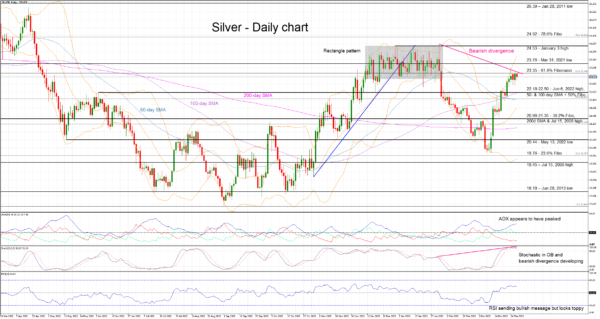

Silver has completed a 2-month round trip. The bears managed to take over the market and push it down to 19.88, only for the bulls to react forcefully during March. And we are back at the lower boundary of the rectangle that defined market action during the December 2022 – February 2023 period. Silver broke with relative ease several resistance points on its way higher, but it is now hovering just below the 23.35 area.

Silver bulls remain hungry, but the technical picture is slightly more complicated at this juncture. The RSI appears to be toppy, and the stochastic oscillator is showing early signs of rally exhaustion. In addition, a bearish divergence has developed as the higher high in the stochastic has been met with a lower high in Silver. If we also add the fact that the Average Directional Movement Index (ADX) appears to be turning lower, then the bears could be prepping to regain control of the market.

Should the bulls remain confident, their initial target could come at the 61.8% Fibonacci retracement of March 8, 2022 – September 1, 2022 downtrend of 23.35, a tad below the March 31, 2021 low of 23.76. Even higher, the January 3 high and upper boundary of the recent rectangle at 24.53 would potentially pose significant resistance.

On the other hand, the bears appear to have a clear path until the 22.18-22.50 range. This area could prove very tricky for the bears as it is defined by the June 6, 2022 high, the 50- and 100-day simple moving averages (SMA) and the 50% Fibonacci retracement respectively. Upon successfully clearing this area, another busy range at 20.96-21.35 is expected to test the bears’ appetite.

To conclude, silver bulls have staged an impressive run since mid-March, but there are increasing signs not favouring them at this juncture.