U.S. Highlights

- Following the collapse of SVB and Signature Bank, policymakers were quick to put together a rescue package over the weekend to allay depositor fears and reassure financial markets.

- Despite recent market jitters, economic data out this week including CPI, retail sales, and housing starts all suggest more tightening is still required to cool demand and return price stability.

Canadian Highlights

- The effects of US bank collapses have spilled over into Canadian markets. Canadian banks, however, are better insulated to protect against similar events.

- The Bank of Canada is likely looking through the turmoil and instead focusing on incoming data. Interest rate hikes are working their way to household budgets and the Canadian housing market is showing signs of reaching its bottom.

Financial Highlights

- A classic run on banks rippled through the financial system, but the regional banks’ equity underperformance reflects the idiosyncratic nature of this episode.

- Risk sentiment tightens financial conditions and feeds through to the real economy if it remains unresolved for a period of time. At this early juncture, it may not deter the Fed from raising interest rates on March 22nd, but can certainly put the May meeting on ice if pressures persist.

U.S. – Lifelines Extended, But Uncertainty Remains

Can policymaker’s walk while chewing gum? We’ll soon find out. The Federal Reserve’s attempt at reining in multidecade inflation without causing a recession was always thought to be a lofty goal. However, last week’s failure of both SVB and Signature Bank followed by the subsequent deposit run at First Republic has added a new layer of complexity.

In an effort to allay depositor fears and reassure financial markets, the FDIC, Federal Reserve, and U.S. Treasury implemented a rescue plan over the weekend. Deposit insurance for all deposits over $250k was extended, while a Bank Term Funding Program was also established, allowing all depository institutions to borrow at the Fed at a low rate using standard collateral. Moreover, the collateral could be valued at par rather than “marked to market” as is the case with other Fed liquidity facilities. Not only will this increase the amount of capital that troubled banks can access, but it will also prevent institutions from having to sell assets at significant losses, which should help to shore up confidence and stem the tide on further deposit outflows.

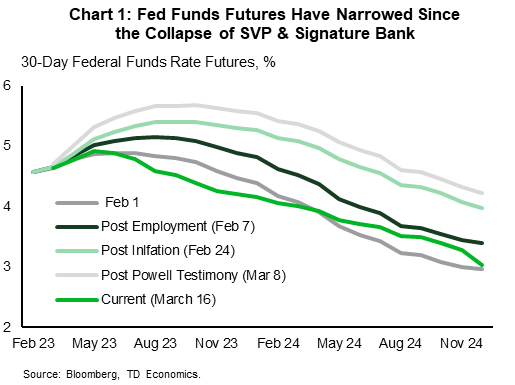

While sound in theory, investors remained skeptical that the risk remained contained to just a handful of regional banks. And this skepticism was only reinforced when news came that Credit Suisse may also be experiencing similar liquidity issues. Market sentiment soured mid-week but was quick to recover following news that First Republic had secured a rescue package and that the Swiss Central Bank would provide a liquidity backstop for Credit Suisse. After a volatile week, the S&P 500 finished 2% higher, while the 10-year yield fell 25bps landing at 3.45%. Investors also significantly recalibrated expectations on the future path of the fed funds rate, with a 25bps hike at next week’s announcement only 75% priced and rate cuts again priced for later this year (Chart 1).

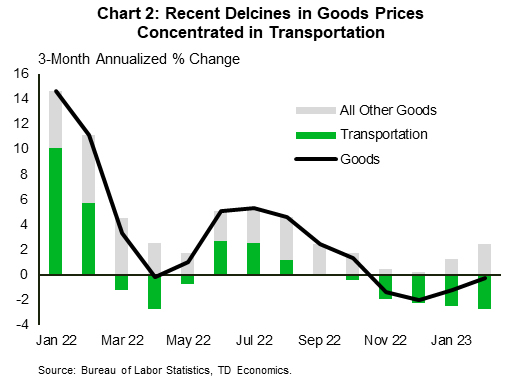

Only time will tell if this sharp repricing is overdone, but at the moment, the Fed appears stuck between a rock and a hard place. It is clear that the rapid adjustment in interest rates over the past year has pinched a nerve within a sub-segment of the banking sector. But on the other hand, the recent flow of economic data suggests more tightening is still required to cool the economy and return price stability. This was evident in February’s reading of CPI, where core inflation accelerated on the month – rising by 0.5% m/m – pushing the 3-month annualized change to a four-month high of 5.2%. Considerable breadth was seen across the cyclical component of services, which is closely tied to discretionary spending. And while goods prices were flat on the month, that was largely due to another sizeable decline in used vehicle prices, offsetting an acceleration across most other goods categories (Chart 2). Outside of inflation, retail sales (-0.4% m/m) softened in February but that was only after an outsized gain in January, while housing starts ended a 5-month slide and surged 10% m/m to 1.45M. The data is definitely telling the FOMC to hike, but the financial stability concerns also cannot be ignored. Provided risks remain contained, we expect the Fed to push ahead with another 25bps hike next week.

