Dollar, Japanese Yen, and Swiss Franc are under selling pressure this week amid improving risk sentiment. Yen is particularly weighed down by the extended rebound in treasury yields, while Swiss Franc is pressured by sell-offs against Euro and Sterling. Currently, the Canadian Dollar leads the pack for the week, aided by recovering oil prices. Australian Dollar, however, lags behind as CPI data supports the possibility of an RBA pause next week.

With a light economic calendar and second-tier releases featured, the main focus remains on the overall development in risk markets. Concerns over the banking crisis could subside if no additional banks are reported to be in trouble. Attention will shift back to inflation data from the Eurozone and the US later in the week.

Oil prices experienced a surge earlier this week due to supply worries after Turkey halted crude pumping from Iraq’s Kurdistan region via a pipeline. The decision followed an arbitration ruling confirming Baghdad’s consent was necessary to ship the oil. These exports represent approximately 0.5% of global oil supply.

Technically, WTI’s break of the 72.16 support-turned-resistance should confirm short-term bottoming at 64.19, supported by medium-term channel support. Immediate focus is on the 55day EMA (currently at 75.19). A firm break there would trigger a more robust rebound to 80.82 resistance, potentially aiding Canadian Dollar’s recovery.

In Asia, at the time of writing, Nikkei is up 1.00%. Hong Kong HSI is up 2.12%. China Shanghai SSE is down -0.06%. Singapore Strait Times is up 0.18%. Japan 10-year JGB yield is down -0.0184 at 0.296. Overnight, DOW dropped -0.12%. S&P 500 dropped -0.16%. NASDAQ dropped -0.45%. 10-year yield rose 0.036 to 3.564.

Australia CPI slowed to 6.8% yoy, supports RBA pause next week

Australia’s monthly CPI in February eased from 7.4% yoy to 6.8% yoy, below expectation of 7.2% yoy. CPI excluding volatile items such as fruit, vegetables, and automotive fuel also slowed from 7.5% yoy to 6.9% yoy.

Michelle Marquardt, Head of Prices Statistics at the Australian Bureau of Statistics (ABS), noted that “this marks the second consecutive month of lower annual inflation, also known as ‘disinflation’, from the peak of 8.4% in December 2022.”

Although inflation remains well above RBA’s target band of 2-3%, the start of disinflation process could increase the likelihood of a pause in the RBA’s tightening cycle during their next meeting. The continued easing of inflationary pressures may prompt the central bank to take a more cautious approach in the near term.

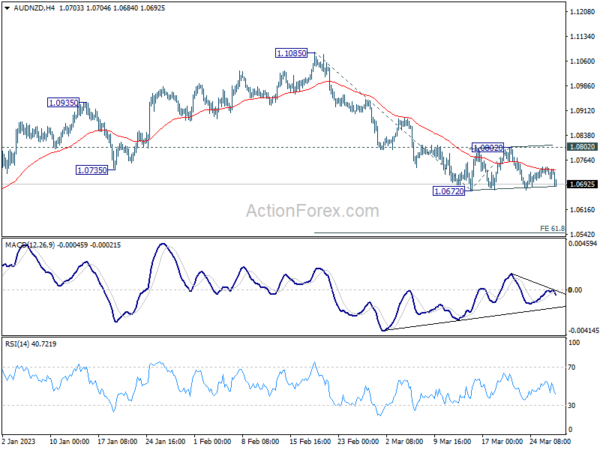

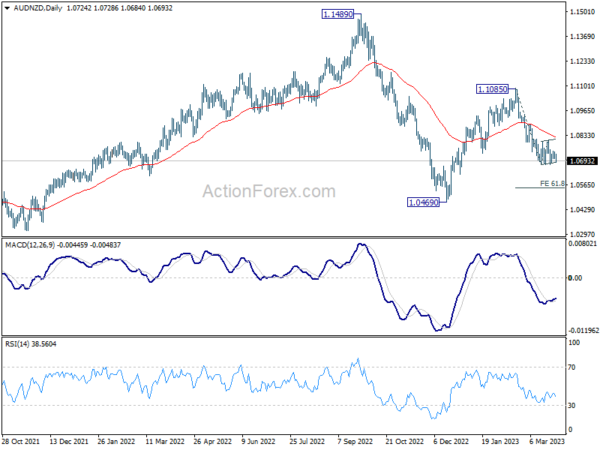

AUD/NZD ready for downside breakout after AU CPI

AUD/NZD is trading slightly lower following the release of Australia’s lower-than-expected monthly CPI data, which bolsters the case for a pause in RBA’s tightening cycle next week. While there are talks of another 25bps RBA rate hike in May, taking rate to 3.85%, it would still be 90bps below RBNZ’s current rate of 4.75%. Furthermore, RBNZ is expected to increase rates by an additional 25bps to 5.00% in April, further widening the gap between the two central banks.

