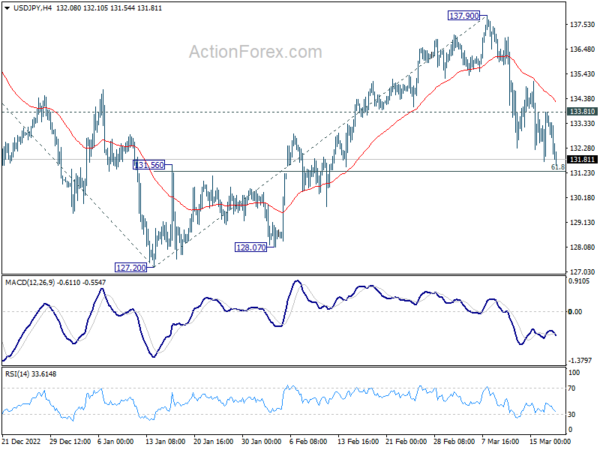

USD/JPY’s decline from 137.90 extended last week even though downside momentum diminished slightly. Further fall is expected this week as long as 133.81 minor resistance holds. Firm break of 61.8% retracement of 127.20 to 137.90 at 131.28 will pave the way to retest 127.20 low. Nevertheless, break of 133.81 will turn intraday bias neutral first.

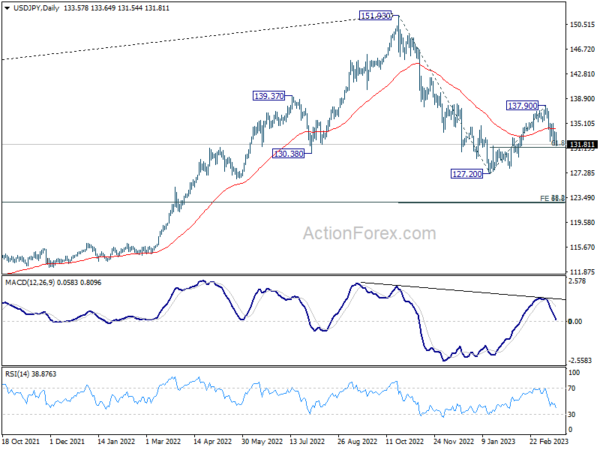

In the bigger picture, rebound from 127.20 should have completed at 137.90 as a corrective move, with strong break of 55 day EMA. The down trend from 151.93 (2022 high) is not over yet. Break of 127.20 will resume this down trend and target 61.8% projection of 151.93 to 127.20 from 137.90 at 122.61. This will now be the favored case as long as 137.90 resistance holds.

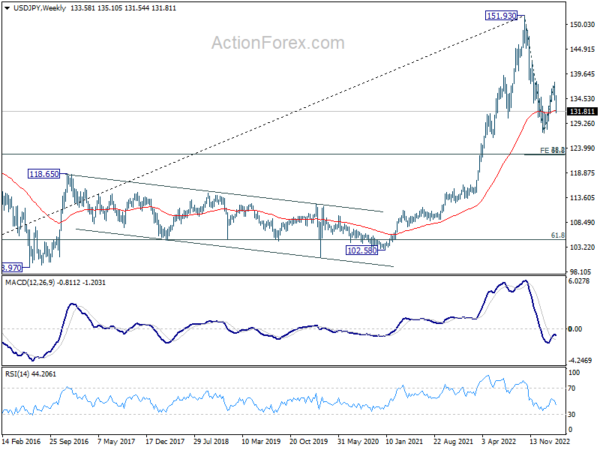

In the long term picture, price action from 151.93 is seen as developing into a corrective pattern to up trend from 75.56 (2011 low). While deeper decline cannot be ruled out, downside should be contained by 38.2% retracement of 75.56 to 151.93 at 122.75.