Canada – Seeing Past the Noise

Canada – Seeing Past the Noise

This week served up an important reminder that fragilities in the global financial system exist. The crisis-like banking events that transpired in the U.S. and Europe over the past week sent shockwaves through global markets. Spillover to Canadian markets sent yields across curve tumbling, with 2-and 10-year yields sliding by as much as 70 bps and 50 bps, respectively, over the week. At the time of writing, the TSX is down ~3% and the Canadian dollar is up 5-tenths of a cent to 0.727 on the back of broad USD weakening across most major currencies.

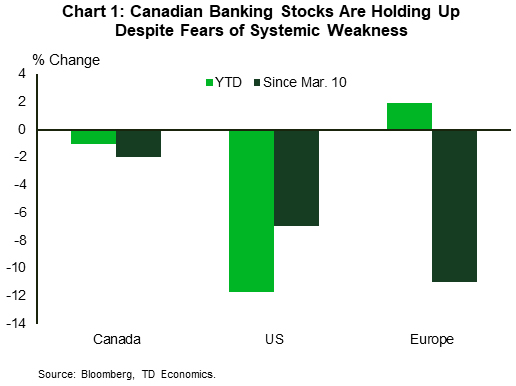

Should Canadians worry about similar events occurring on home soil? The short answer is no. Knee-jerk reactions by Canadians are understandable, but the likelihood of a Canadian bank failure is exceptionally low. The plumbing of the Canadian system is fundamentally different than that of the U.S., with a highly concentrated subset of large banks carrying more systematic importance. Further, Canada’s banks are subject to rigorous liquidity standards, have more robust capital ratios, are diversified across industries and business lines, and are more diligently regulated. All said, Canadian banks are positioned more favourably to withstand mounting pressures in the sector. Case in point, (Chart 1) illustrates how Canadian bank stocks have been less affected than those in the U.S. and Europe since the initial news of the SVB collapse on March 10.

The Bank of Canada (BoC) appears to be sitting in a more comfortable position and likely isn’t as pressured as other major central banks to alter course in the wake of current events. We expect the BoC to look through the turbulence and remain in a wait and see mode, holding the policy rate at 4.50% through the remainder of the year.

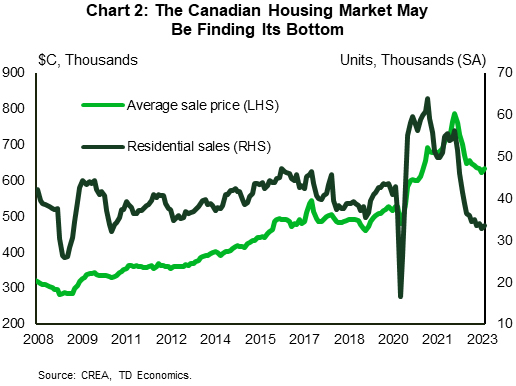

Household balance sheet data for Q4-2022 revealed that elevated interest rates are slowly working their way to the resilient Canadian consumer, as debt servicing costs have been pushed upward and debt repayments slowed. The BoC would still like to see further evidence of this passthrough helping to further cool the domestic impulse to still-elevated inflation. Higher interest rates have had more pronounced effects in the Canadian housing market. Existing home sales for the month of February increased by 2.3% month-on-month (m/m), which puts sales growth effectively flat on a 3-month moving average basis. The overall level of home sales is still depressed, having retraced by 40% compared to 2022 peak sales, but the recent data suggest a bottom may be forming (Chart 2). Average home prices advanced 1.7% m/m in February, while the MLS home price index that accounts for composition in home prices, slipped by 1.1% m/m.

Next week’s highlight is the February CPI release where we expect a further cooling in headline and core inflation measures. Also on tap, retail sales for January are tracking another gain, following strong consumer spending in December. Lastly, the BoC will release its Summary of Deliberations from their March 8th policy meeting.

