Market sentiment seems to have taken another hit as Silicon Valley Bank filed for Chapter 11 bankruptcy today. Bank shares in the US are in sharp decline, dragging down the broader market. Yen surges again, bolstered by falling treasury yields too. Dollar, Euro, and Swiss Franc emerged as the weakest performers for the day, with renewed weakness also appearing in commodity currencies. It appears that the markets are not quite ready to settle down as we approach the final trading session of the week.

In Europe, at the time of writing, FTSE is down -0.70%. DAX is down -0.90%. CAC is down -1.05%. Germany 10-year yield is down -0.1279 at 2.161. Earlier in Asia, Nikkei rose 1.20%. Hong Kong HSI rose 1.64%. China Shanghai SSE rose 0.73%. Singapore Strait Times rose 0.88%. Japan 10-year JGB yield dropped -0.0240 o 0.273.

Eurozone CPI finalized at 8.5% yoy, core CPI at 5.6% yoy

In February, Eurozone CPI was finalized at 8.5% yoy, a marginal drop from January’s 8.6% yoy. Meanwhile, core CPI, which excludes volatile components like energy, food, alcohol, and tobacco, was finalized at 5.6% yoy, up from the previous month’s 5.3% yoy. The primary drivers of the annual Eurozone inflation rate were food, alcohol, and tobacco, contributing 3.10%, followed by services at 2.02%, non-energy industrial goods with 1.74%, and energy at 1.64%.

EU’s overall CPI for February was finalized at 9.9% yoy, slightly lower than January’s 10.0% yoy. Among member states, Luxembourg, Belgium, and Spain registered the lowest annual rates at 4.8%, 5.4%, and 6.0%, respectively. In contrast, Hungary, Latvia, and Czechia experienced the highest annual rates at 25.8%, 20.1%, and 18.4%, respectively. Notably, annual inflation fell in fifteen member states, remained unchanged in two, and rose in ten.

ECB Kazimir: We are not yet at the finish line

ECB Governing Council member Peter Kazimir has asserted that the recent events in financial markets have not altered his stance on the necessity of continuing with monetary tightening. The Slovak central bank governor acknowledged the delicate nature of the current situation but emphasized that the end goal has not yet been reached.

Kazimir said, “even the current events on the financial markets do not change my view that we need to continue,” with monetary tightening.

“I am very well aware of the delicacy of the situation … but we are not yet at the finish line,” he added.

He said underlying inflation is “stubbornly sticky”. “There are risks to inflation on both sides, but in my view, upward risks are much greater.”

Nevertheless, he also noted it was useless to speculate what ECB could do at next meeting on May 4. ECB raised interest rate by 50bps yesterday, but omitted tightening reference in the accompanying statement.

ECB Villeroy: We sent a signal of confidence

ECB Governing Council member Francois Villeroy de Galhau told BFM Business radio that yesterday’s 50bps sent a “signal of confidence that is strong and dual” to the public.

“It reflects both confidence in our anti-inflation strategy and confidence in the solidity of European and French banks,” he said.

Regarding recent banking crisis, Villeroy, also the Bank of France Governor, noted that “French and European banks are very solid,” and they are “not in the same situation as US banks”.

ECB had the “tools to ensure the liquidity of banks”, but according to him, it’s unlikely that they have to be used.

USD/JPY Mid-Day Outlook

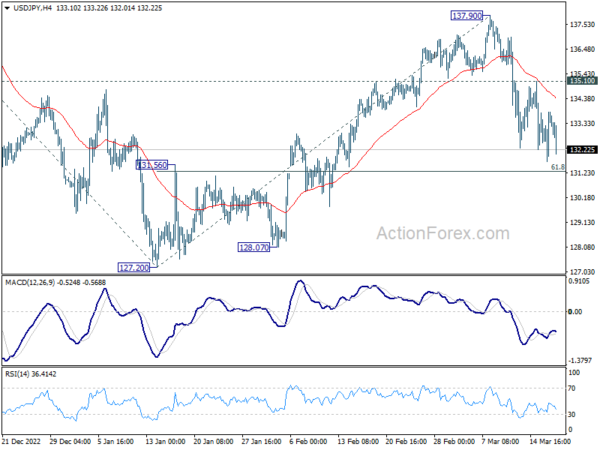

Daily Pivots: (S1) 132.38; (P) 133.10; (R1) 134.49; More…

No change in USD/JPY’s outlook as further decline is expected with 135.10 resistance intact. Firm break of 61.8% retracement of 127.20 to 137.90 at 131.28 will pave the way to retest 127.20 low. However, break of 135.10 will argue that fall from 137.90 is completed and turn bias back to the upside for retesting this high.

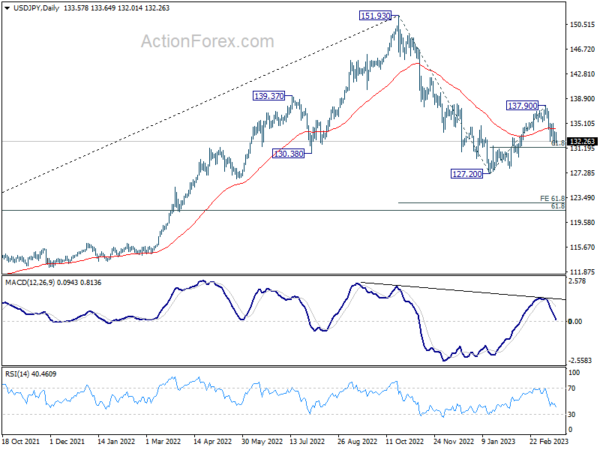

In the bigger picture, rebound from 127.20 should have completed at 137.90 as a corrective move, with strong break of 55 day EMA. The down trend from 151.93 (2022 high) is not over yet. Break of 127.20 will resume this down trend and target 61.8% projection of 151.93 to 127.20 from 137.90 at 122.61. This will now be the favored case as long as 137.90 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 04:30 | JPY | Tertiary Industry Index M/M Jan | 0.90% | 0.30% | -0.40% | |

| 09:00 | EUR | Italy Trade Balance (EUR) Jan | -4.19B | 1.50B | 1.07B | |

| 09:30 | GBP | Consumer Inflation Expectations | 3.90% | 4.80% | ||

| 10:00 | EUR | Eurozone CPI Y/Y Feb F | 8.60% | 8.60% | 8.60% | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Feb F | 5.60% | 5.60% | 5.60% | |

| 12:30 | CAD | Industrial Product Price M/M Feb | -0.80% | -0.30% | 0.40% | |

| 12:30 | CAD | Raw Material Price Index Feb | -0.40% | -0.20% | -0.10% | |

| 13:15 | USD | Industrial Production M/M Feb | 0.60% | 0.00% | ||

| 13:15 | USD | Capacity Utilization Feb | 78.50% | 78.30% | ||

| 15:00 | USD | Michigan Consumer Sentiment Index Mar P | 67 | 67 |