Technically speaking, AUD/NZD’s price movements from 1.0672 appear to be corrective in nature. Rejection by 4 hour 55 EMA suggests that the decline from 1.1085 could resume soon. A break below 1.0672 would confirm the resumption of the fall and target 61.8% projection of 1.1085 to 1.0672 from 1.0802 at 1.0547. In any case, outlook will remain bearish as long as 1.0802 resistance level holds.

Incoming BoJ Deputy Governor Uchida Stresses Importance of Trend Inflation in Monetary Policy

Incoming BoJ Deputy Governor Shinichi Uchida emphasized the significance of trend inflation in a parliamentary session today, stating that the central bank will conduct a comprehensive assessment of various data, including trend inflation developments, to guide monetary policy.

Uchida said that “trend inflation is an extremely important factor for us in judging on achievement of 2% inflation target in a stable manner.” He also mentioned that the BoJ will “make comprehensive judgment by looking at various price indicators.”

In addition, Uchida highlighted the importance of communication between the central bank and the markets, saying, “We will strive to communicate firmly with markets to gain understanding” regarding the BoJ’s policy approach. This statement underscores the commitment of the BoJ to transparency and open dialogue in shaping its monetary policy.

Looking ahead

Germany Gfk consumer sentiment, Swiss Credit Suisse economic expectations, UK mortgage approvals and M4 money supply will be released in European session. Later in the day, US will publish pending home sales.

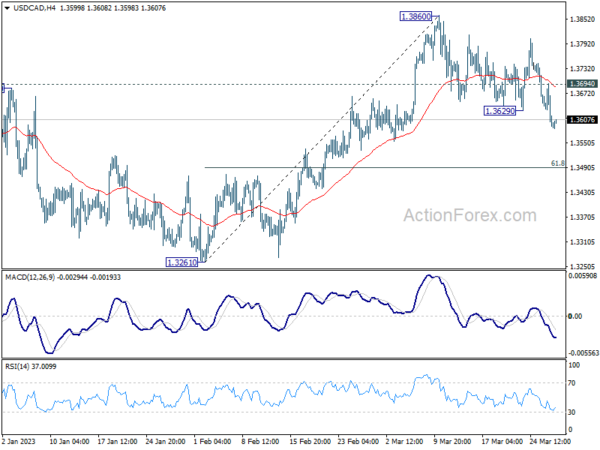

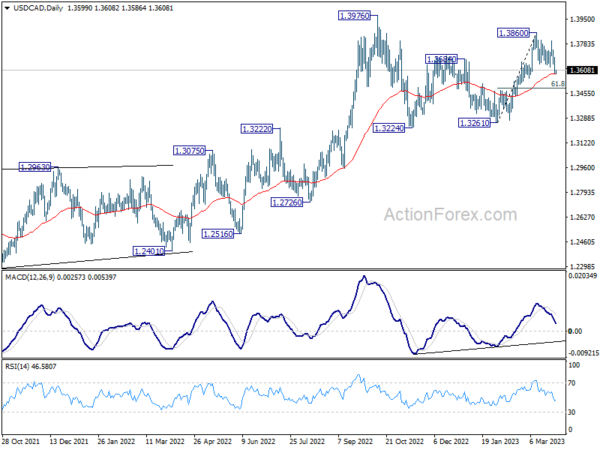

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3562; (P) 1.3628; (R1) 1.3665; More….

USD/CAD’s break of 1.3629 support indicates that deeper pull back in underway. Intraday bias is back and break of 55 day EMA (now at 1.3586) will target 61.8% retracement of 1.3261 to 1.3860 at 1.3490. On the upside, above 1.3694 minor resistance will turn intraday bias neutral first. Overall, the corrective pattern from 1.3976 could be extending with another falling leg from 1.3860.

In the bigger picture, the up trend from 1.2005 (2021 low) is still in progress. Break of 1.3976 will confirm resumption and target 61.8% projection of 1.2401 to 1.3976 from 1.3261 at 1.4234. Firm break there will pave the way to long term resistance zone at 1.4667/89 (2016, 2020 highs). On the downside, break of 1.3261 support is needed to confirm medium term topping. Otherwise, outlook will remain bullish even in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Monthly CPI Y/Y Feb | 6.80% | 7.20% | 7.40% | |

| 06:00 | EUR | Germany Gfk Consumer Confidence Apr | -29 | -30.5 | ||

| 08:00 | CHF | Credit Suisse Economic Expectations Mar | -12.3 | |||

| 08:30 | GBP | Mortgage Approvals Feb | 42K | 40K | ||

| 08:30 | GBP | M4 Money Supply M/M Feb | 0.90% | 1.30% | ||

| 13:00 | CHF | SNB Quarterly Bulletin | ||||

| 14:00 | USD | Pending Home Sales M/M Feb | -2.20% | 8.10% | ||

| 14:30 | USD | Crude Oil Inventories | 1.8M | 1.1M |