The forex markets have been relatively quiet during today’s Asian session, with currency pairs staying within Friday’s range. Major stock indexes are also demonstrating mixed performance in a tight range. Inflation data from the Eurozone and the US will be closely monitored this week. Although these figures are crucial in determining the future rate path, reactions to this week’s data may be somewhat subdued, given that both ECB and Fed meetings will not reconvene until May.

Ongoing developments in the banking crisis will continue to be a significant driving factor for all financial markets. As for currencies, Yen has emerged as the biggest winner for the month, seemingly bolstered by risk aversion and falling benchmark treasury yields in other markets. European majors follow closely behind, despite banking sector troubles. Commodity currencies and Dollar have been the weakest performers. It remains to be seen whether Yen could experience further gains before the month’s end and which currencies will be most affected.

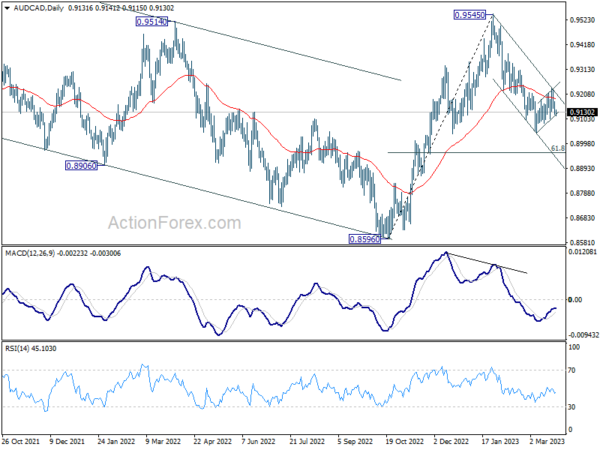

From a technical perspective, AUD/CAD is a currency pair to watch this week. The corrective recovery from 0.9043 may have reached its peak at 0.9229, after failing to break through channel resistance and 55 day EMA decisively. A break below 0.9102 minor support level could signal that decline from 0.9545 is resuming through 0.9043. In this scenario, next target would be 61.8% retracement of 0.8596 to 0.9545 at 0.8959.

Fed’s Kashkari warns of recession risks amid banking sector stress

Fed President Neel Kashkari expressed concerns in a recent CBS “Face the Nation” interview about the recent stress in the banking sector, warning that it could lead to a widespread credit crunch and ultimately push the US into a recession. Kashkari stated, “What’s unclear for us is how much of these banking stresses are leading to a widespread credit crunch. Would that slow down the economy? This is something that we’re monitoring very, very closely.”

He acknowledged that the situation is still relatively new, saying, “Right now, the stresses are only a couple of weeks old.” However, Kashkari pointed out some positive signs, such as a slowdown in deposit outflows and a restoration of confidence among smaller and regional banks. He noted, “There are some concerning signs. The positive sign is deposit outflows seem to have slowed down. Some confidence is being restored among smaller and regional banks.”

Despite these positive developments, Kashkari emphasized the potential risks if capital markets remain closed due to nervous borrowers and lenders, stating, “If those capital markets remain closed because borrowers and lenders remain nervous, then that would tell me, okay, this is probably going to have a bigger impact on the economy.”

ECB’s de Guindos on rate hikes: Data-Dependent and cautious amid banking sector uncertainty

ECB Vice President Luis de Guindos recently shared his thoughts on the central bank’s approach to future rate hikes, emphasizing a data-dependent and cautious stance in light of the uncertainties arising from the financial sector problems in the US and Switzerland.

In an interview, de Guindos stated, “We raised rates by 50 basis points in March and we are open-minded with respect to the future… We are not pre-committing to any action.”

The impact of the US banking system and Credit Suisse events on the Eurozone economy is a pressing concern for the ECB. Over the coming weeks and months, de Guindos noted that the central bank would need to evaluate whether these events would lead to tighter financing conditions.

The ECB Vice President acknowledged that such events increase uncertainty and may result in tighter credit standards in the Eurozone, potentially affecting the economy with lower growth and inflation. However, de Guindos explained that it is too early to determine the intensity of this factor.

Regarding the ECB’s inflation target, de Guindos emphasized the importance of a timely return to 2% inflation within the two-year projection horizon and highlighted the crucial role of core inflation in achieving this goal.

He stated, “Headline inflation will decline quite rapidly over the next six to seven months as the base effects play in favor of a rapid reduction in inflation… What we want to see is a steady and clear convergence towards the 2% target. In that respect, core inflation is going to be key. It is very difficult to converge towards the 2% target in a sustainable way without a clear decline in core inflation.”

Inflation Data Takes Center Stage as Central Banks Weigh Next Policy Decisions

As we head into a week highlighted by inflation data, central banks are gearing up to navigate their policy decisions based on the numbers. Australia’s monthly CPI, Eurozone’s CPI flash, and US PCE inflation will be under close scrutiny as monetary authorities assess their next moves.