Financial – Some Banks Fail, but It’s Not a Free Fall

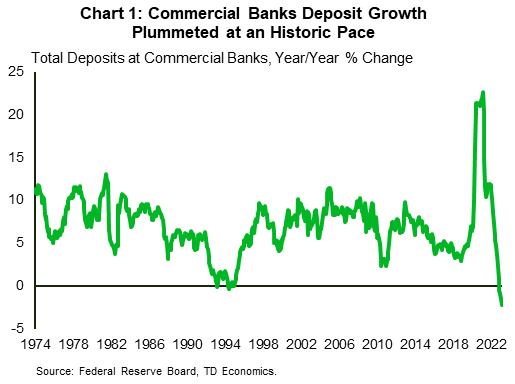

The Federal Reserve was blind sighted by an evolving risk that was right under its nose. While it tightened monetary policy at an unprecedented pace, deposit growth within commercial banks plummeted at an historic pace (Chart 1). Some of this movement reflected the outcome of quantitative tightening and some reflected a shift in depositor preferences into higher yielding products. Predicting this shift was actually well within forecast models, offering little element of surprise. Predicting individual behaviors and market confidence, however, is another story.

Unless you’ve been completely cut off from every form of communication, by now it’s well known that the sudden failure of Silicon Valley Bank was more than a classic “run on a bank”. The aggressive rate hike cycle pressured the market value of the bank’s financial assets, even though these were deemed high quality and liquid. Meanwhile, a concentration of a large amount of uninsured deposits from start-up companies left the bank exposed to a sudden shift in confidence. Once the financial market participants witnessed a mass deposit exit and a swift bank failure, it opened the door to lurking risks within other institutions. The fear of the known unknown kicked in.

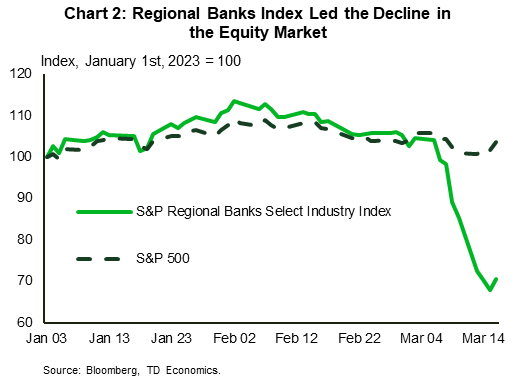

However, that fear has largely been contained, at least at this juncture. The pressure on equity markets was not economy wide. A concentration within the banking sector was further narrowed to the regional banks’ sub-sector. In the period between March 8th and March 15th, the S&P’s Regional Banks Sub-Industry Index lost more than 30% of its value while the S&P 500 index declined by 2.5%, half of which was due to the pressure on the banking sector (Chart 2). While large, the magnitude of change is not unprecedented. During the Global Financial Crisis – the poster child of the banking sector crisis – the index lost almost 80% of its value (albeit, in a period of six months), while its maximum daily loss was 1.5 times greater than the current episode.

The relative containment of the crisis doesn’t negate the seriousness of the situation. Look no further than within expectations for the fed funds rate. In a matter of ten days, the futures market turned upside down, shifting its pricing from a 50-basis point hike in March and a 5.75% terminal rate, to 25-basis point hike and a terminal rate 85 basis points lower. On March 13th, the two-year yield collapsed by 57 basis points to 4.03% – the largest decline since the Black Monday market crash of 1987. This initially pushed the U.S. dollar down 2% relative to other currencies. But, the greenback reclaimed its strength as a safe-haven currency as soon as the confidence shock drifted over the Atlantic. As the biggest shareholder of Credit Suisse declared no interest in upping its funding commitment to the already-beleaguered institution, the greenback finished 1.5% below March 8th level.

In both cases, the respective regulators and the central bank stepped in to provide a liquidity backstop, having learned from the past that the first order of business is to stabilize financial market shocks that have the potential to seize up the system if left unchecked. The second order of business will be to ensure guard rails are in place to limit a future episode. This usually comes in the form of more oversight. Market chatter has already settled on one possible change for U.S. mid-and-small sized banks to lower the banks’ asset threshold at which stricter capital and liquidity rules start to apply from $250 to $100 billion. Another proposal being bantered about is to put more rigor into the stress test that assesses valuation of banks capital during a hypothetical macroeconomic recession scenario.

From an economic perspective, any permanency in tighter financial conditions among mid- and smaller-sized banks that flows through to tighter credit standards will impact loan demand and the real economy. The irony is that this feedback loop might help the Fed tap down domestic demand and contain inflationary pressures, as long as pressure on financial conditions remain ‘controlled’. Up until now, the U.S. economy was described as stronger-for-longer, with consumers and job demand completely defying the odds. Time will tell.