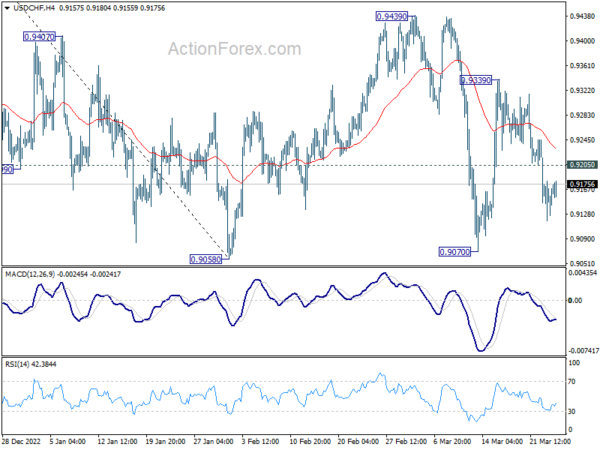

Daily Pivots: (S1) 0.9129; (P) 0.9156; (R1) 0.9192; More…

USD/CHF’s fall from 0.9339 should still be in progress and intraday bias stays on the downside for retesting 0.9058 low. Decisive break there will resume larger down trend from 1.1046. On the upside, above 0.9205 support turned resistance will turn intraday bias neutral again. Overall outlook will stay bearish as long as 0.9474 fibonacci level holds.

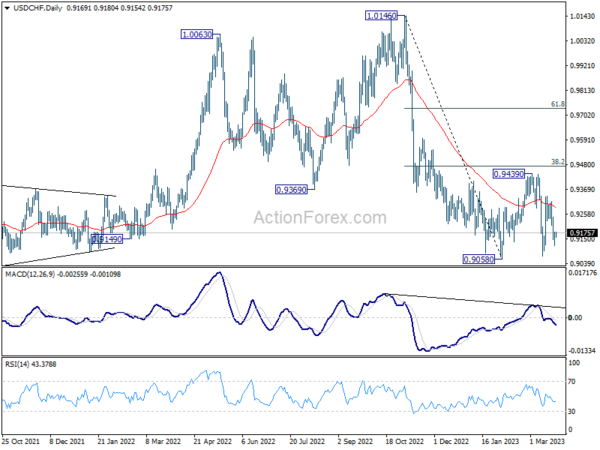

In the bigger picture, fall from 1.1046 (2022 high) should still be in progress with 38.2% retracement of 1.0146 to 0.9058 at 0.9474 intact. Prior rejection by 55 week EMA was a medium term bearish sign. Break of 0.9058 will resume such decline towards 0.8756 support (2021 low). But overall, such fall is still as a leg in the long term range pattern from 1.0342 (2016 high). So, downside should be contained by 0.8756 to bring reversal.