RBA has suggested the possibility of hitting the pause button in May, but the final call will largely rest on how inflation unfolds. On the other hand, ECB is expected to proceed with tightening in May, but the ultimate peak interest rate will be influenced by the pace at which inflation decelerates.

Market participants consider Fed current 4.75-5.00% interest rate as the peak already, contrasting with Fed’s own projection of 5.1%. Once again, inflation trends will be the deciding factor here.

Besides inflation, other significant economic indicators to watch this week include US consumer confidence, Japan’s industrial production and retail sales, Canada’s GDP, Australia’s retail sales, and New Zealand’s ANZ business confidence.

Here are some highlights for the week:

- Monday: Japan corporate service price index; Germany Ifo business climate: Eurozone M3 money supply.

- Tuesday: Australia retail sales; US goods trade balance, house price index; consumer confidence.

- Wednesday: Australia CPI; Germany Gfk consumer climate; Swiss Credit Suisse economic expectations; UK mortgage approvals, M4 money supply; US pending home sales.

- Thursday: New Zealand building permits, ANZ business confidence; Germany CPI flash; ECB monthly bulletin;US Q4 GDP final, jobless claims.

- Friday: Japan Tokyo CPI, industrial production, retail sales, housing starts; China PMIs; Germany import prices, retail sales; UK Q4 GDP final, current account; Swiss retail sales, KOF economic barometer; France consumer spending; Germany unemployment; Eurozone CPI, unemployment rate; Canada GDP; US personal income and spending with PCE inflation, Chicago PMI.

USD/JPY Daily Outlook

Daily Pivots: (S1) 129.93; (P) 130.43; (R1) 131.23; More…

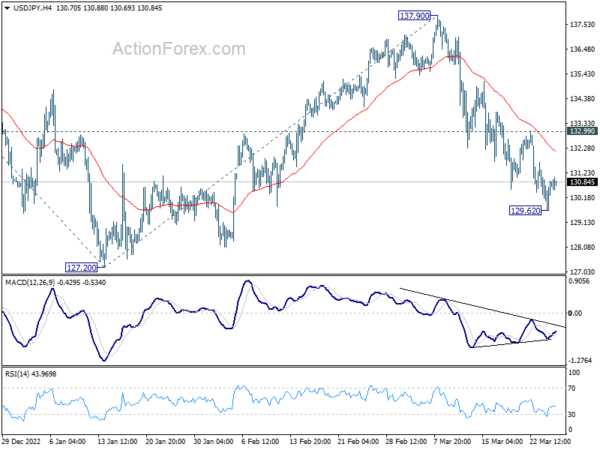

Intraday bias in USD/JPY is turned neutral with as fall from 137.90 lost momentum after hitting 129.62. Some consolidations could be seen first. But outlook stays bearish as long as 132.99 resistance holds. Break of 129.62 will target a test on 127.20 low. Decisive break there will resume larger decline from 151.93 to 61.8% projection of 151.93 to 127.20 from 137.90 at 122.61.

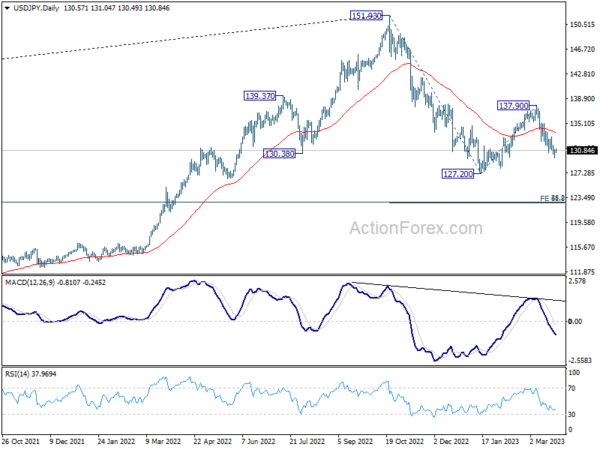

In the bigger picture, rebound from 127.20 should have completed at 137.90 as a corrective move. The down trend from 151.93 (2022 high) is still in progress. Break of 127.20 will resume this down trend and target 61.8% projection of 151.93 to 127.20 from 137.90 at 122.61. This will now be the favored case as long as 137.90 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Feb | 1.80% | 1.80% | 1.60% | |

| 08:00 | EUR | Germany IFO Business Climate Mar | 92 | 91.1 | ||

| 08:00 | EUR | Germany IFO Current Assessment Mar | 94 | 93.9 | ||

| 08:00 | EUR | Germany IFO Expectations Mar | 87.4 | 88.5 | ||

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Feb | 3.30% | 3.50% |