.33; 162.00.