Today, Canada’s consumer inflation data takes center stage as markets anticipate a slowdown in headline inflation from 5.9% yoy to 5.4% yoy in February. If this decrease materializes, it would mark the lowest inflation reading in over a year. BoC’s preferred core inflation metrics, the trimmed and median CPI, are also projected to decelerate from 5.1% yoy to 4.8% yoy and from 5.0% yoy to 4.8% yoy, respectively.

BoC became the first major central bank to pause its tightening cycle last Wednesday, following eight consecutive rate hikes totaling 425 basis points. Market participants are still expecting one more rate increase this year, but these odds could dwindle if inflation continues to decline.

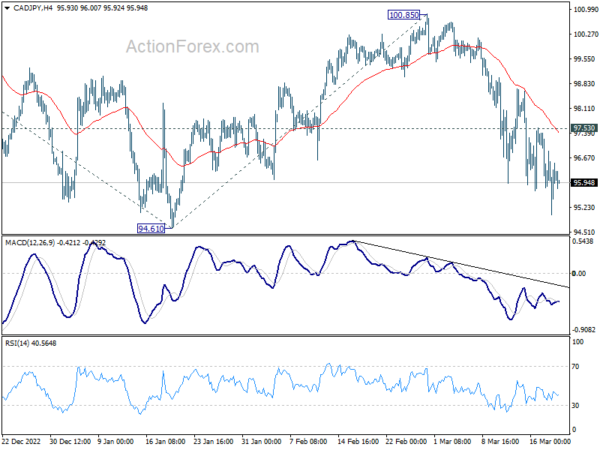

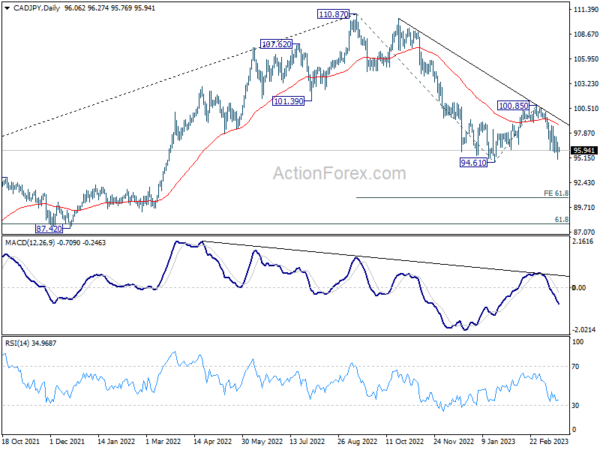

CAD/JPY is closely watching the 94.61 support level after a recent drop. A decisive break below this threshold would rekindle the broader downtrend from the 110.87 high and aim for a 61.8% projection of 110.87 to 94.61 from 100.85 at 90.80. However, if the cross breaks above 97.53 resistance, it could delay the bearish scenario and extend the corrective pattern from 94.61 with another upswing.