- With market sentiment stabilizing, underlying inflation still elevated & systemic crisis risks now seemingly contained, we think Fed will continue hiking next week.

- Even if a broader crisis is averted, the tightening credit standards in regional US banks could weigh on economic growth, and inflation expectations.

- We still expect a 25bp hike next week and a terminal rate of 5.00-5.25% by May.

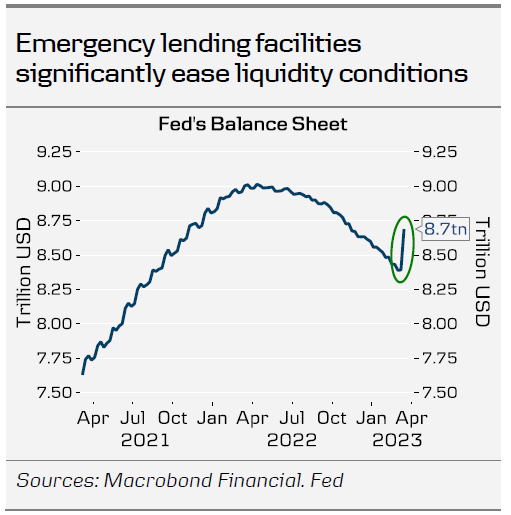

This week, the ECB emphasized that there is no trade-off between inflation and financial stability risks, and we expect Fed to deliver a similar message next week. The new Bank Term Funding Program, allowing banks to tap liquidity from the Fed against collateral valued at par, provided banks with USD11.9 billion during its first three days of use.

Fed’s more traditional ’emergency lending facility’, the discount window, was tapped for 152.9bn (up from 4.6bn the week before), while Fed funded the bridge-banks for SVB and Signature bank by around 142.8bn. The discount window values collateral at market value, but accepts a wider range of collateral compared to the BTFP. All together, Fed’s balance sheet grew by 298bn, reversing the impact of past four months of QT. The fact that banks are tapping the emergency lending facilities is not worrying on its own. Rather, it seems some of the negative stigma related to using the facilities appears to have faded with the volatility. Hence, we also think calls for Fed to end QT and/or restart QE are misplaced.

Fed cannot afford to stop tightening monetary policy and by no means start easing given that underlying price pressures remain sticky, or even accelerate, as we highlighted in Global Inflation Watch – Central banks balance inflation and financial stability risks, 15 March. For now, it seems the emergency measures have managed to stabilize the acute contagion risks, but as ECB demonstrated, they open up the door for further rate hikes even amid the ongoing uncertainty. The extent further tightening will be needed depends on how the banking crisis affects the macroeconomic outlook.

While the small regional banks are not as large systemic threats as say, Credit Suisse is, they do still account for a significant share of lending in the US. Thus, as uncertainty remains high, tighter credit standards could weigh on lending growth and the economy.

Reflecting the downside risks, oil prices have fallen and short-term market-based inflation expectations have declined by ~75bp. If a similar move is seen in consumers’ expectations as well, Fed could turn towards cutting nominal rates earlier. But if growth, and consequently inflation turn out more resilient, recovering market sentiment could quickly bring rate hikes back to the table. For now we do not expect rate cuts before next year.

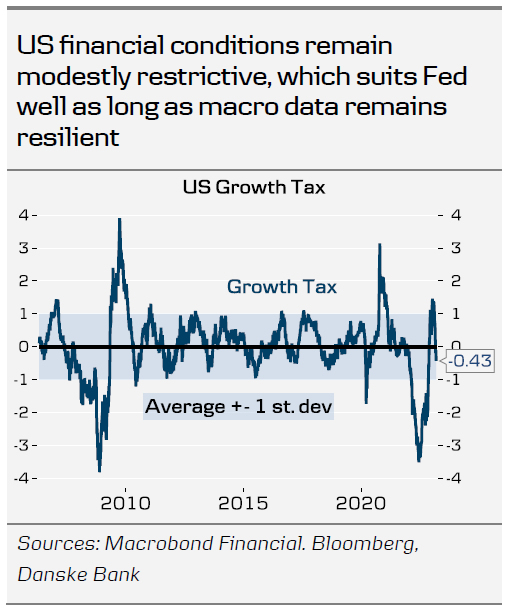

So far, short-term real rates and broader financial conditions have remained relatively stable. Our in-house ‘growth tax’ measure is at modestly restrictive territory, as the tightening in credit and equity components has compensated for the lower yields and mortgage rates. This suits Fed well as long as macro data remains strong, and for the time being, we like our call of a 25bp rate hike next week and a terminal rate at 5.00-5.25% in May. Hence, we see modest upside risks to short-term rates from current levels